Advertisement

Advertisement

Dan Steinbock

Dr Dan Steinbock is an internationally recognised expert of the multipolar world. He focuses on international business, international relations, investment and risk among the major advanced economies and large emerging economies; as well as multipolar market trends. His commentaries are published across all world regions. For more, see www.differencegroup.net

Dr Dan Steinbock is an internationally recognised expert of the multipolar world. He focuses on international business, international relations, investment and risk among the major advanced economies and large emerging economies; as well as multipolar market trends. His commentaries are published across all world regions. For more, see www.differencegroup.net

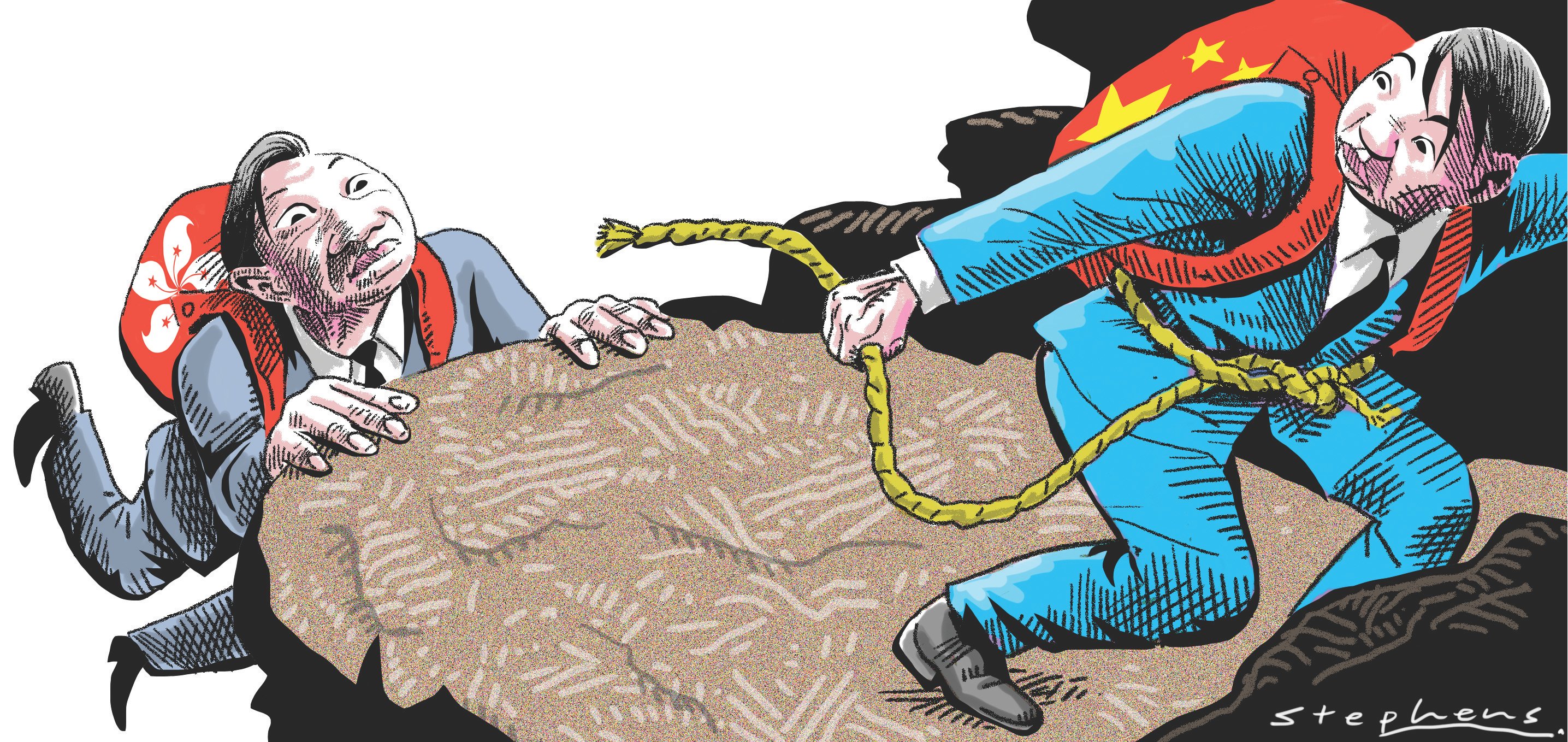

Policy failures in the past decade have brought plunging trade and investment, slowing migration and an explosion of global displacement. The longer stagnation prevails, the greater the chances of cold wars turning into hot wars.

