Brexit, US recovery could spell doom for euro’s rally against US dollar

- With the threat of a no-deal Brexit looming and the European Central Bank moving towards another monetary policy ease, the euro is living on borrowed time

- A US interest rate rise is likely while euro zone rates are in negative territory, so shorting the euro and going long on dollars could gain a strong following

The euro has had a good run against the US dollar in 2020, but the rally appears to have reached the end of the road. The dollar seems a better bet with the US Federal Reserve stonewalling on negative interest rates, US growth prospects looking more upbeat, and markets focused on a Joe Biden victory in the US presidential election in a fortnight’s time.

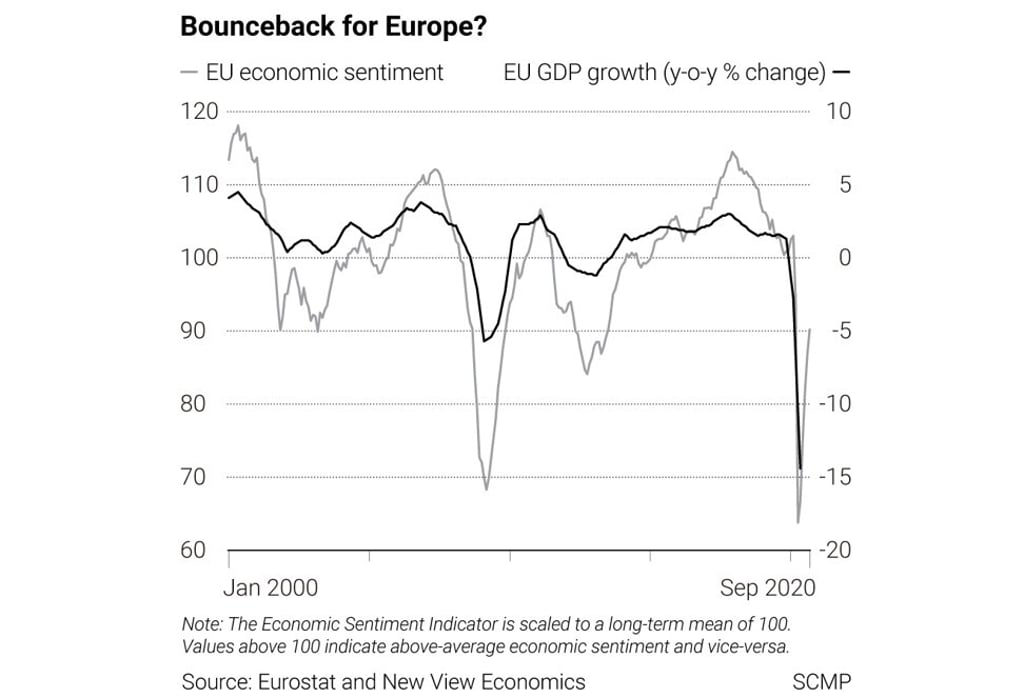

Europe’s three largest economies – Germany, France and Italy – are all in recession, and an expected recovery in the second half of 2020 would stall if economic confidence takes another turn for the worse. Europe is vulnerable after GDP growth contracted by 2.5 per cent year on year in the first quarter of this year, followed by a 14.1 per cent collapse in the second quarter. The pressure remains for European monetary and fiscal policy to stay highly accommodative for a long while yet.

Europe’s confidence indicators are bouncing back, but the big issue is whether recovery is sustainable. Europe’s bellwether economic sentiment indicator rallied from an all-time low of 63.8 in April to 90.2 in September, an encouraging sign for recovery but only as long as there are no further setbacks.

Europe could go into a deeper stall, unemployment could rise sharply and the ECB would need to compensate with deeper rate cuts and more quantitative easing, adding pressure on the euro.