Macroscope | Investor euphoria and economic reality are set to collide in 2017

‘For investors, 2017 could quickly turn into the year of living dangerously’

2016 is ending on a high note, with global stock market optimism breaking new highs, pumped up on a raft of central bank money and ultra low interest rates. But it is optimism that is growing increasingly detached from economic reality. 2017 could easily see investor sentiment come crashing back down to earth.

Likewise many economic confidence surveys remain upbeat about next year’s outlook, boosted by hopes that US President-elect Donald Trump unleashes a fresh wave of global economic stimulus into the world with a barn-storming US fiscal reflation. Yet there are many parts of the global economy still showing scars of slowing growth set against a backdrop of rising risks.

As investor euphoria and economic reality collide the markets will have every good reason to panic

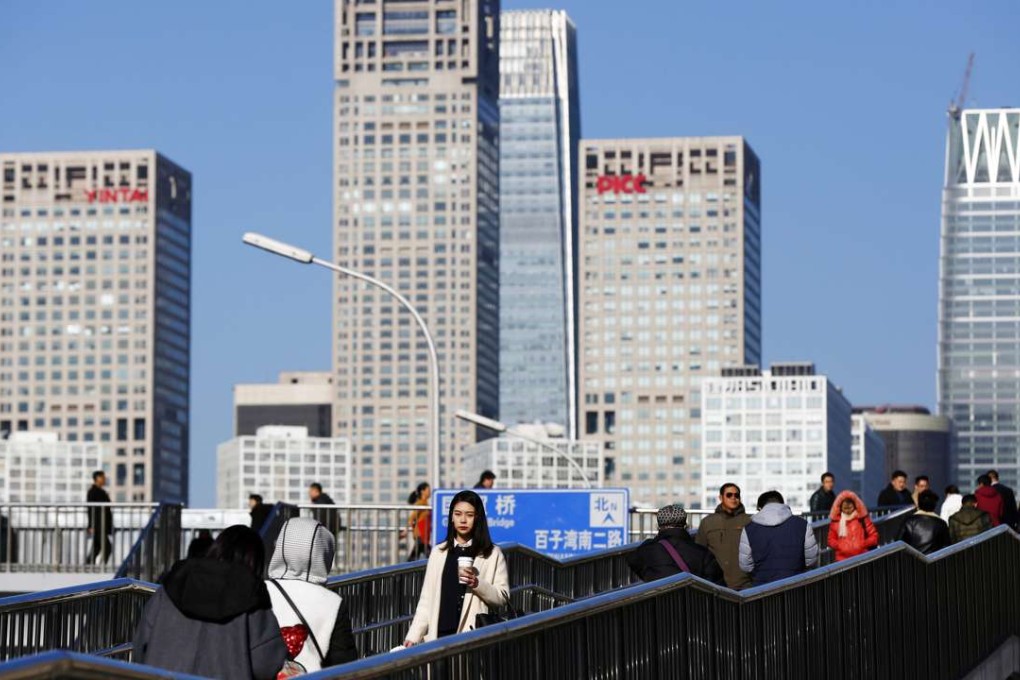

Fears of a China hard landing, political upsets in Europe, risks of an emerging markets debt crisis and the US Fed on an even tougher tightening quest next year are just a few of the potential trip wires markets must contend with. Perhaps the greatest wild card threat of all is that so-called “Trumpflation” turns out to be nothing more than huff, puff and bluster.

Whether the market continues to be driven by “irrational exuberance”, or “rational despair” sinks in, will be the defining test for 2017. For the US, where the monetary stratagem of ultra low interest rates and QE pump-priming seems to have worked wonders in the last eight years, there is no guarantee of future success, especially when the monetary tide is on the turn.

Right now, the odds are clearly shifting in favour of a tougher Fed policy response than markets might have been expecting. The whispering campaign is already shifting up a gear, with hints the Fed might need to hike interest rates more than three times next year. With headline US inflation already up to 1.7 per cent and the core annual CPI rate at 2.1 per cent, the Fed’s new emphasis is cooling down future price pressures.

The worry is that it goes too far. Expectations about the Fed are already driving up the US dollar and pushing up US bond yields, potentially strangling exports, mortgage demand and corporate borrowing in the process. This suggests the US is unlikely to be the hive of extra demand that world financial markets are gambling on – unless Trump stumps up an even bigger reflation deal.