Analysis | Ignore the White House rhetoric. Here are five ways China is winning Trump’s trade war

From intellectual property to the trade gap, China appears to have given a little, but got a lot in return

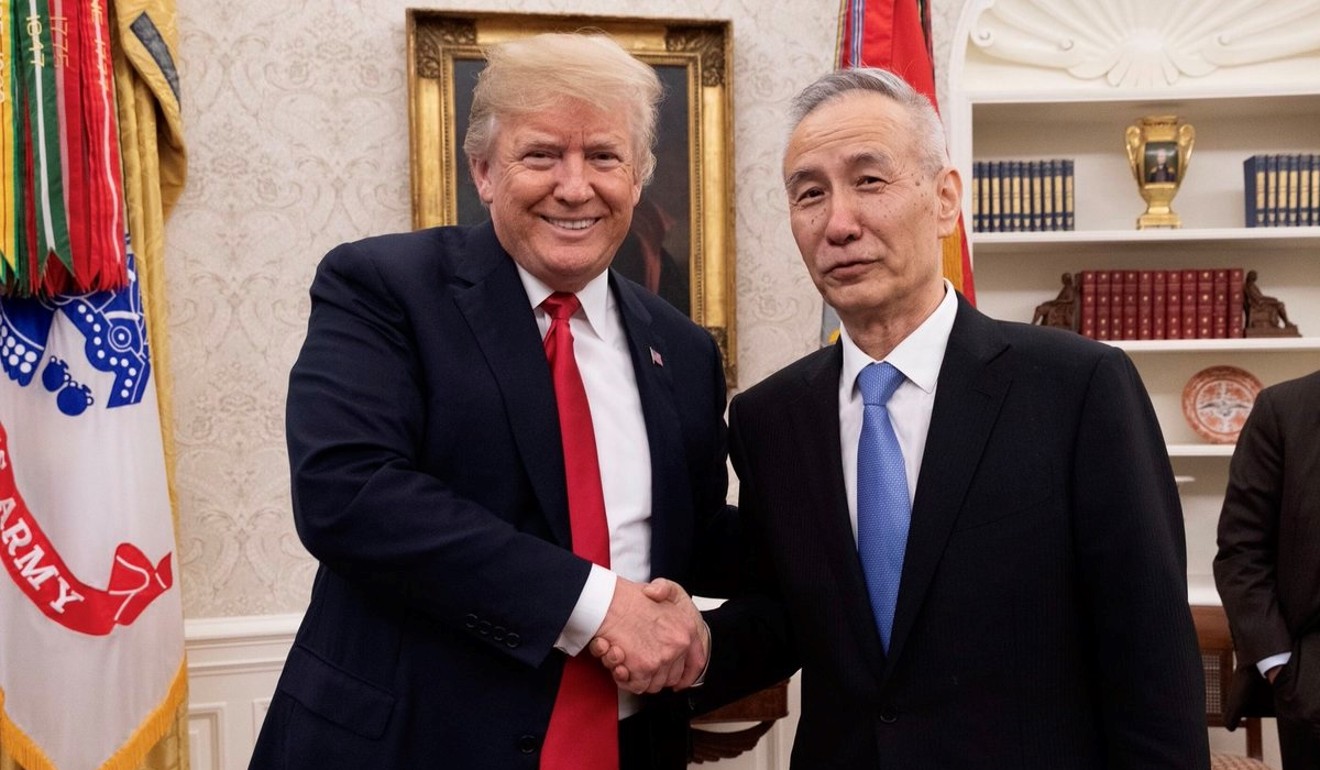

It was easy to miss the US-China trade statement that the White House released on Saturday, right in the midst of royal wedding mania.

But it is hard to hide that China looks as if it is winning President Donald Trump’s trade skirmish – so far.

The statement said that after several days of talks, the Chinese agreed to “substantially” reduce the United States’ US$375 billion trade deficit with China and that the details would be worked out later. It was noticeably vague.

