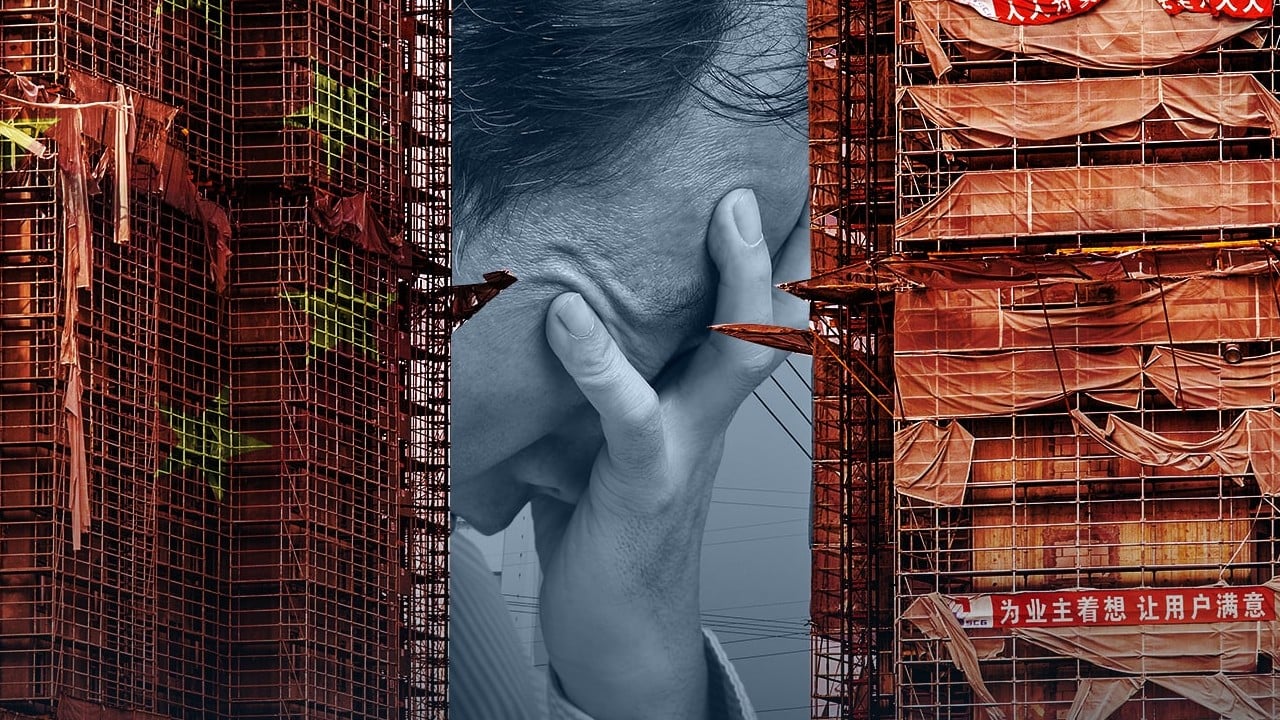

No end in sight to China’s property crisis as new home prices post sharpest decline since February 2015

- Prices of new homes tracked in 70 Chinese cities fell 0.4 per cent month on month in October, the most since a 0.5 per cent decline in February 2015

- The number of cities that reported a drop in prices rose to 56 in October, from 54 in the previous month, official data showed

Home prices in major Chinese cities fell for the fourth straight month in October, recording the steepest drop in nearly nine years, as demand continues to slump despite measures to support the market.

Prices of new homes in 70 medium and large cities fell 0.4 per cent month on month, the most since a 0.5 per cent decline in February 2015, data from the National Bureau of Statistics showed on Thursday. Prices fell 0.3 per cent in September.

Fifty-six of the cities tracked saw prices of new homes fall last month, two more than in September, while prices of lived-in homes fell in 67 cities, versus 65 in September.

“The lacklustre home price data reflects a fluctuating home market, but it was also a result of big discounts given by developers and local governments,” said Yan Yuejin, director of Shanghai-based E-house China Research and Development Institute.

The data comes after the statistics bureau reported a contraction in property investment on Wednesday. Real estate investment fell by 9.3 per cent in the first 10 months compared with a year earlier, worsening from a 9.1 per cent contraction in the first nine months. Beijing’s measures, from cutting mortgage rates to lowering thresholds for first-time buyers, have failed to revive the market, indicating a worsening property sector.

Home sales at the country’s top 100 developers slumped by 27.5 per cent year on year in October to 406.7 billion yuan (US$56 billion), according to data compiled by the China Real Estate Index System. However, sales rose by a negligible 0.6 per cent from September.

Among tier 1 cities, Beijing, Guangzhou and Shenzhen new homes in October recorded month-on-month price declines ranging from 0.4 per cent to 0.7 per cent. Prices, however, rose in Shanghai by 0.2 per cent.

Prices fell 0.2 per cent in tier 2 cities and by a sharper 0.5 per cent in tier 3 cities and elsewhere.

Second-hand home prices in tier 1 cities fell 0.8 per cent versus a 0.2 per cent increase in September, with the declines in Beijing, Shanghai, Guangzhou and Shenzhen ranging from 0.5 per cent to 1.1 per cent.

“There remain many twists and turns in the recovery of the housing market,” said Zhang Bo, chief analyst at 58 Anjuke Real Estate Research Institute in Shanghai. Tier 1 cities continue to underperform, as the supportive measures launched in Beijing, Shanghai and Shenzhen are not strong enough, Zhang added.

Separately, Japanese investment bank Nomura said China’s property sector has yet to bottom out, noting that the market appears to have been a bit too optimistic about the property stimulus policies over the past two months.

“Amid surging property credit fallout among property developers, homebuyers might become increasingly impatient waiting for home delivery,” Nomura analysts led by Lu Ting said in a report on Wednesday. This could trigger a negative feedback loop, further dampening confidence and demand.

The bank estimates there are around 20 million pre-sold units that are “either unconstructed or delayed”. “We also estimate that the total funding gap to complete the remaining units would be around 3.2 trillion yuan,” Nomura said.

“At some point next year, the issue of home delivery could turn into a social issue and endanger social stability, and Beijing may eventually need to significantly ramp up policy support. We see this as key to truly restoring the confidence in the property sector and economy.”