LeEco unit suspended from trading after shares plunged amid layoff fears

Leshi Internet Information and Technology’s shares fell 7.85 per cent on Tuesday, reportedly triggering margin calls by brokerages

Chinese internet giant LeEco’s Shenzhen-listed arm, Leshi Internet Information and Technology Corp, was halted from trading on the stock exchange on Wednesday after a share price plunge that was said to have triggered margin calls by brokerages and financial lenders.

The Shenzhen bourse said in a statement that trading in Leshi was suspended before market opening on Wednesday, pending an announcement. No further detail was provided.

The trading halt came after Leshi’s shares plummeted 7.85 per cent on Tuesday to close at 35.8 yuan amid mounting concerns that the company may layoff staff to help trim costs as it undergoes restructuring. The share price had fallen to an intraday low of 35.01 yuan.

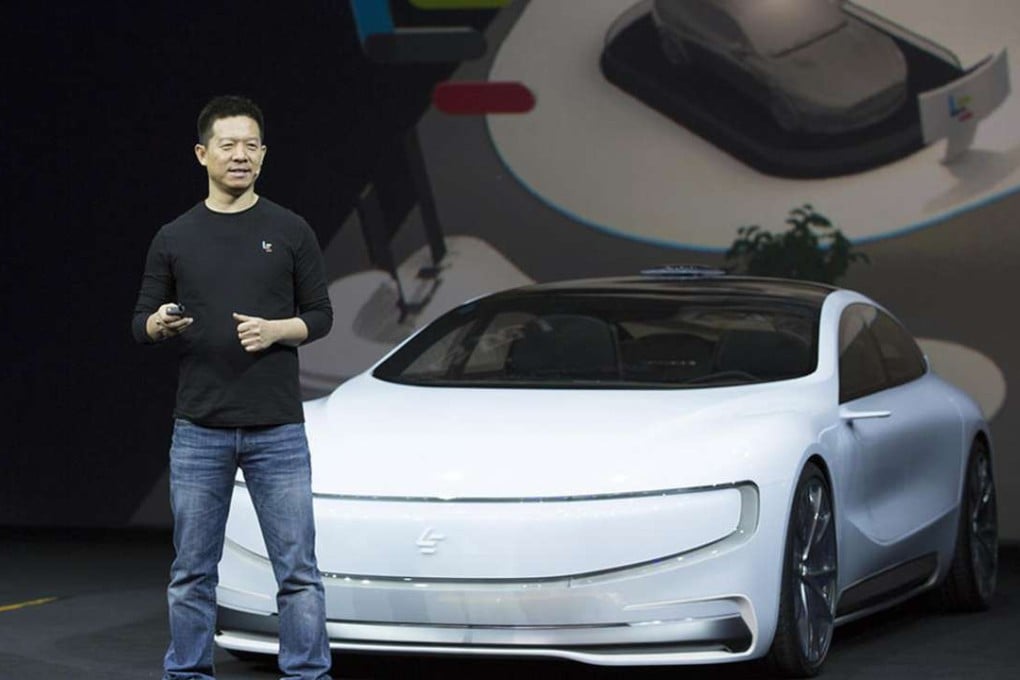

Several mainland media reports cited rumours among traders that margin calls on the credits of LeEco’s billionaire founder Jia Yueting and his brother Jia Yuemin were triggered when the stock price slipped to below 35.21 yuan on Tuesday.

A LeEco spokeswoman said that the stock price mentioned in the media reports was “speculation”.

According to Wind, a Chinese financial data and analysis company, LeEco’s founder and his brother pledged more than 84 per cent of their combined holdings in Leshi as collateral for more than 10 billion yuan of loans. Analysts had said any decline in Leshi’s share price could trigger a margin call on their credits and exacerbate their financial woes.