House price slump in China shows no sign of abating as more cities record falls in December

- New home prices fell 0.25 per cent in December, while the fall in lived-in home prices was steeper at 0.5 per cent, according to National Bureau of Statistics

- The number of Chinese cities that saw a fall in home prices rose to 55 in December, from 51 in November

China’s new home prices fell for the 16th consecutive month in December, easing by 0.25 per cent, with analysts forecasting persistent weakness in the nation’s residential property market for the foreseeable future.

Of the 70 large and medium-sized cities tracked in the mainland, 55 recorded a decline in home prices, an increase of four compared with the previous month, according to data from the National Bureau of Statistics on Monday. In the secondary housing market, prices retreated in 63 cities, up from 62 in November.

The pace of decline in new home prices was the same in November, though lived-in homes saw a deeper fall. Secondary home prices fell 0.5 per cent, compared with 0.4 per cent in November.

China’s property market, until recently, had been hobbled by both Beijing’s crackdown on unfettered borrowing by property companies and its strict zero-Covid policy.

With Covid restrictions largely eased since last month and measures such as encouraging banks to lend to developers and relaxing down payment requirements for homebuyers to support the ailing sector, the housing market is likely to see a gradual upswing, according to analysts.

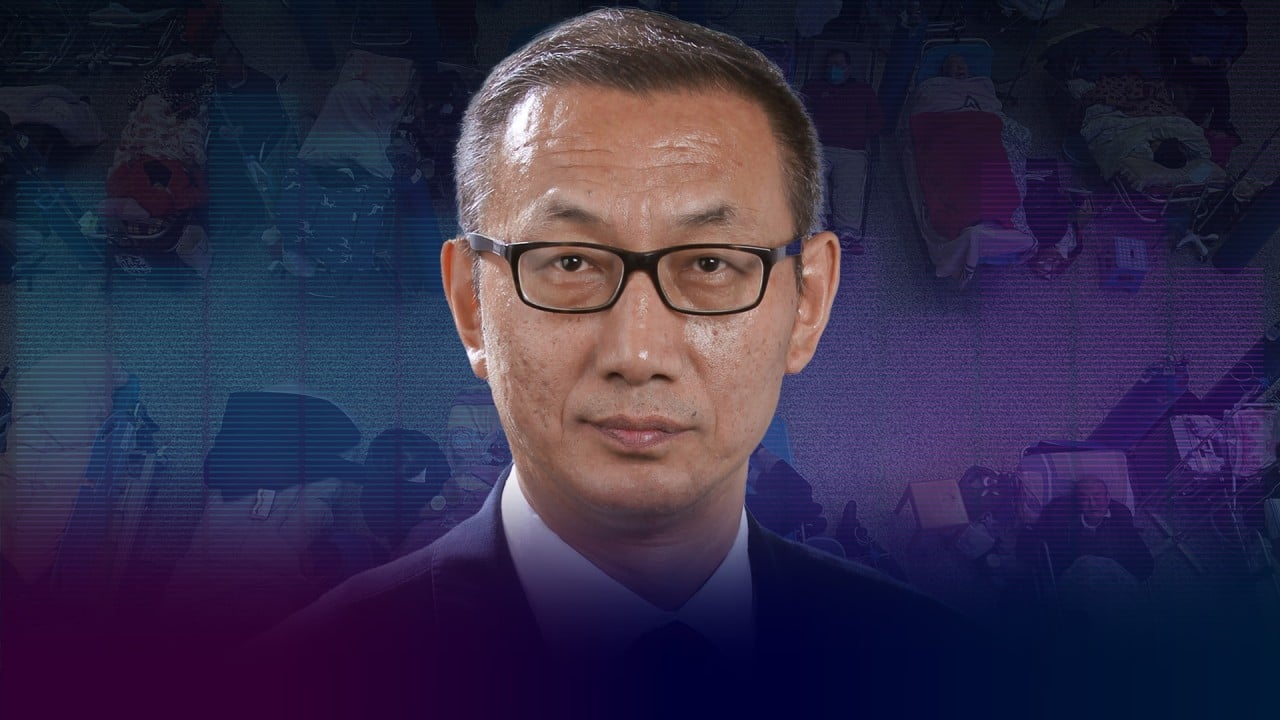

“The reopening [of China] will have a limited impact on property prices in China as most of the demand is domestic,” said Martin Wong, director and head of research and consultancy for Greater China at Knight Frank. “That said, it will lead to higher transaction volume as the reopening would lead to an improvement in market confidence.”

China pledges lower mortgage rates to spark life into ailing property market

Overall home prices in tier-1 cities are likely to rise as much as 3 per cent, while prices in other cities could slump further by as much as 2 per cent, Wong added.

“We believe it could take a few more months for property prices to show signs of recovery, due to Beijing’s determination on the [zero-Covid strategy] and its reluctance to stimulate home demand in large cities,” Nomura Holdings, Japan’s biggest brokerage, said in a note on Monday.

China property crisis: Officials draft 21-point action plan to aid developers

Home prices in Shenzhen, one of China’s most prosperous cities, retreated for the first time in 36 months in December. New home prices fell 0.2 percentage points year on year.

Meanwhile, about half the respondents in a recent survey released by Shanghai-based real estate platform Anjuke Group said they were planning to buy a home, while nearly a third said they have an “urgent need” to own a dwelling.

The report, timed to coincide with the Spring Festival Holiday, did not provide details, but said those surveyed were born in the 1980s to early 2000s. Many Chinese buy houses to coincide with the Lunar New Year, which starts on Monday.

“More than 80 per cent of potential buyers intend to use the Spring Festival to inspect and purchase houses, nearly half plan to buy houses within one to two years, and nearly 70 per cent of them prefer to buy houses in cities where they work,” the report said.