Shui On shares notch biggest weekly gain after profit beat forecast, even if outlook is modest

Shui On increasingly rely on selling equity interests in specific projects to local developers

Shares of Shui On Land, the Hong Kong developer that owns the landmark Shanghai shopping and entertainment district Xintiandi, jumped by their most in a week, after its 2017 profit and sales revenue beat forecasts.

Net profit under general accounting rules more than doubled to 2.24 billion yuan, while its adjusted figure declined 31 per cent to 925.75 million yuan last year. Sales revenue rose 5 per cent to 18.45 billion yuan (US$2.9 billion), according to Shui On’s filings to the stock exchange, beating estimates by 3.4 per cent.

Excluding a revaluation gain on investment properties, Shui On posted 3.15 billion yuan in core earnings.

The company has benefited from the booming property market in mainland China in 2016, when a year of unrestrained growth had cause prices to surge, forcing local authorities to impose administrative and lending policies to prick the real estate bubble.

Shui On shares rose as much as 1.8 per cent to HK$2.23, their biggest intraday gain since March 14.

Shui On’s total property sales that were recognised in the 2017 results rose 38 per cent to 30.3 billion yuan, including gains from its disposal of investment properties. However, its contracted sales fell by 7 per cent, last year contrary to most major mainland Chinese developers that reported more than 50 per cent growth in contracted sales last year.

“Our growth pace is a long way behind domestic developers,” Shui On’s chairman Vincent Lo said in a press conference yesterday in Hong Kong. “Our business model is drastically different from theirs. I know that we can’t compete head-on with domestic developers.”

Analyst estimates for 2018 earnings are little change, a prospect that Lo has acknowledged.

“Residential sales in the top-tier cities are expected to stay modest in the near future,” Lo said. “We expect that the property market curbs that are in place will continue, including price controls and restrictions on home purchases and the granting of sales permits.”

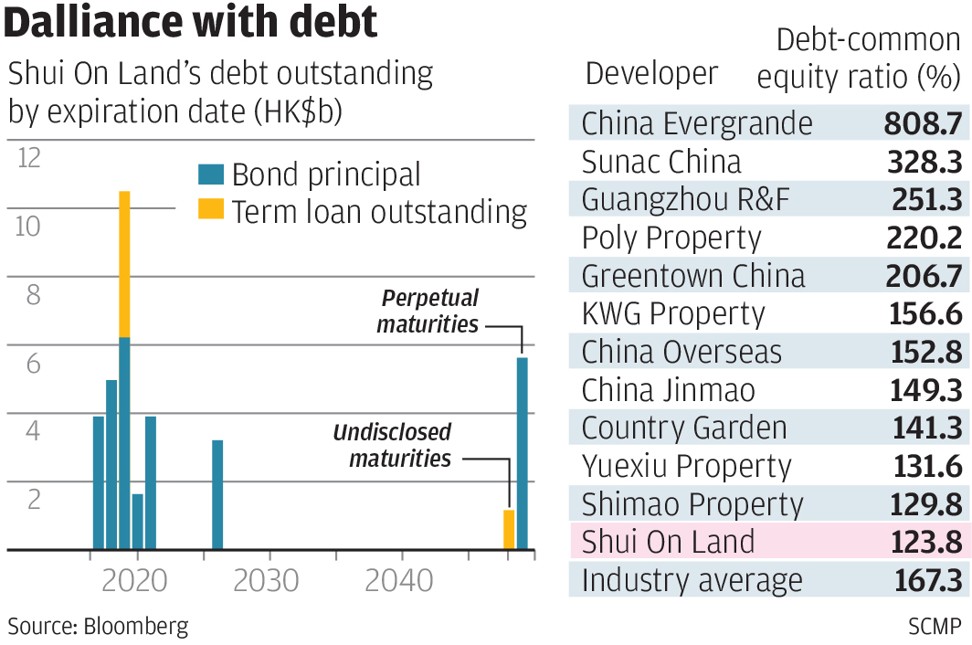

To reduce debt, Shui On has been increasingly relying on selling equity interests in some of its projects to mainland Chinese developers, instead of breaking up the property to retail buyers. It sold stakes in four projects in Shanghai, Chongqing and Dalian in 2017 alone, a disposal that lowered its net gearing ratio by 17 percentage points.

By the end of 2017 the company had just 5.9 million square metres (63.5 million square feet) of plots in its land bank, making it a minnow in comparison to China’s biggest developer Country Garden, with 280 million square meters of land.