Hong Kong stocks gain on China stimulus bets while Bank of Japan stokes recession risk in shift to tightening path

- Stocks snapped a two-day slide as traders stay optimistic China will dig deeper into its stimulus toolbox to support the virus-hit economy

- Bank of Japan stoked concerns about recession after altering its dovish stance by guiding government bond yields higher

The Hang Seng Index rose 0.3 per cent to 19,160.49 at closing of trading on Wednesday, after rising as much as 0.8 per cent. The Tech Index added 0.7 per cent while the Shanghai Composite Index declined 0.2 per cent.

Tencent Holdings climbed 0.5 per cent to HK$311 while Alibaba Group also added 0.5 per cent to HK$84.45. Hansoh Pharmaceutical surged 1 per cent to HK$13.92, while WuXi Biologics jumped 2.5 per cent to HK$51.25. Carmaker Xpeng soared 4.7 per cent to HK$38.85.

“Today’s turn is just a short-term rebound after the recent correction,” said Kenny Wen, head of investment strategy at KGI Asia. “I still think China will use more fiscal and monetary policy tools to support the economy.”

‘Painful, bumpy’ road ahead for China’s economy amid zero-Covid exit

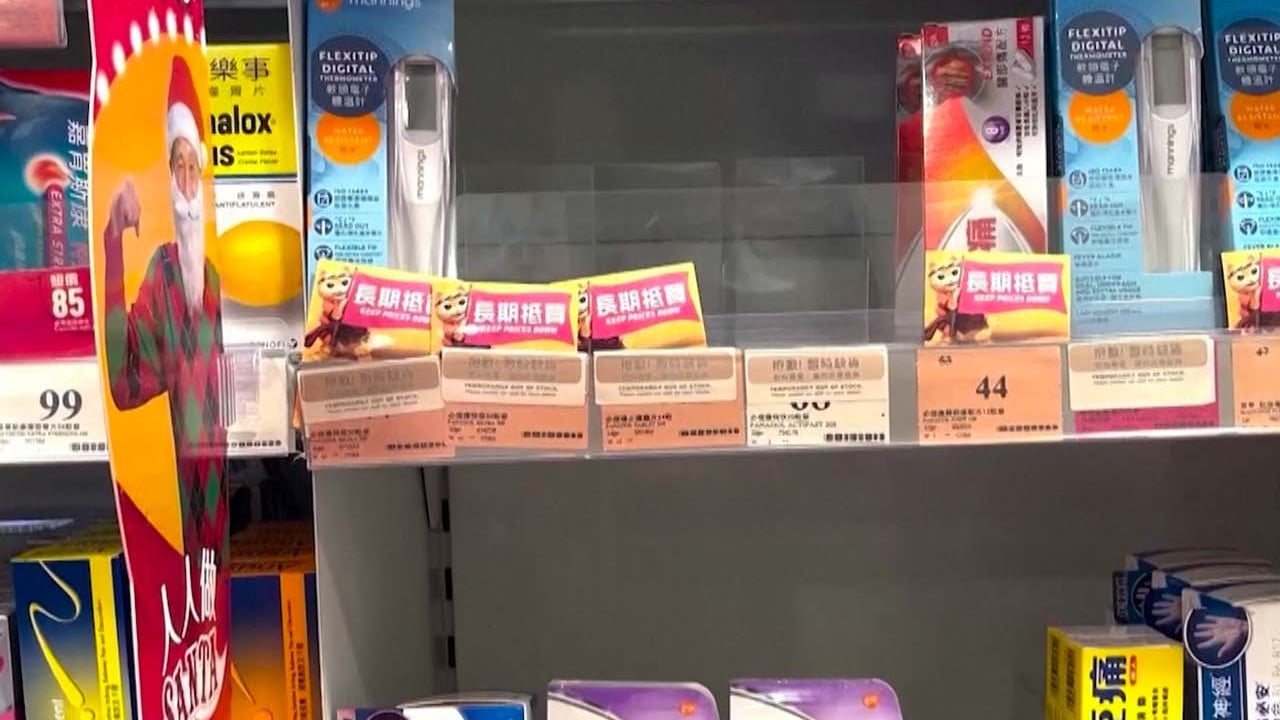

New Covid-19 infections in China rose to 3,049 on Wednesday from 2,656 on Tuesday, the National Health Commission reported.

The Bank of Japan on Tuesday altered its dovish stance by allowing 10-year government bond yields to move within 50 basis points on either side of its zero target, versus 25 basis points previously. It marked the first change to the central bank’s so-called yield-curve control since late 2016.

Yuanjie Semiconductor Technology was the sole debutant on Wednesday. The stock jumped 16 per cent to 116.42 yuan at the close of trading in Shanghai.

Markets in Asia-Pacific were mixed. The Nikkei 225 declined 0.7 per cent, after sliding on the Bank of Japan shocker on Tuesday. Equity benchmarks in Australia rose by 1.3 per cent and fell 0.2 per cent in South Korea.