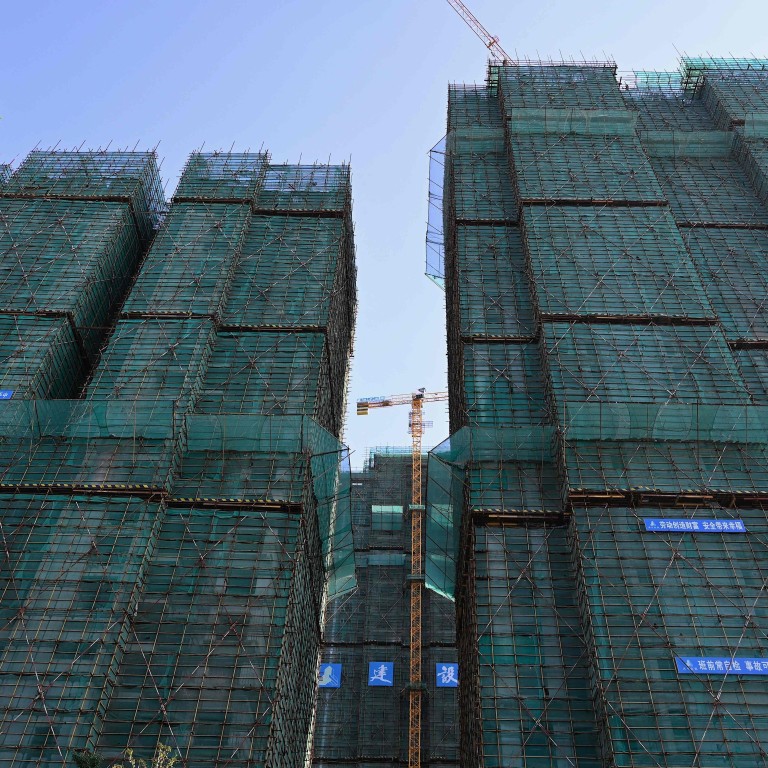

China’s home-price growth weakens to eight-month low on cooling measures while Evergrande’s struggles keep buyers away

- The average price of new homes across 70 major cities rose 0.2 per cent month on month in August, the slowest since February’s 0.4 per cent gain

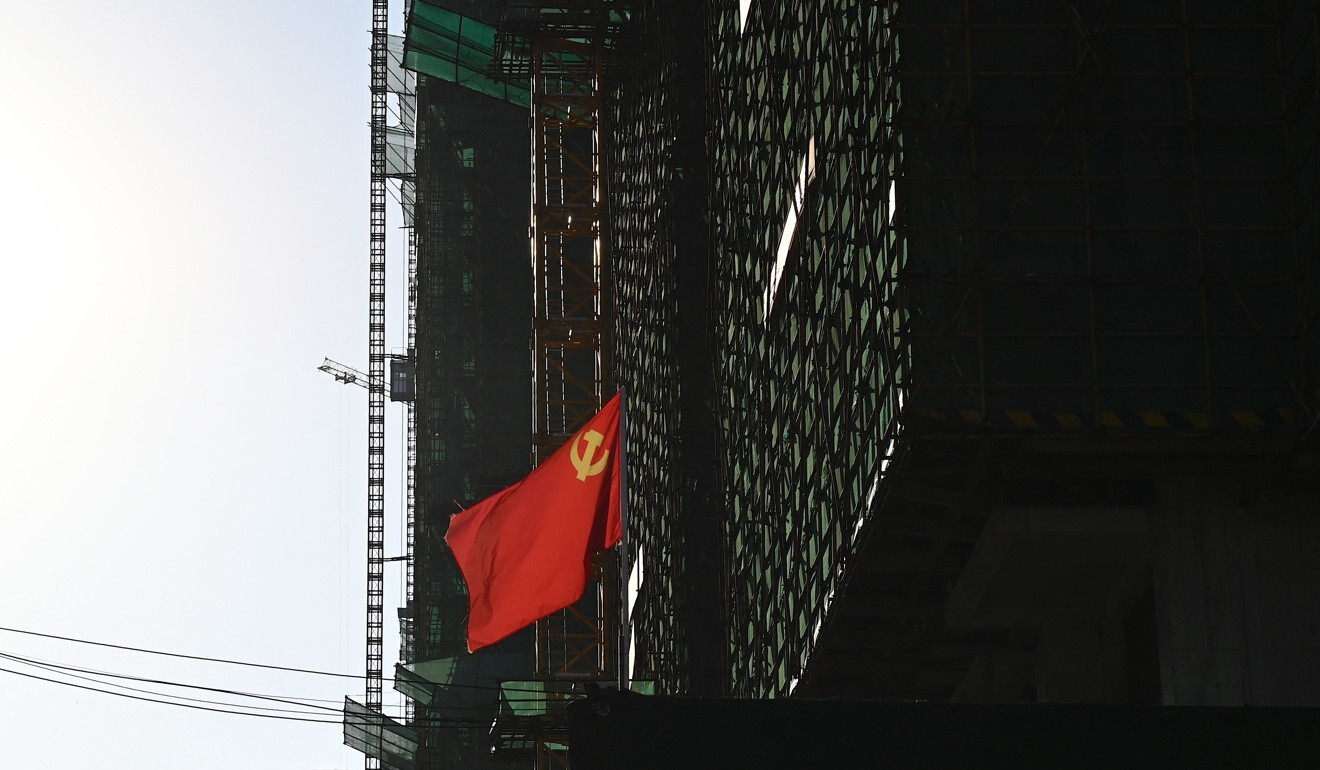

- Negative news surrounding China Evergrande hits sales at indebted developer

The average price of new homes across 70 major cities rose 0.2 per cent month on month in August, slowing from a 0.3 per cent increase in July, according to figures released by the National Bureau of Statistics (NBS) on Wednesday. In February, prices increased by 0.4 per cent, the highest this year.

“The softening property market was largely due to negative news surrounding the sector, such as more cities rolling out restrictions to cap price growth for new and old homes, as well as increasing difficulties in obtaining mortgage loans,” said Andy Lee Yiu-chi, chief executive for southern China at property agency Centaline China.

He added that China’s property market is likely to undergo a correction but was reluctant to predict the extent of the decline in prices.

“More importantly, we see potential buyers prefer staying on the sidelines as they are wary more developers may encounter similar financial stress like China Evergrande and may face difficulties in raising finance to complete their property projects,” he said.

Lee said that Centaline has suspended marketing for Evergrande’s projects, noting that home buying sentiment has been affected after videos of investors protesting outside the developer’s Shenzhen headquarters went viral on social media.

Sales of lived-in homes in Shenzhen, China’s technology hub, have plunged 80 per cent so far this month, while in Guangzhou they have fallen 40 per cent, Centaline data showed.

Moreover, owners in Shenzhen have lowered their asking prices by as much as 15 per cent after banks indicated that quota for mortgage loans have been filled up this year, Lee said.

“Current applications submitted for home loans have to wait for banks’ new lending quotas, which will be announced early next year,” he said. “As government data lags behind market trends, home prices in Shenzhen should record a deeper fall next month.”

Data from NBS showed lived-in home prices in Shenzhen dropped 0.4 per cent last month from July, but rose 0.5 per cent in Guangzhou, 0.4 per cent in Beijing and 0.2 per cent in Shanghai.

Yan Yuejin, director at Shanghai-based E-house China Research and Development Institute, said measures to slow down home-price growth have worked remarkably well as they have prevented chaos from spreading in the market.

“The government is not only combating excessively increase in home prices but is also ensuring that flat values do not fall too fast,” Yan said.