What about the IP fight? The real battle against the Chinese was supposed to be over intellectual property theft, which the Trump administration says has been going on for years and costs the US economy US$225 billion to US$600 billion a year. Trump was supposed to get the Chinese to stop stealing US business secrets and technology. On this front, the statement was brief and lacklustre, saying that both sides agreed to “strengthen cooperation” (diplomatic speak for not doing much) and that China would “advance relevant amendments” to its patent law. It remains to be seen whether that happens (and whether China enforces any new laws).

Reaction to the announcement in the US was mostly negative, even among people who are usually Trump allies. Dan DiMicco, a former steel CEO who has been a big supporter of Trump’s steel and aluminium tariffs, tweeted soon after the statement came out, “Not good enough. Time to take the gloves off.”

He followed that up with: “Did [the] president just blink? China and friends appear to be carrying the day.”

Fox Business anchor Lou Dobbs summed up the situation this way: “Chinese say ‘no deal.’ ”

Wall Street Journal trade reporter Bob Davis tweeted that the big takeaway is: “Trump administration gets rolled by the Chinese.”

Here’s a rundown of five ways China appears to have got the upper hand.

Those are not Chinese concessions. Those are inevitabilities

China’s “concessions” are things it planned to do anyway. The Chinese have one of the fastest-growing economies and middle classes in the world. Chinese factories and cities need more energy, and its people want more meat. It is no surprise then that China said it was interested in buying more US energy and agricultural products.

The Trump administration is trying to cast that as a win since the United States will be able to sell more to China, but it was almost certain that the Chinese were going to buy more of that stuff anyway.

What Trump got from the Chinese is “the kind of deal that China would be able to offer any US president,” said Brad Setser, a China expert at the Council on Foreign Relations. “China has to import a certain amount of energy from someone and needs to import either animal feed or meat to satisfy Chinese domestic demand.”

China has been buying about US$20 billion worth of US agricultural products a year and $7 billion in oil and gas, according to government data. Even if China doubled – or tripled – purchases of these items, it will not equal anywhere near a US$200 billion reduction in the trade deficit.

