Donald Trump should know to give up on his trade or currency wars because they are easy to lose and impossible to win

- Japan could be next on Trump’s hit list for a trade deal, and there may be a currency element in it

- Any attempt by Team Trump to regulate the yen’s value – or the renminbi for that matter – will prove as futile as it is risky

Team Trump has opened up a Pandora’s Box and is ill-equipped to deal with what’s inside.

Japan could be next on Trump’s hit list for a trade deal and Tokyo fears there could be a currency element in the deal, as there may be yet with China. If so, this would take Trump’s trade policies even further into the realm of fantasy than they have strayed already.

Japan is vulnerable because its continued monetary easing at a time of tightening by the US and Europe looks increasingly like a device to stem the yen’s appreciation.

Even so, any attempt by Team Trump to regulate the yen’s value – or the renminbi for that matter – will prove as futile as it is risky.

Achieving balanced trade on a bilateral basis is complicated enough as it is, whether we are talking about barter or monetised commerce. Trade is measured by value rather than volume, and any attempt to control the value of the medium of exchange as part of a trade agreement is naive at best.

Commentary: What Donald Trump should know about the global trade in human hair

The value of currencies is determined by international capital flows, allowing trade deficits to be financed. The US economy, which runs a huge deficit in merchandise trade, uses the dollar’s status as a reserve currency to attract huge capital inflows, effectively funding the deficit.

Instead of wasting time on currency wars with China or Japan, Trump’s negotiators should educate themselves better on how today’s semi-globalised economy works, and then resolve either to push on toward full economic globalisation or retreat altogether from international trade. There is no viable halfway house.

Production centres no longer correspond to national borders. They are strung out as supply chains across the world, and this is largely what determines trade balances; not the trade or monetary policies of individual countries.

Yet, US negotiators cannot seem to see beyond their own borders. They are like aircraft pilots of yesteryear, thinking they can still pull or push a few simple controls in a small plane, when the global economic system has become as complex as a jumbo jet. The dangers of pushing the system into a stall and crash, taking us all with it, are very real.

There is no longer such thing as a “simple” trade agreement between nations. Trade is one element of a complex economic relationship between countries. As former US senior trade official Clyde Prestowitz said, the question is not whether countries are playing fair, but whether they are even playing the same game.

When Prestowitz was negotiating in the 1980s over Japan’s trade surplus with the US, it dawned on him that the two countries were not playing the same game. Japan’s government-guided economic structure was fundamentally different to America’s free market.

It is now dawning upon US negotiators that much the same applies to China. China’s economy is centrally planned while the US is market-based. Since China under President Xi Jinping is moving toward even more centralised control, the chances are slim of persuading, or coercing China into behaving like a market economy.

The US may try to become more like China, Prestowitz said. He is promoting the idea of an industrial policy under which resources can be directed toward planned targets rather than leaving everything to the wisdom or whim of the market. A Senate Committee report has inclined in a similar direction.

This can be part of a great reversal dating to early 2018 when the traditionally pro-free-trade Economist newspaper ran a cover story entitled “The West Made the Wrong Bet” in believing that China would become a market economy under the World Trade Organisation.

On one hand, we have Trump’s trade officials pushing for China to conclude a trade deal as though between two equal partners, while influential figures in the US establishment favour “fighting like with like” in making their economy more like China’s.

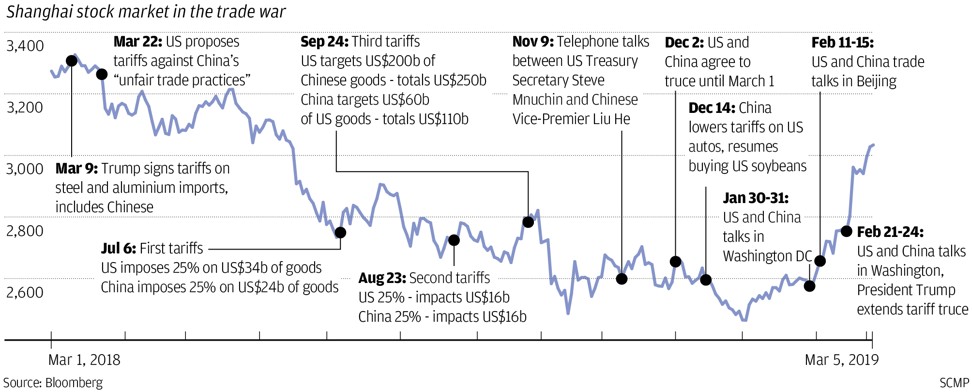

This will lead to more friction and even more harm to the international trading system than Trump’s policies have done. If the US-China deal crash lands in the same way that the US-North Korea negotiations did in Hanoi, US tariffs could even go higher, with damage all round.

Infographics: Why ‘Made in China 2025’ triggered Trump’s wrath

Whatever the outcome of the US-China trade war – or looming conflicts with Japan and others – the way forward is not through confrontation but mutual trade and monetary reforms that recognise the implications of globalisation for political and economic sovereignty. Recognition of the fact that there is a problem would be at least a step toward resolving it.

The danger is that the Trump administration will be tempted to double down on trade and currency wars in view of the latest data showing that a 12.4 per cent jump in US merchandise deficit in December contributed to last year’s record US$891.3 billion trade shortfall.

It may take a crisis to force more rational solutions.

Anthony Rowley is a veteran journalist specialising in Asian economic and financial affairs