Advertisement

Advertisement

TOPIC

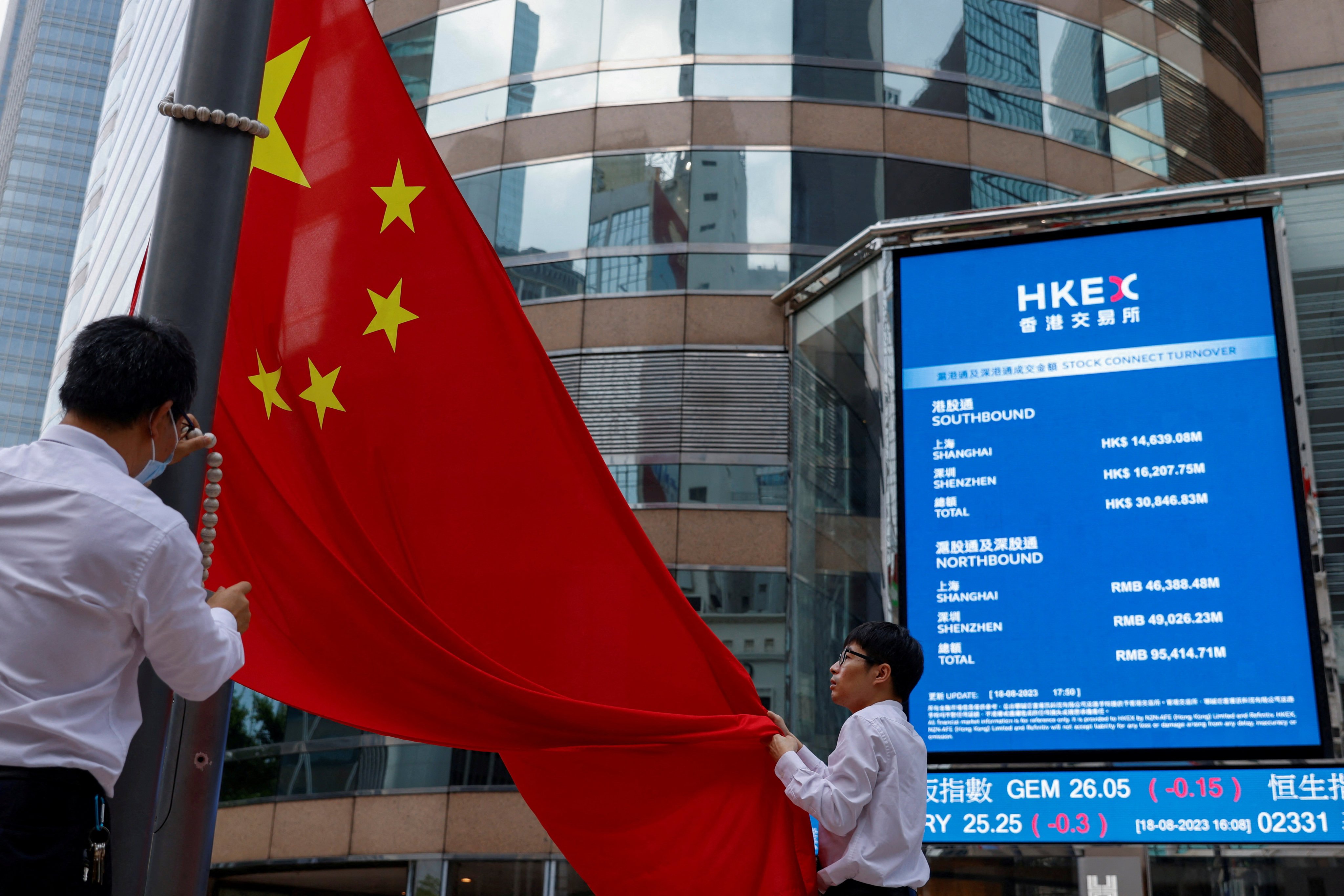

China stock market

Related Topics:

China stock market

The latest news, analysis and opinion on China stock market. In-depth analysis, industry insights and expert opinion.

Help preserve 120 years of quality journalism.

SUPPORT NOWAdvertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement