US funding of multinational bodies seems to be keeping their critique muted. The power of the purse should not ensure immunity from criticism.

17 Jan 2026 - 5:07PM videocam

Family firms, the backbone of the Asian economy, have tended to be reluctant to go public but are increasingly open to private equity funding.

The desire for economic growth and military might is driving the world towards conflict while devaluing concepts such as mutual respect and peaceful coexistence.

3 Jan 2026 - 4:30PM videocam

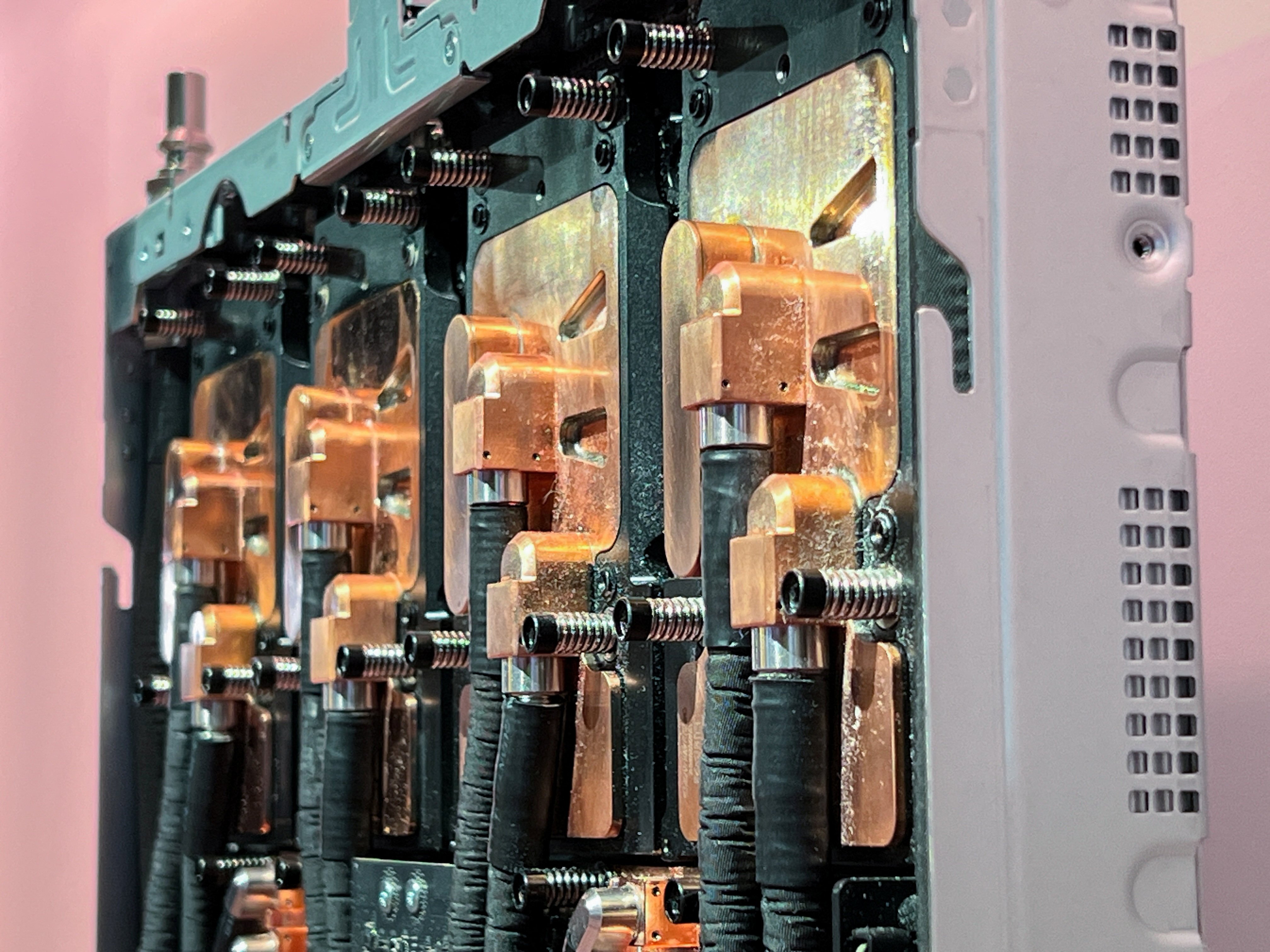

The dash towards AI might become a rout as the public rebels against the environmental costs while investors worry about the returns.

