Update | Chinese steelmakers slide after Trump levies 25pc tariff on US imports

Analysts gauge how raised import duties will affect China, and the US’ other major steel suppliers

Hunan Valin Steel and Chongqing Iron & Steel led the decliners among Chinese makers of the alloy in mainland trading after US President Donald Trump signed off on hefty tariffs on imported metals.

Hunan Valin slumped 9.4 per cent to 9.04 yuan (US$1.43) on Friday in Shenzhen, capping the biggest drop since September 2016. Chongqing Steel slid 3.5 per cent to 2.49 yuan in Shanghai and Baoshan Iron & Steel dropped 3 per cent to 9.10 yuan. The benchmark Shanghai Composite Index closed 0.6 per cent higher.

Trump officially levied a 25 per cent tariff on steel imports and 10 per cent on aluminium on Thursday, excluding Mexico and Canada, despite some opposition from his administration on concerns the would escalate the risk of a global trade war.

Analysts were split over the repercussions on the profitability of Chinese steelmakers.

While Everbright Securities and Gousen Securities said the impact would be muted as sales to the US only accounted for around 1.5 of China’s steel exports last year, Haitong Securities argues the implication could be far-reaching as some of the exported steel was eventually sold to the US after being processed in a third country. Some estimates suggest that figures is higher, at nearly 3 per cent.

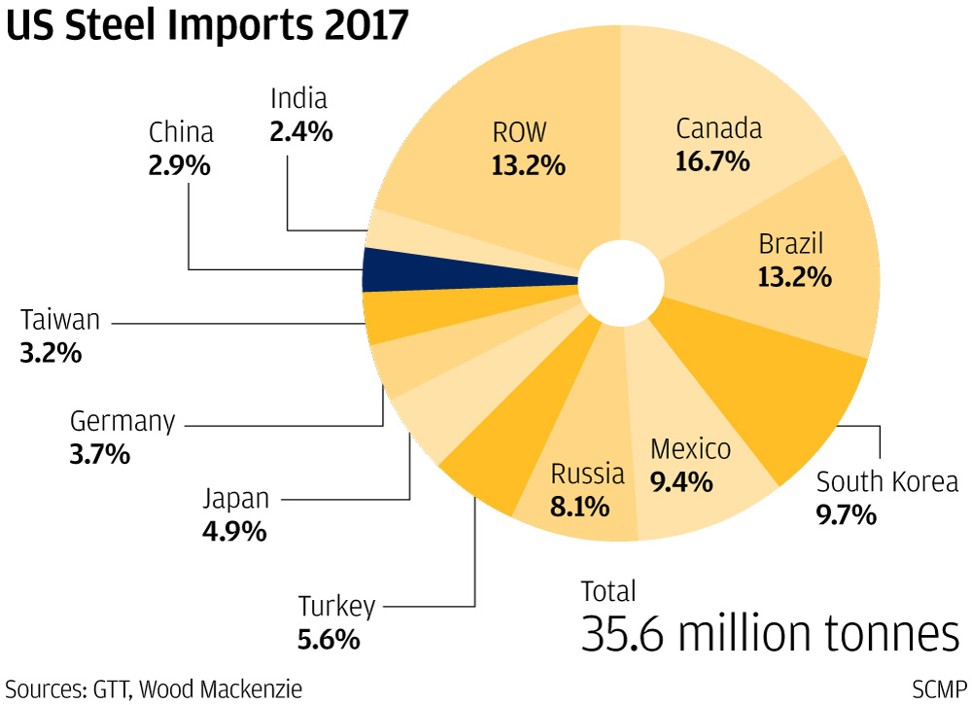

Canada is the biggest steel-exporting country to the US, followed Brasil and South Korea, according to Everbright.

China’s steelmakers were among the major beneficiaries of a government drive to reduce excessive capacity in traditional industries, with shares in some of the biggest players including Hesteel and Baoshan Steel rising at least 17 per cent last year.

The nation aims to cut steel output by 30 million tonnes this year in Premier Li Keqiang’s work report delivered to the opening session of the annual legislative meeting on Monday. Last year, the government eliminated 65 million tonned of unneeded capacity.

Chongqing Steel’s Hong Kong-traded shares fell as much as 1.3 per cent before finishing the day unchanged at HK$1.57.