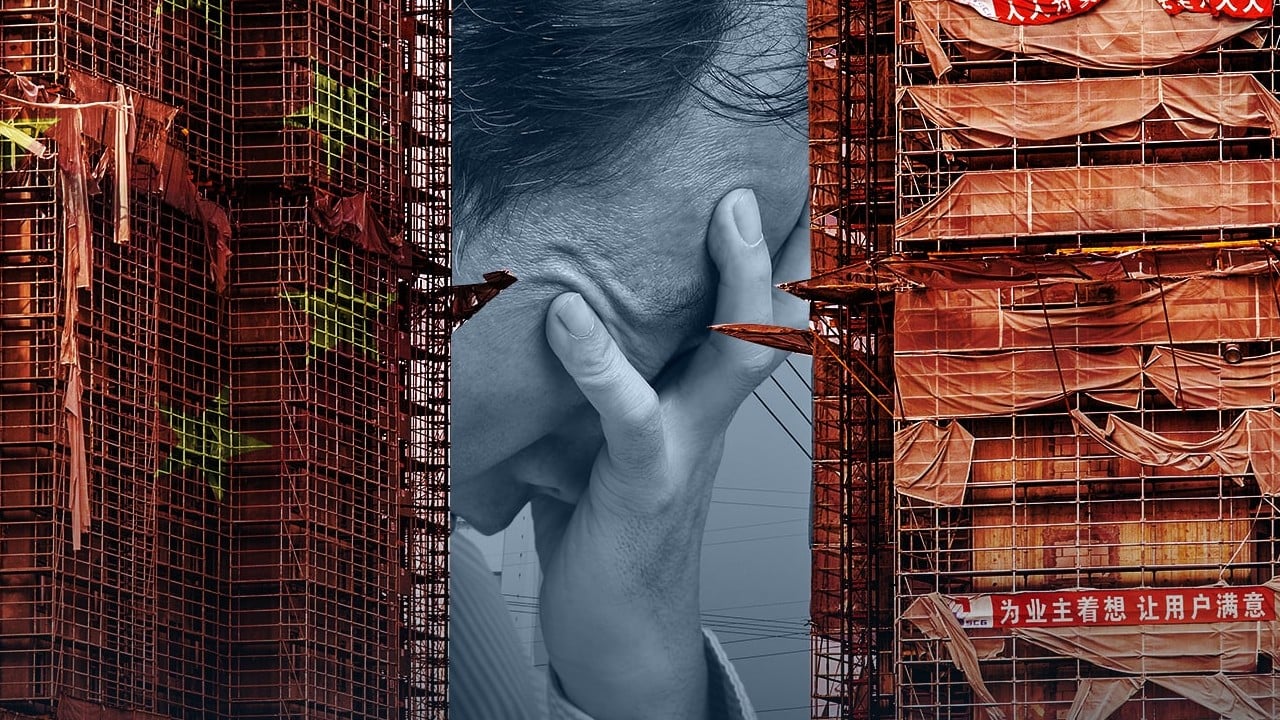

China’s state-backed developers grow earnings as buyers look for safety in home delivery, shunning troubled builders

- Report cards from Poly Property and China Merchants Shekou showed consumers preferred the safety of state-backed developers

- Longfor Group also issued a warning this month, saying net profit probably declined by 45 per cent to 24.4 billion yuan in 2023

Poly Property Group reported a 77 per cent jump in net profit to 1.44 billion yuan (US$200 million) in 2023 from a year earlier, according to its Hong Kong stock exchange filing on Thursday. Sales increased by 7 per cent to 53.6 billion yuan, it said.

The developer, which is a unit of state-backed and biggest home builder China Poly Group, declared a final dividend of 8.3 HK cents per share versus 4.3 HK cents in 2022.

Earnings at China Merchants Shekou Industrial Zone, the third ranked builder by sales and a state-controlled entity, surged 48 per cent to 6.3 billion yuan last year, according to its exchange filing, despite flattish sales of 293.6 billion yuan.

China’s property market will remain a “huge market” with a market size of about 1 trillion yuan, local news outlet the Paper reported on Wednesday, citing chairman Jiang Tiefeng as saying at Shekou’s annual meeting with shareholders. There is limited room for further downturn, the report said.

That probably will not apply to the nation’s struggling and debt-laden developers, as homebuyers stayed away from their property showrooms. Reports about their financial troubles and a crackdown by authorities on accounting misdeeds have contributed to another year of slumping sales.

What next for Evergrande’s Hui Ka-yan after China slaps penalty and market ban

The nation’s junk-rated private developers have defaulted on more than US$160 billion of offshore bonds between 2020 and 2023, according to an estimate by Goldman Sachs. China Evergrande, for example, defaulted on US$20 billion of them preceding its liquidation in January, triggering severe penalties this week.

Zhenro Properties on Tuesday warned that it is likely to report a net loss between 8 billion yuan and 9 billion yuan for 2023, adding to a 12.9 billion yuan of losses in 2022. Slimmer margins and higher provision for impairment of property projects abetted the slump as demand shrank nationwide.

Longfor Group also issued a profit warning earlier this month, saying net profit probably declined by 45 per cent to 24.4 billion yuan in 2023. Revenue and gross profit margin were undermined by lower selling prices for its home projects as the firm pushed to trim inventories.

The weakness has persisted in its business this year. Contracted sales fell 55 per cent in the first two months from a year earlier, the Beijing-based developer said last week.

The contrasting fortune is reflected across the industry. Home sales fell for about 70 of the nation’s top 100 developers in 2023, according to data compiled by China Real Estate Information Corp. Almost half of 70, dominated by private developers, suffered declines in excess of 30 per cent, it added.

Homebuyers are not easily swayed by property-related easing measures, Moody’s Ratings said, indicating a weak buying sentiment in the next six to 12 months. Less than a fifth of respondents in a February survey by China Index Academy said they were planning to buy a home in the next six months. The proportion fell from 30 per cent in a similar survey a year ago.

“Sales recovery is not in sight despite intensified government support,” Moody’s said in a March 6 report. “It will take time to improve homebuyers’ expectations of income growth prospects amid softening economic growth.” Lingering concerns about project completion risks are also hurting sentiment, it added.