27 Dec 2025 - 4:30PM videocam

The emphasis on securing supply chains and stockpiling critical resources is no substitute for free and open trade and investment.

20 Dec 2025 - 4:30PM videocam

The increase in government debt means that nations must look elsewhere for funds required to meet socioeconomic needs.

13 Dec 2025 - 9:59PM videocam

With hyperinflated sectors across multiple asset markets, the next crash could be so severe that it prompts a restructuring of global finance.

6 Dec 2025 - 4:30PM videocam

The politics around digital currencies have extended into the long-running battle for supremacy between the world’s major currencies.

29 Nov 2025 - 4:30PM videocam

China’s central and local governments and state entities are willing to issue or guarantee green bonds on a scale unmatched elsewhere.

22 Nov 2025 - 5:29PM videocam

It is the tech sector’s projected spending that points to trouble ahead. Are investors prepared to wait for the return on their investment?

15 Nov 2025 - 4:30PM videocam

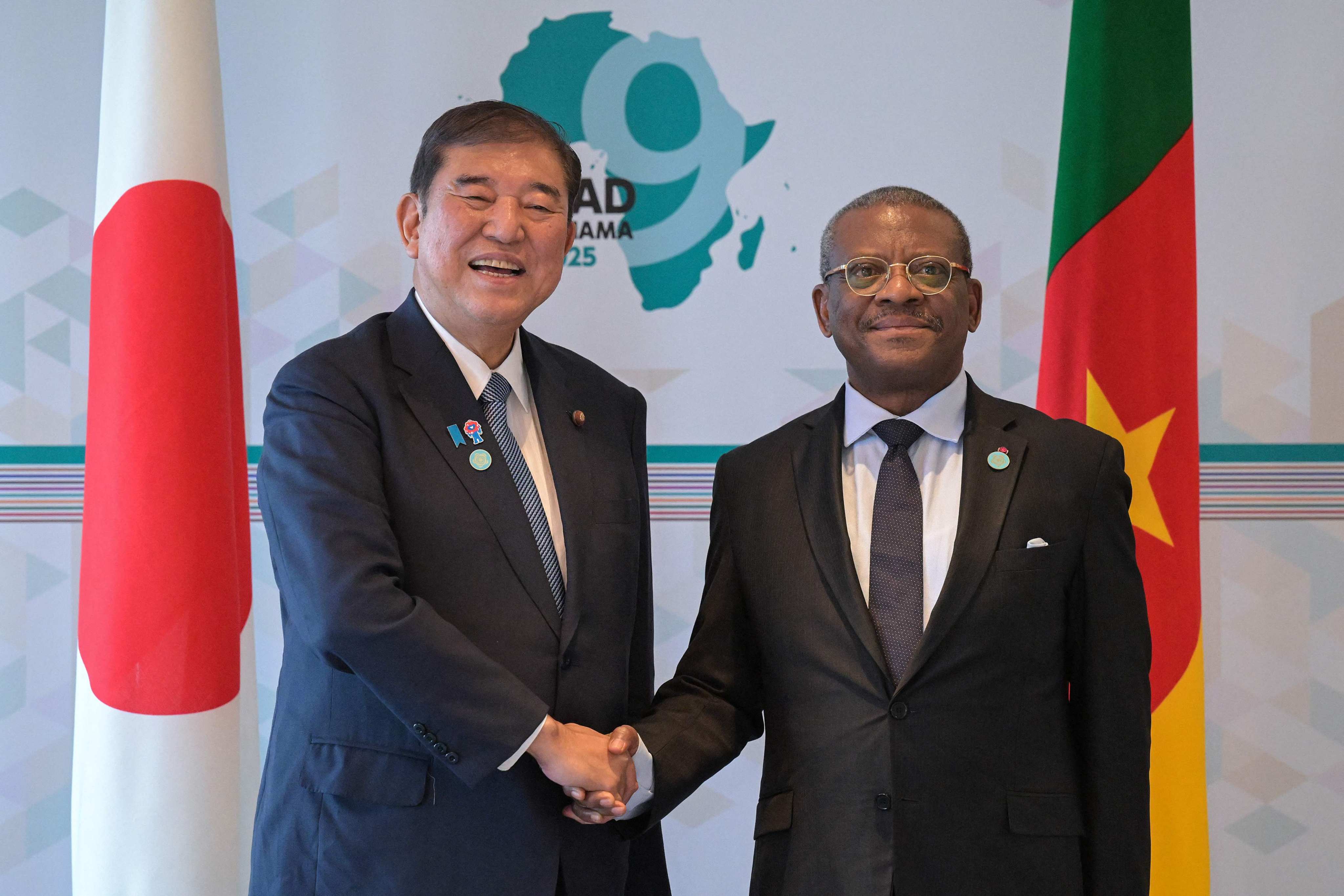

Developing nations are being urged to boost domestic demand and mutual trade to drive growth, but key factors like population ageing must also be addressed.

8 Nov 2025 - 9:15PM videocam

Leaders of superpowers should not use regional multilateral summits to advance their own interests, overshadowing the vital work of other nations.

The unravelling of First Brands and Tricolor in the US have exposed vulnerabilities in the non-bank sector, raising fears of a repeat of the 2008 crisis.

