Advertisement

Advertisement

TOPIC

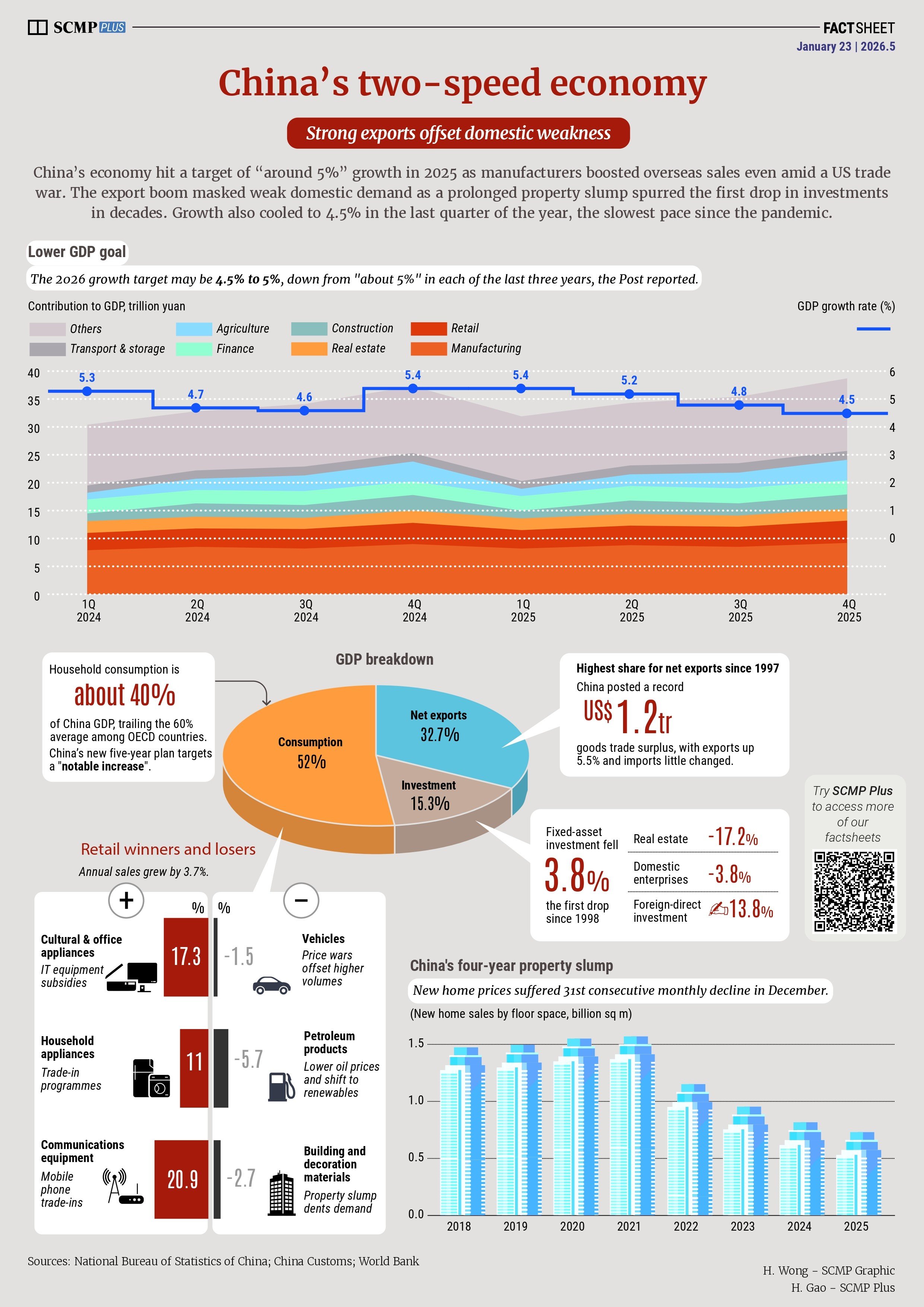

China property

China property

China’s property market has surged in recent years. After prices jumped 25 per cent in 2009 alone, the central government imposed austerity measures, including lending curbs, higher mortgage rates and restrictions on the number of homes each family can buy.

Help preserve 120 years of quality journalism.

SUPPORT NOWAdvertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement