Proposal to relax reit restrictions finds support among some in industry

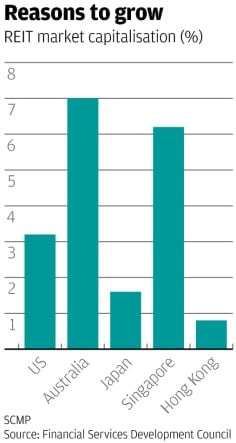

Change in investment rule would bring city in line with Singapore and Japan, say players

Some members of the real estate investment trusts industry are upbeat on the proposal to give listed reits greater flexibility to undertake development projects even though others have expressed reservations about it.

"Some tax incentives and relaxations on development should help the Hong Kong reit sector to capture the next wave of capital inflow from the world's largest real estate investors," said Victor Yeung, the chief investment officer at property management company Admiral Investment.

Yeung said allowing reits to dabble in developments would allow them to achieve capital growth and put them at the same competitive level as reits from Singapore and Japan.

Peter Mitchell, the chief executive of the Asia Pacific Real Estate Association (APREA), said: "Hong Kong reits can only acquire investment properties already in the market and are forbidden from building their own assets. The capacity to invest early in the project cycle would create pricing advantages and would also give reits control over the final product."

"Permitting a degree of development activity in itself will not make reits more risky," he said, adding that such restrictions did not apply in the US, Australia, Singapore and Malaysia.