Topic

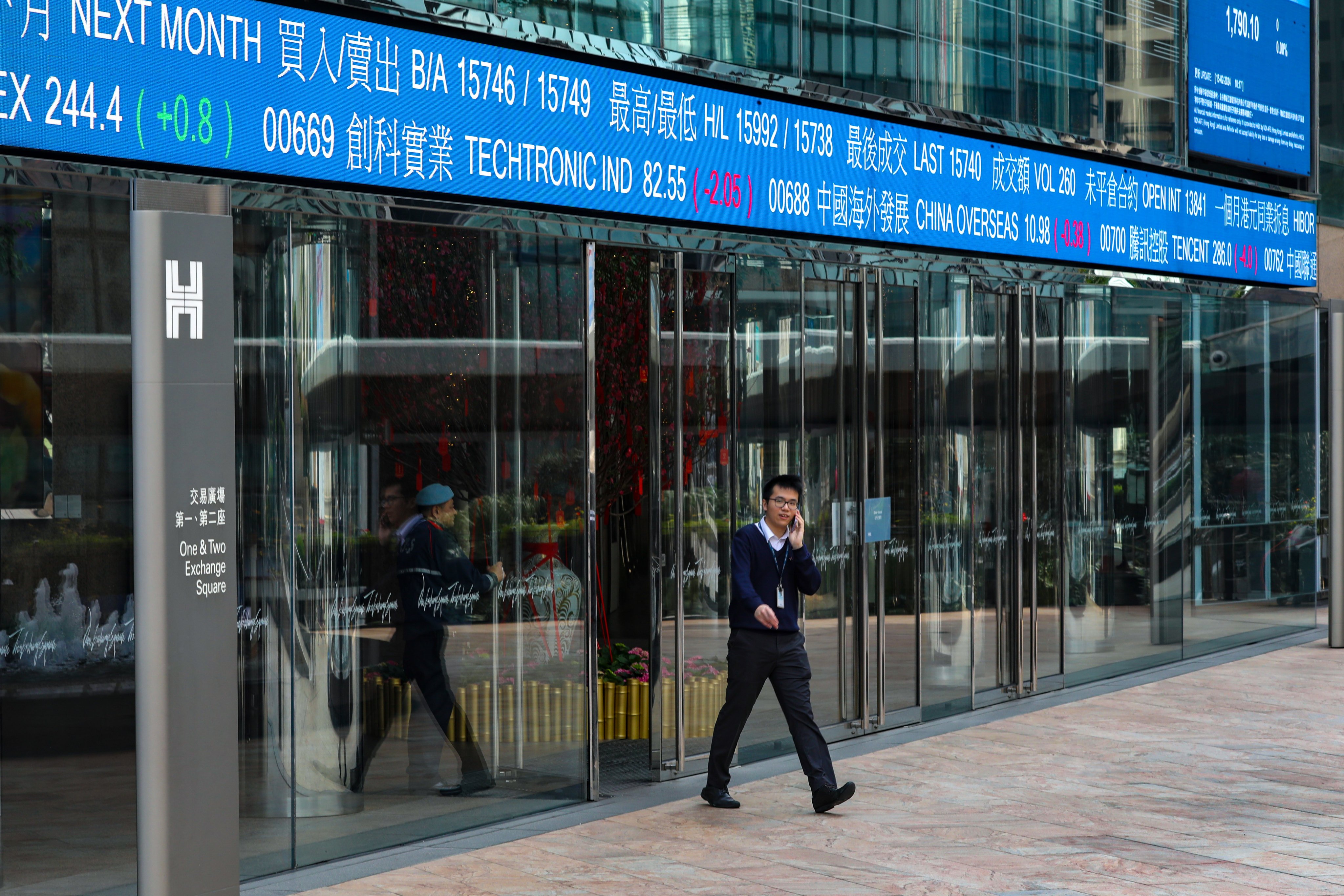

Latest news and analysis about the benchmark stock indices of the Shenzhen equity market, including the Shenzhen Composite Index, the Shenzhen A-share Index, and the ChiNext market for growth companies.

As Beijing halves stamp duty on share deals to lift investor confidence, Hong Kong is seeking greater liquidity to strengthen its position.

- Yao Qian is the director of the department of technology supervision at the China Securities Regulatory Commission

- He is being investigated by the Central Commission for Discipline Inspection and a local inspection unit, according to official announcements

Hong Kong stocks rose and completed its best weekly performance since October 2011 as positive earnings from top-tier Chinese companies and supportive policy measures boosted investor confidence

Hong Kong stocks rise on optimism that the appetite for Chinese assets is returning as Beijing pledges support to markets and signs of an earnings recovery emerges.