International critiques of Rodrigo Duterte’s authoritarianism and war on drugs are in stark contrast to the trust he enjoys at home. The People Power movement, of which the Liberal Party has portrayed itself as the institutional embodiment, has failed most Filipinos. Antagonistic relations with China will not help.

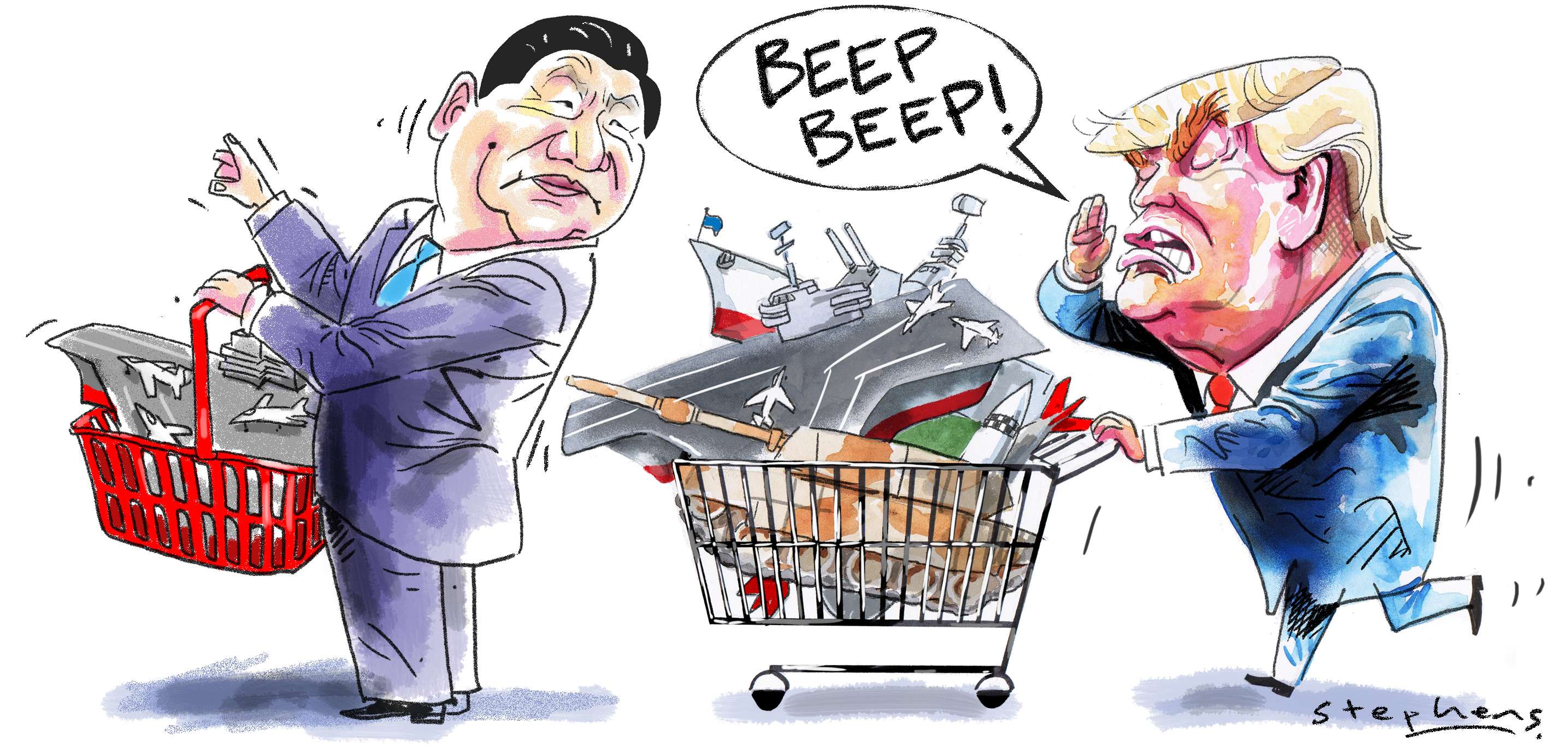

Global growth is unlikely to recover soon, given not only the US-China trade war but also geopolitical tensions. Around the world, the number of forcibly displaced people has hit a record high.

