Advertisement

Trump’s health and US election leave currency markets seeking stability

- November’s US presidential election could easily be a lottery like 2016, making it too risky for investors to make rock-solid bets at this stage

- The worry is how the rest of the world responds to any new phase of US dollar instability, especially if it leads to competitive devaluations by other countries

Reading Time:3 minutes

Why you can trust SCMP

Global currency markets have a deep dilemma with less than a month to go before the US presidential election on November 3. It’s a tough call for investors with so much hanging in the balance and the market deeply divided between unreconstructed dollar bears and diehard dollar bulls.

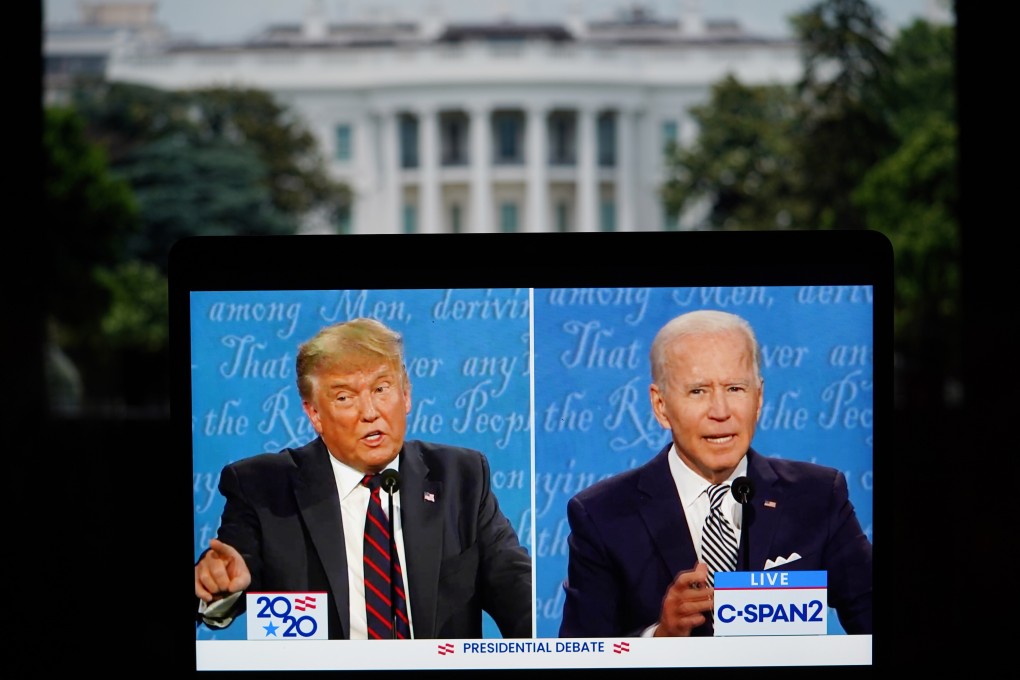

Considering the shock outcome of the 2016 election when Donald Trump snatched victory from Hillary Clinton, next month’s result could just as easily be another lottery, making it too risky to make any sort of rock-solid bet at this stage.

Concerns about Trump’s health and his statements about rejecting any immediate election result could mean deep political chaos looms. Currency markets could face a period of extreme volatility, bad news for exporters trying to plan for recovery in a very uncertain world.

Advertisement

The next US president will be in charge at a time when the world is in tumult and needs fast answers to the pandemic, recession and growing political disorder. The world needs reassurance, not another four years of car-crash leadership from the United States. Unfortunately for currency markets, the US election outcome will be binary – either another four years of Trump turbulence or the hope of something better from his Democratic opponent Joe Biden.

This uncertainty is reflected in a wide spread of future expectations, ranging from a US dollar collapse or a return to relative strength. It is fair to say Republican administrations generally tend to favour a weaker dollar to boost business, while Democratic governments tend to follow a more dollar-positive line. It’s a simple mantra which will carry a lot of weight in the months ahead.

The unsettled appetite for risk in an uncertain world and worries about ongoing US dollar debasement thanks to super-loose monetary policy and its impact on relative interest rate and bond yield differentials all have their part to play. However, foremost is who wins the US election, whether the US-China trade war is settled amicably and how soon America’s economic fundamentals recover.

Advertisement

Advertisement

Select Voice

Select Speed

1.00x