Macroscope | The euro’s lucky streak will come to an end in 2018

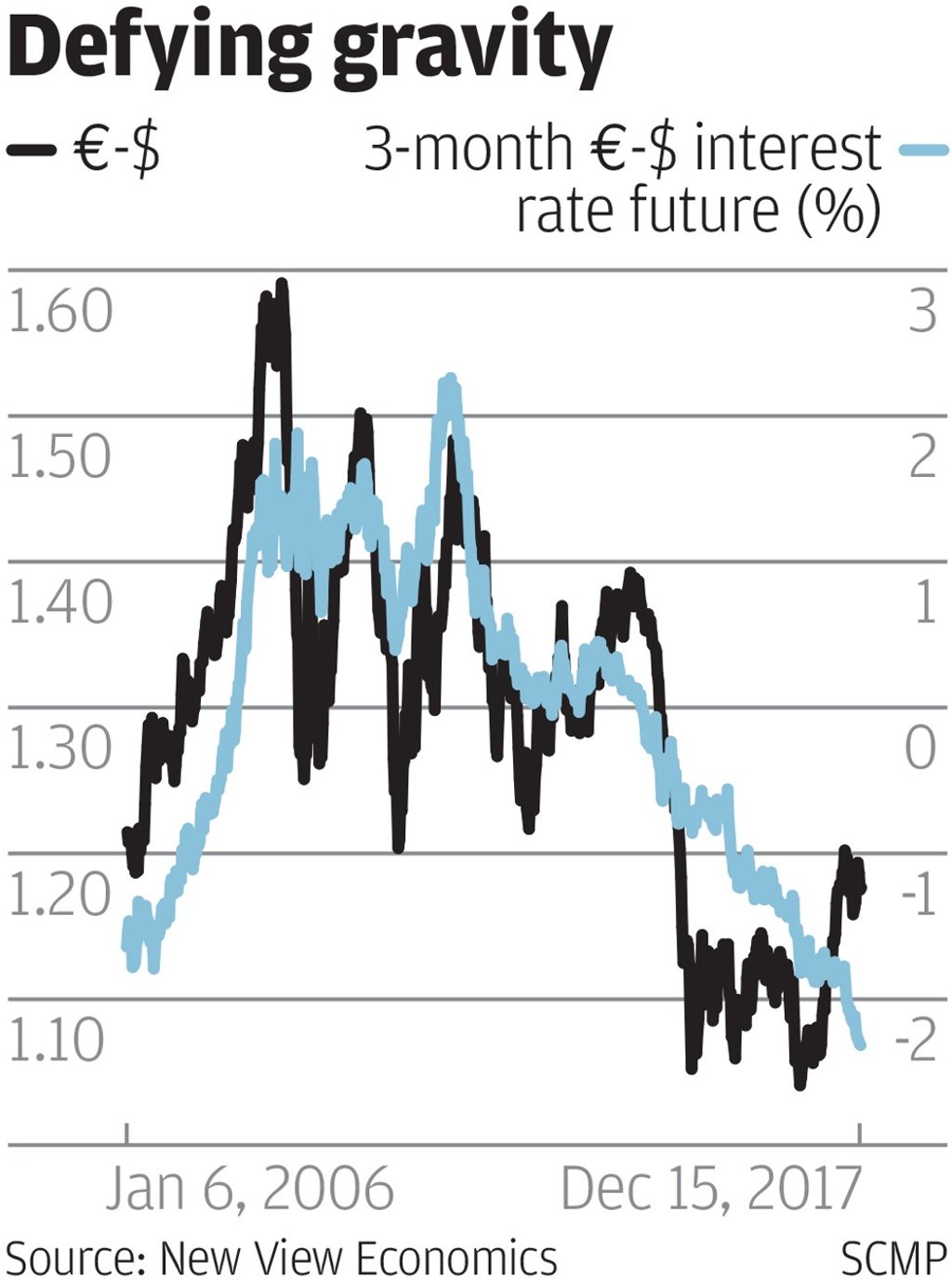

The single currency will face a number of challenges in the year ahead, not least of which is the growing US interest rate spread

There is a well-known rule in financial theory that if you leave a drunken man in a field and come back to collect him the following day, the most probable place to find him is exactly where you left him.

The euro currency might have done a lot of random walking in the past, but two decades on the euro/dollar exchange rate is still glued to where it began life at US$1.1743 in January 1999.

For investors the euro has been like Marmite – you either love it or hate it. It has frustrated the life out of its fans and been a boon to its detractors. Its volatility swings have been wild and vicious, taking no prisoners in its extreme peaks and troughs, suffering the slings and arrows of outrageous fortune along the way. Its very existence has often been in doubt.

But the euro has had a good 2017 and even surprised on the upside, winning the sobriquet as the Comeback Kid. The euro-zone economy might have turned the corner, European politics have settled down and there has even been a palpable sense of harmony as Europe has united behind tough Brexit negotiations against Britain. The glaring question is will it last going into 2018?

The European Central Bank has done a first-rate job in pulling recovery out of the bag with a restorative mix of cheap and easy money. The ECB came to the global easing party late in the day – well after the US, UK and Japan – but it has still pulled off an economic miracle. It averted a catastrophic debt disaster over Greece and ramrodded more recovery into the euro zone than could ever been imagined a few years ago.

The euro zone is now enjoying the fruits of those labours, with economic growth notching up its fastest rate of expansion for seven years. Economic confidence is flying, unemployment is tumbling and the recovery seems reasonably broad-based. France, normally an economic laggard in Germany’s shadow, is enjoying its fastest pace of business activity for over two decades. Even Greece is back on track again.