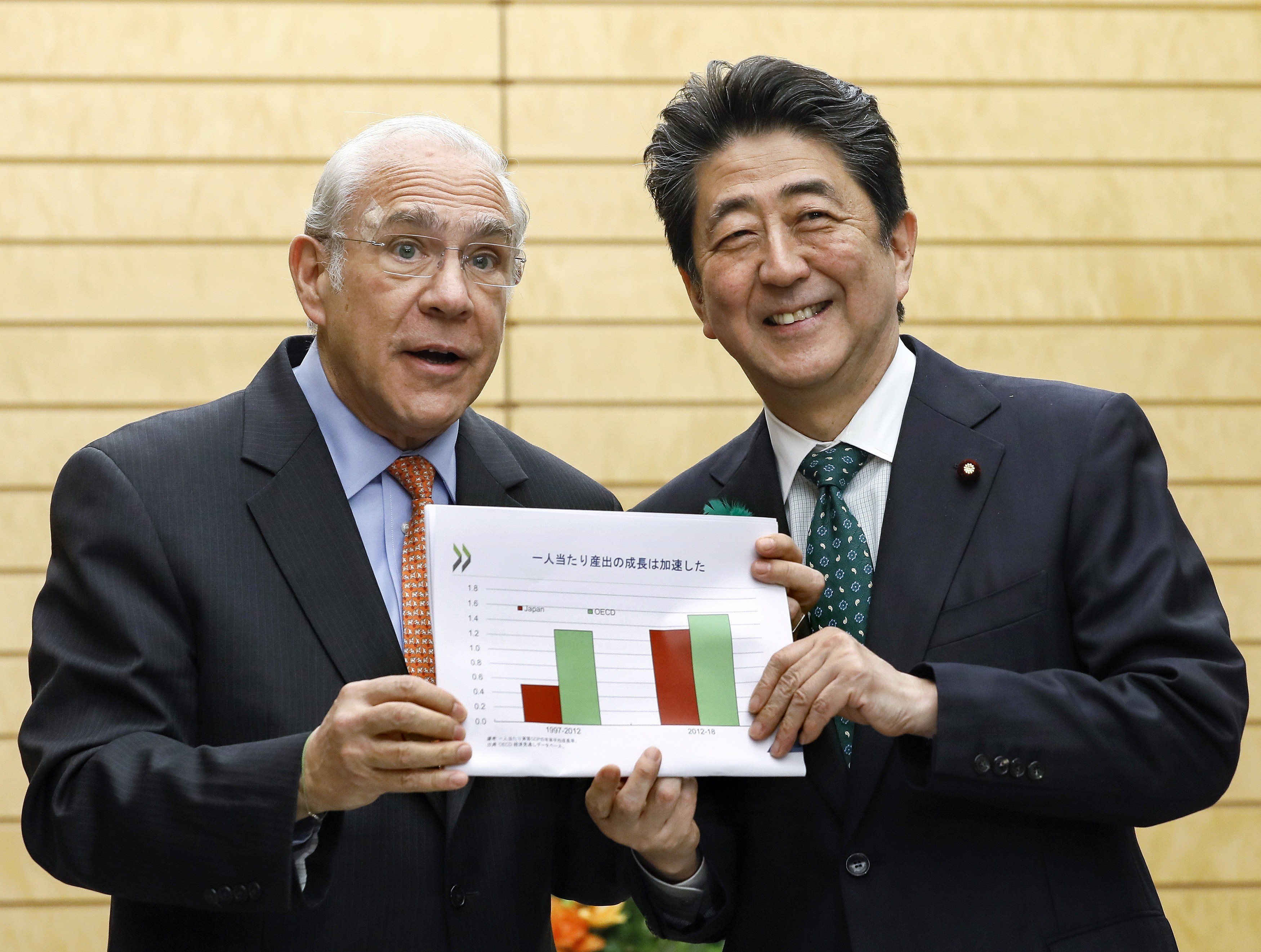

Compared to pre-2008 crisis levels, world economic growth has already plummeted by half and is at risk of a long-term, hard-to-reverse stagnation. Returning to global integration and multilateral reconciliation could dramatically change the scenario.

Advertisement