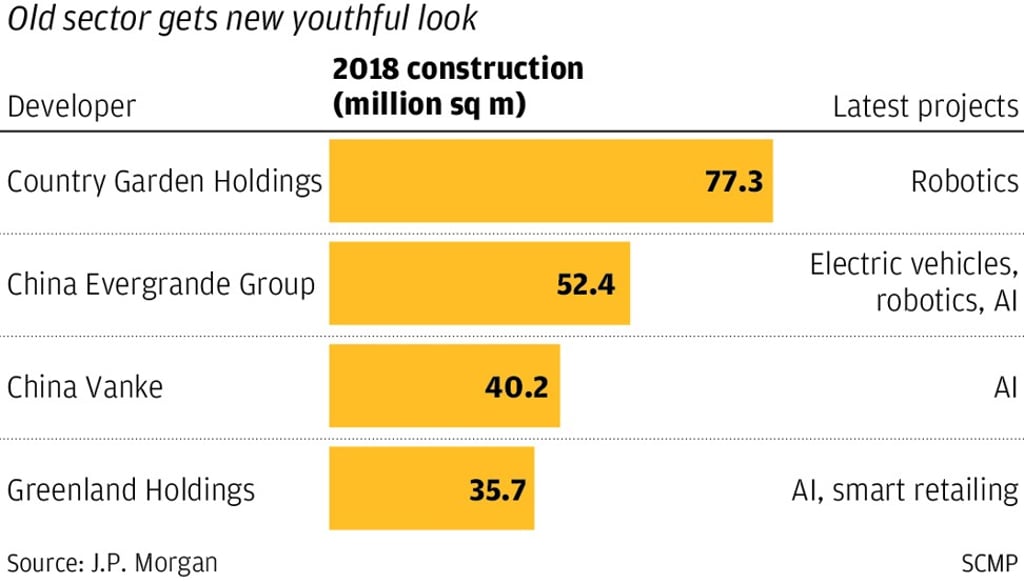

Chinese developers’ New Year’s resolution – diversify into robotics, green cars and Beijing’s other pet projects

- 20 out of 24 developers tracked by JPMorgan Chase missed their 2018 sales targets, underscoring why they are looking ahead

- Piling into Beijing’s pet projects can cut costs, build future profitable businesses and also curry political favour

It’s hard to be a rich Chinese property developer these days. Profits are still booming, for sure. And property development remains one of the most powerful engines of the economy. But when developers look ahead, they see diminishing profits – and diminishing favour.

To stay at the top of the tycoon pile, they are quickly diversifying, embracing the government’s new pet industry – tech. Think robotics. Think green cars. Think artificial intelligence.

“Failure or success does not really matter,” said Lung Siu-fung, an analyst at China Merchants Securities International. “At this stage, it is the new identity card that new business can give Chinese builders that matters. Property development is clearly not the favourite kid of the government at the moment.”

In a sign of the shift under way, one of China’s largest property developers changed its name from Longfor Properties to Longfor Group, saying the new brand is “more aligned with the long-term business strategies,” which include “continuous innovation”.

“It is not easy to negotiate with the government if you are purely a property developer currently,” Longfor CEO Shao Mingxiao recently told the South China Morning Post.