China’s securities regulator pledges action to shore up region’s worst-performing stock market, says rout is an ‘overreaction’

- Measures include encouraging more tech companies to go public and adding more stocks to the exchange link with Hong Kong

- Vice-chairman of the China Securities Regulatory Commission seeks to soothe shattered nerves of investors in interview with Xinhua

He described the sell-off that has wiped billions off the value of Chinese equities as an “overreaction” to negative headlines.

The CSRC said it will roll out of a raft of measures to stabilise the market. These will include encouraging more technology platform companies to go public either domestically or overseas, increasing the participation of institutional investors and expanding the investible universe of the exchange link with Hong Kong, according to Wang.

“The impact of all these risks on the A-share market is controllable,” he said. “The size of margin trading is limited … and the mutual-fund industry has still seen net subscription rather than redemption. We believe that the short-term market swing will not change the uptrend of the capital market.”

To make things worse, Shanghai was placed under lockdown, triggering the suspension of work at Tesla’s local factories and electronic plants in neighbouring Jiangsu province.

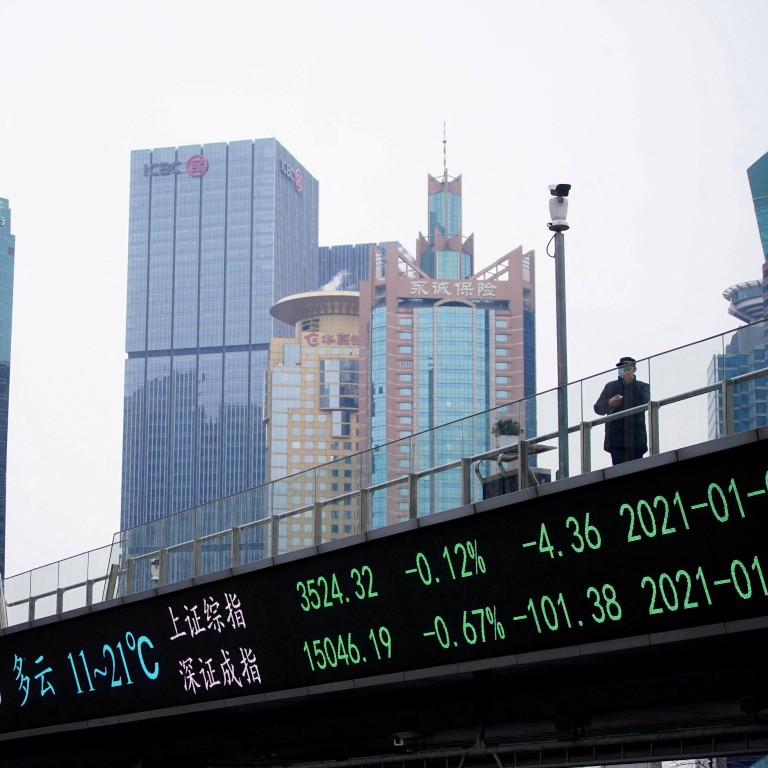

The Shanghai Composite remains 6 per cent above a two-year low set on April 26. Still, it is the worst performer in Asia this year with a 16 per cent decline.

Wang also highlighted the attractive valuations of China’s stocks in the Xinhua interview. The declines boosted the dividend ratio of the CSI 300 Index of the biggest onshore listed companies to 2.8 per cent, matching the yield on China’s 10-year government bond, he said.

China will broaden the investment scope of the cross-border Stock Connect mechanism by including exchange-traded funds, and enact new regulations that will support Chinese companies’ listings in the US, Hong Kong and Europe, he said.

The CSRC will also reduce the burden on publicly traded companies by cutting their annual listing fees, and allow them to conduct refinancing and mergers and acquisitions to overcome the impact of the pandemic.