Hong Kong stocks climbed most in three weeks as investors ramped up their buying on expectations that a slew of supportive measures from the Chinese securities watchdog will aid sentiment.

CSRC’s new chief Wu Qing has sought to improve corporate governance and close deep valuation discounts in a bid to revive investors’ faith in China’s US$9 trillion stock market and these bold moves have met with some early success.

China’s capital market regulators have announced a package of measures to boost liquidity, attract international investors and enhance competitiveness between the mainland and Hong Kong.

Hong Kong stocks eased, pressured by the weak Chinese yuan currency and following trade data that showed a contraction in exports from the world’s second-largest economy.

Hong Kong stocks tumble after data suggested China’s consumption demand remains weak and as investors lowered their bets on the US Federal Reserve cutting rates in June.

Hong Kong stocks rose as a growing number of corporate buy-backs triggered bets that the market is nearing a bottom.

Sentiment has been recovering after a visit to China by US Treasury Secretary Janet Yellen, as traders await March economic data due later this week.

First-time stock offerings in Hong Kong are expected to improve after a dismal first quarter, according to Deloitte China. Tighter regulatory oversight could hinder bourses in mainland China.

Hong Kong stocks ended steady but the mood was cautious as ahead of economic data releases that will drive sentiment later in the week.

China’s state-directed buying binge has swollen the size of exchange-traded funds (ETFs) tracking the underlying benchmark CSI 300 Index, helping them outperform the market while boosting their asset-size ranking.

Chinese state intervention has tentatively put a floor under stocks, but corporate earnings show little sign of providing upwards momentum as pressure is building for investors to pocket profits from the decent gains the market has made.

Global fund managers have increased their exposure to Chinese yuan-traded stocks for a second month in March, indicating that foreign appetite for these shares is recovering.

Chinese stocks advanced on the back of an earnings-fuelled rally in state-owned banks which reported steady financial results and gold stocks after bullion hit a fresh peak.

Hong Kong outperforms the region as President Xi Jinping assures US business leaders about China’s commitment to a market-oriented business environment.

Hong Kong stocks underperformed the region as sentiment was dealt a blow by the cancellation of a Hong Kong IPO by Alibaba Group’s logistic unit and a cautious outlook from electric vehicle maker BYD, with the yuan’s slide adding to the gloom.

Hong Kong stocks closed higher as China Merchants Bank and China Resources Land posted better-than-estimated results and China’s central bank governor struck an upbeat tone about the property market.

Hong Kong stocks retreated after a brief boost from a resurgent yuan currency, as investors are watchful awaiting earnings announcements this week from about a third of the companies that comprise the benchmark.

Has China’s long march to recouping stock market losses begun, after a US$1.75 trillion bounce in value from January lows? Many sentiment indicators have reached inflection points, backstopped by state intervention. Or do market bears still hold sway?

Samsonite is exploring a dual listing plan for its shares, a surprise move that tempered market speculation about a potential offer to take the luggage maker private.

Hong Kong stocks retreated as the focus returned to corporate earnings and after the euphoria over the US Federal Reserve’s dovish comments evaporated. The yuan broke a key level for the first time since November, adding to the gloomy sentiment.

Stocks suffer from a twin blow on interest-rate front. China keeps its one-year loan facility unchanged, while stronger than expected US price reports this week undermine bets on a rate cut in the next two meetings.

Hong Kong stocks eased amid caution about corporate earnings although property sector shares advanced amid hopes of state support.

Hong Kong stocks took a breather from a three-day gain that helped key equity gauges overcome some key technical barriers, with sportswear maker Li Ning and Chinese developers weighing on the market.

South Korea plans to review the sale of potentially high-risk investments after a probe found that banks mis-sold China-linked structured products, exposing retail investors to more than US$4 billion in losses.

Hong Kong stocks were lifted by hopes more companies could launch share buy-backs to take advantage of the current market valuations, sending the Hang Seng Index into the black for the year and thrusting the Hang Seng Tech Index into a bull market, defined as a rise of 20 per cent from recent lows.

Hong Kong stock market began the week on a firm note amid signs of a demand pickup in the world’s second largest economy and following positive investor flow data.

Hong Kong stocks rose, amid expectations global central banks will ease monetary conditions this year following dovish comments from heads of the US Federal Reserve and the ECB.