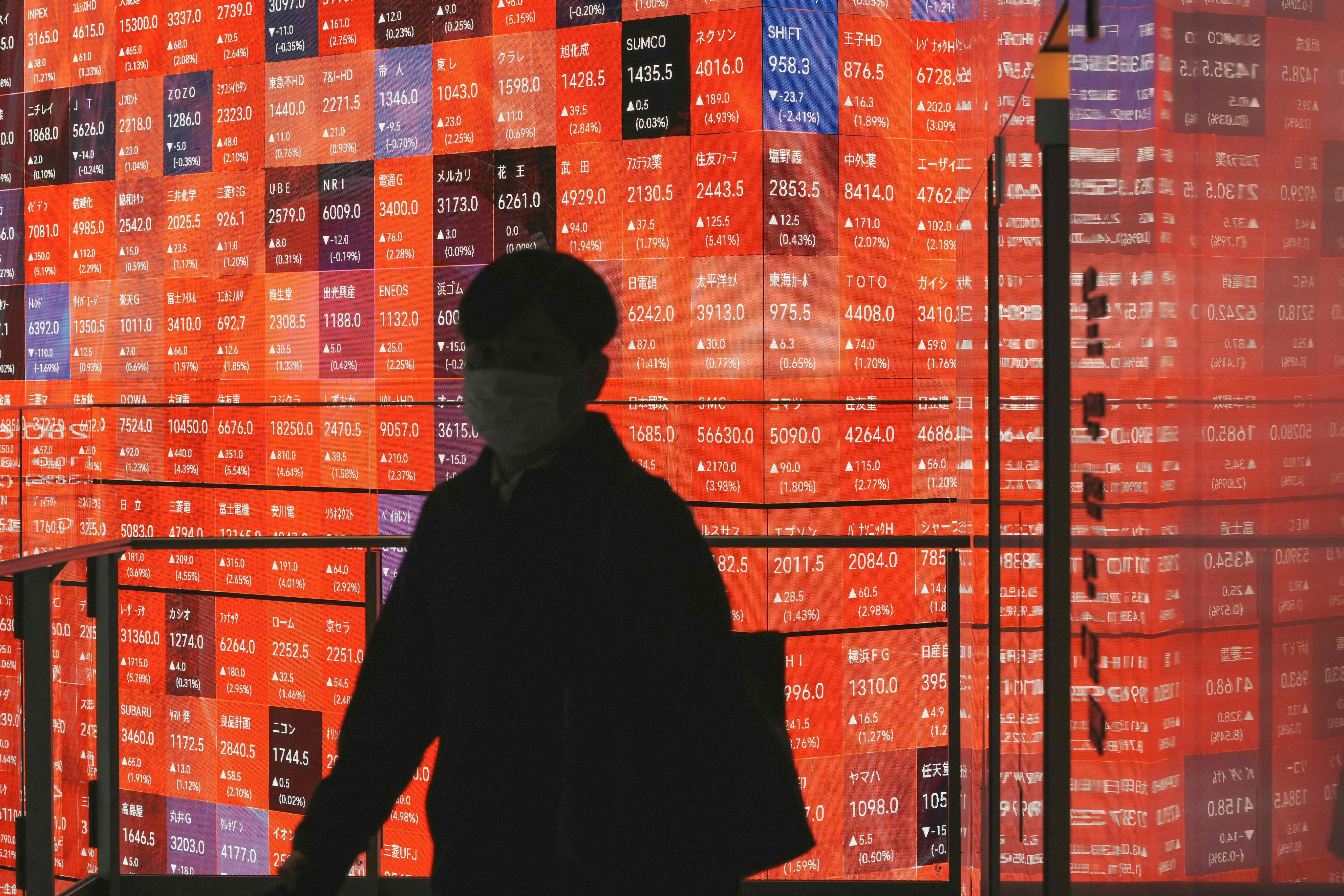

More than just who heads the government, the fate of Japan’s leadership race has implications for markets, regional economies and geopolitics.

18 Oct 2025 - 4:30PM videocam

With bond yields rising and stock markets hitting precarious highs, gold-backed monetary policy could be a much-needed source of stability.

11 Oct 2025 - 6:20PM videocam

The apparent resilience of the global economy in the face of a series of shocks comes amid dangerously high debt levels.

4 Oct 2025 - 4:30PM videocam

As markets greet the Fed rate cut with enthusiasm, long-term bond yields paint a much more alarming picture.

20 Sep 2025 - 4:30PM videocam

The finance world is in flux, with stablecoin issuer Tether investing heavily in the metal it has been trying to usurp as a primary means of exchange.

13 Sep 2025 - 4:31PM videocam

SCO summit’s vision can’t be implemented without the requisite monetary and financial systems in place. The West must play a role if the world is not to fragment into blocs.

6 Sep 2025 - 4:30PM videocam

Policymakers don’t pay enough attention to bubble economics – despite how the advent of cryptocurrencies has added fresh layers of risk.

Tokyo’s recently announced Indian Ocean and Africa economic zone initiative could put it on course to overlap and clash with Beijing.

23 Aug 2025 - 6:04PM videocam

