A leading Hong Kong real estate investment trust (reit) is urging authorities to ease restrictions on Mandatory Provident Fund investments in the trusts.

Phiyona Au Yeung Ming-sze believes architecture should reflect community needs in a city. In Hong Kong, an increasing desire for more open space and green areas will be addressed by her design firm's current major project - the West Kowloon park.

The government faces an uphill task in increasing land supply, with more than half of the residential sites in the land sale programme yet to complete the rezoning process.

A small residential site in Fanling attracted 23 bidders yesterday although the site is far from the city centre, with surveyors estimating it could be worth between HK$525 million and HK$693 million.

New World Development kept a conservative target for contracted sales in the fiscal year to June 2015, even though its contracted sales hit a record in the previous financial year.

New World China Land said it cut its sales target for the current financial year by 15 per cent given the downturn in the sector as it reported net profit last year rose marginally, although it came in slightly above market expectations.

Nanjing has become the latest mainland city to remove property curbs in a move to boost the struggling market, but the rights issue offering of Agile Property Holdings has led to a fall in mainland property shares.

Xiamen is the only mainland city which recorded growth in new private housing prices among the 70 major mainland cities in August, government figures showed.

Average rents at 50 major housing estates in Hong Kong hit a record high last month, research by Ricacorp Properties shows.

CSI Properties, a property investment company, is raising up to HK$442.4 million through placement of new shares to fund its property investment.

MTR Corp released the tender terms for the Tai Wai Station residential project as the land premium was cut to a level 18 per cent lower than two years ago in a bid to woo developers.

New projects with smaller flats in Kowloon and on Hong Kong Island and luxury flats at Kowloon Station are proving the most attractive to investors.

The mainland's inventory of unsold housing stock has soared 190 per cent over the past four years, in a further sign that the downturn in the property market is deepening.

MTR Corp's Tai Wai Station residential project yesterday received an overwhelming response, with 23 developers expressing interest in the property.

The MTR Corp will reopen bidding for the Tai Wai Station residential project, two years after its tender was pulled. The project was withdrawn in 2012 because of a lack of interest and the bids were too low.

Developers are taking advantage of the government's controversial plan to rezone green belt areas to meet housing targets.

The outlook for Hong Kong's retail property market has become a hot topic for debate amid the recent decline in retail sales and proposed changes to the scheme allowing individual mainland tourists to visit the city.

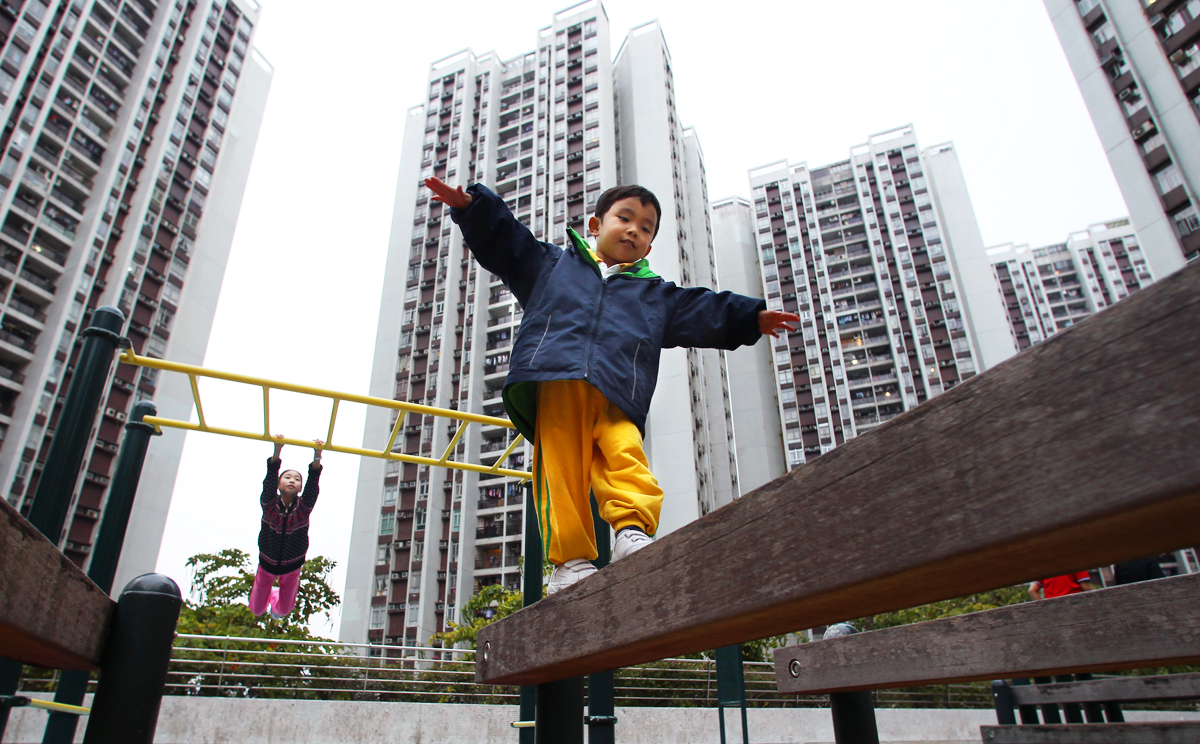

Strong demand for small flats helped push Hong Kong property prices to a fresh high for the third consecutive month in July, with analysts expecting gains to continue in the coming months.

Prices in five of the housing estates most popular among investors in the 1990s are still below their peak values in 1997, although the average home price in HK is 23.8 per cent higher than at the top of the market 17 years ago.

Fast-selling properties in Tseung Kwan O and at a luxury project at Kowloon Station could be a sign of an upturn in the property market.

The government tender for the first commercial site to become available in 16 years in Tsim Sha Tsui right attracted 18 bidders yesterday.

Sino Land said its underlying profit slid 24.3 per cent to HK$5.02 billion for the year to June as the lack of completed new projects weighed on its results.

Shimao Property Holdings reported a 20.5 per cent jump in first-half net profit yesterday, but falling turnover prompted fellow developer Guangzhou R&F Properties to cut its full-year target for contracted sales by 14 per cent.

The Urban Renewal Authority (URA) succeeded in attracting more bidders for the latest phase of its biggest redevelopment project after it relaxed the terms for the sale of the land following an aborted auction earlier.

Guangzhou R&F Properties has cut its contracted sales target by 10 billion yuan (HK$12.57 billion) this year on signs of slowing sales.

The only commercial site in Tsim Sha Tsui released for sale in 16 years is expected to generate an overwhelming response by the time the tender closes on Friday.

Hysan Development, the largest landlord in Causeway Bay, believes it can seize the opportunities from the consolidation of store networks undertaken by luxury brands as a slowdown in retail sales gathers pace.