Trump’s tariffs on hold

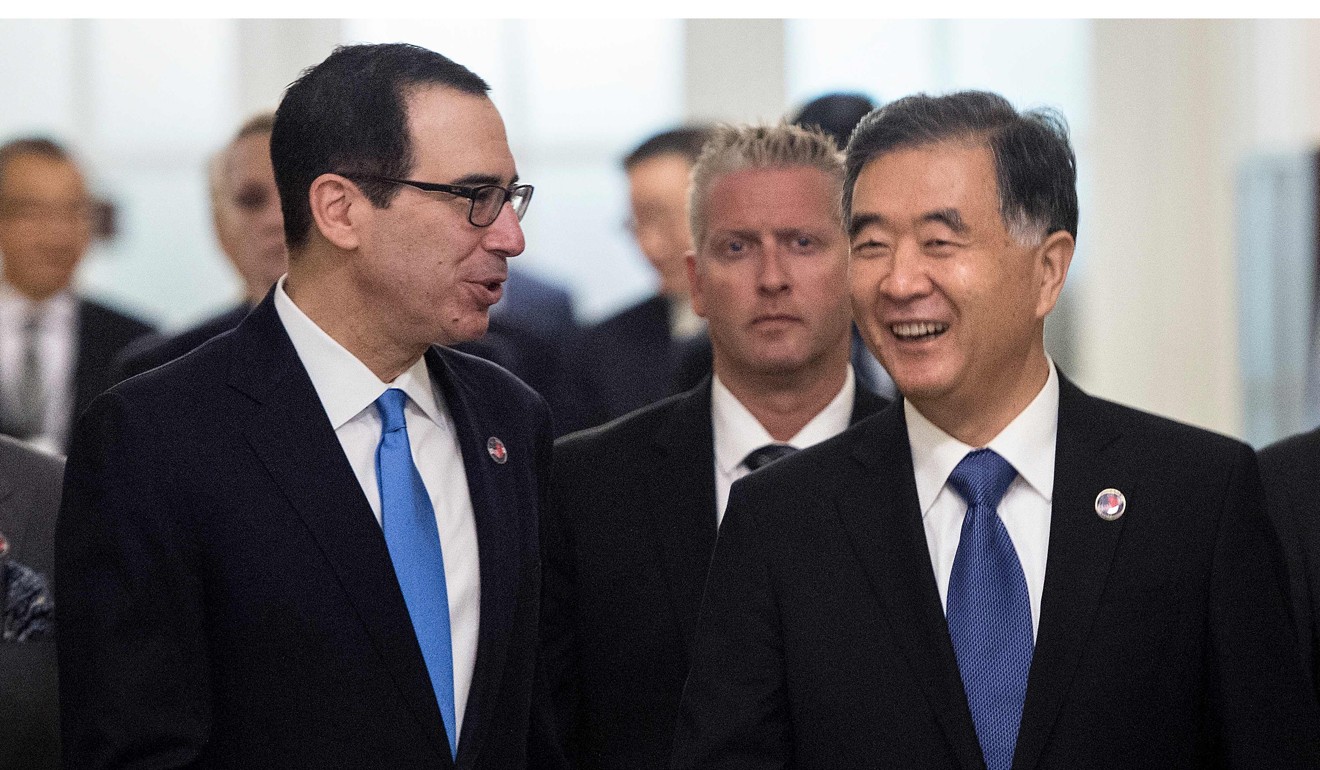

The United States agreed to suspend tariffs. Chinese officials sold the talks as a win for them back home, telling state-run media that the United States had agreed to “not to launch a trade war and to stop slapping tariffs against each other.” Chinese media called this the most important result of the talks.

Treasury Secretary Steven Mnuchin confirmed that the tariffs are now “on hold” when he appeared on Fox News Sunday.

Yes, it is good for both sides not to be in a trade war, but the Chinese had more to lose economically from the tariffs. The Trump administration rolling back its US$150 billion tariff threat against China is a good “get” for the Chinese.

China used North Korea as leverage

Trump wants the summit with North Korea on June 12 to go well. It would be a huge breakthrough for the United States and the world and a significant achievement for his administration. The Chinese understand Trump needs them to help make this happen, and they reportedly expected Trump to be more amenable on trade while North Korea is in play. Trump even expressed openness to rolling back restrictions on the Chinese tech firm ZTE, a surprise to many.

“A US-China trade disconnect or worse at this juncture only would detract and distract from mutual progress on North Korea,” said Terry Haines, managing director of Evercore ISI.

New curbs on Chinese investment unlikely

Another Chinese goal is to be able to invest more in the United States. Mnuchin is supposed to be working on strong curbs to Chinese investment in America, another tough measure to show the Chinese that if they will not play fair and let US companies fully operate in China, then America isn’t going to be so open to Chinese firms and money.

Monday is the deadline for Mnuchin to “report progress” on the investment barriers. Now it looks as if those limitations are on hold, too, according to a lobbyist familiar with the deliberations who isn’t authorised to speak publicly about the administration’s decision-making and spoke on the condition of anonymity.

Derek Scissors, a China expert at the right-leaning American Enterprise Institute who advised the Trump administration on China trade last year, also thinks Mnuchin will not push this week for any further blocks on Chinese investment in the United States.

“Mnuchin never had any intention of recommending anything serious that I know,” Scissors said.

Zero curbs on China’s hi-tech plans

There was little in the Saturday statement about IP protections and nothing about China altering its plans for hi-tech growth and domination (President Xi Jinping’s “China 2025” plan). When the Trump administration originally presented China with a list of demands, it included China agreeing to stop subsidising its tech companies.

It was always unlikely that the United States would get China to alter its marquee economic growth plan, but it is yet another reminder that the Chinese gave a few concessions on things that are not sacrifices for China.

Overall China appears to have the upper hand, but this is just the beginning. This is only round one of lengthy negotiations between the two nations on trade, and it was conducted by various secretaries and advisers. Even Kudlow said Sunday that this cannot be considered a deal yet. Much could change when Trump and Xi meet face-to-face.

But so far, the Chinese are pitching Trump a “deal” that does not alter much on their end.