As the US allows 401(k) investors to access assets such as cryptocurrency and real estate, there seems to be little official recognition of the risks.

16 Aug 2025 - 5:42PM videocam

Contrary to markets’ exuberance, record levels of borrowing and the growth of shadow banking pose a significant risk of a financial crisis.

9 Aug 2025 - 4:30PM videocam

We need radical solutions reinforced by legal statutes to bolster the fight against climate change and make polluters pay.

2 Aug 2025 - 4:30PM videocam

The world is crying out for systemic reforms to markets that heap investment in fashionable sectors instead of where it is needed the most.

The stock market’s bullish sentiment amid tariff threats and hot wars feels a lot like the calm before a cataclysmic storm.

19 Jul 2025 - 5:23PM videocam

If Brics nations want to present a viable alternative to the US-led world order, they must do more than eschew confrontation with the West.

12 Jul 2025 - 8:46PM videocam

The US is the largest shareholder of several multilateral financial institutions, calling into question how unbiased their advice can be.

5 Jul 2025 - 6:53PM videocam

Central bank gold holdings are now back to where they were in the 1960s, before gold went out of official fashion.

28 Jun 2025 - 4:30PM videocam

Buffeted by Trump’s disruptive policies, Asia should seize the chance to reassert the need for regional integration as the US retreats.

21 Jun 2025 - 5:52PM videocam