Advertisement

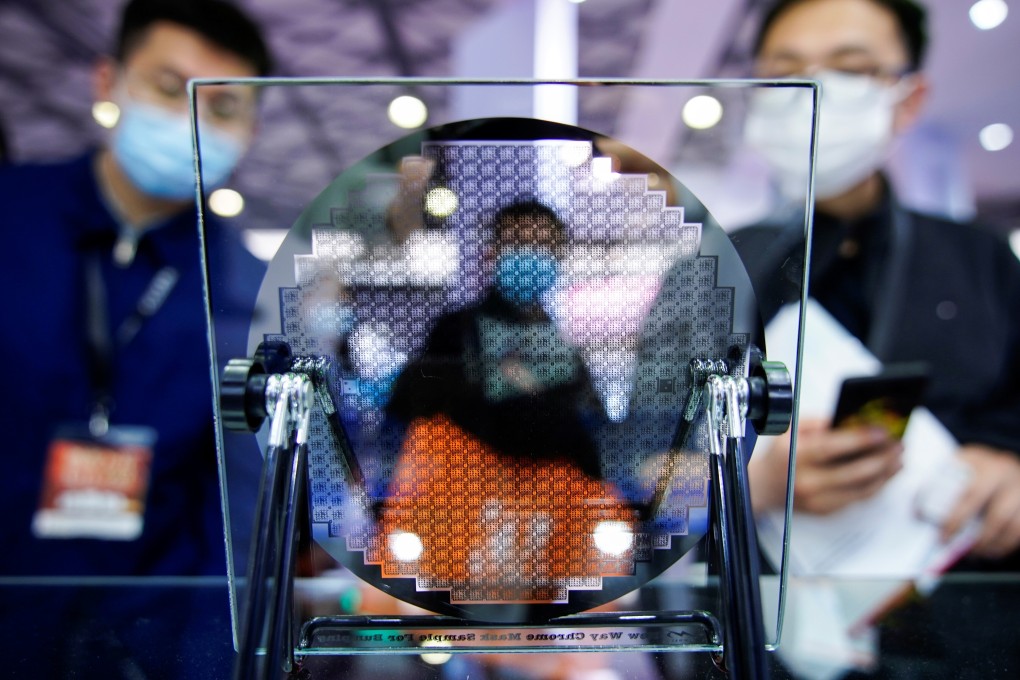

SigmaStar is eyeing US$780 million IPO in Shanghai as China’s semiconductor industry raises capital to expand

- The company is aiming for a valuation of between 30 billion yuan and 50 billion yuan, according to a person familiar with the matter

- The plan is not finalised and is subject to change, said people familiar with the matter

1-MIN READ1-MIN

Chip maker SigmaStar is seeking to raise at least 5 billion yuan (US$780 million) in an initial public offering (IPO) in Shanghai, according to people familiar with the matter, as China expands its semiconductor industry.

The start-up is working with advisers toward a share sale on the Nasdaq-style Star board as soon as this year, said the people, asking not to be identified because the information isn’t public. The plan isn’t finalised and is subject to change, they said. The company targets a valuation of 30 billion yuan to 50 billion yuan, said one of the people.

China’s semiconductor makers are seeking to capitalise on the government’s push to match the US and become more self-reliant as global chip supply dwindles. The world’s most-populous nation wants to build a group of technology giants that can stand shoulder to shoulder with Intel and Taiwan Semiconductor Manufacturing (TSMC), with Premier Li Keqiang pledging to boost spending and drive research into cutting-edge chips.

Advertisement

Founded in 2017, SigmaStar designs chips for security systems, sports cameras, self-driving vehicles, and smart home devices, among other products, according to the company’s website. Its backers include China’s Kunqiao Capital and SummitView Capital, according to CB Insights.

SigmaStar representatives didn’t immediately respond to emailed requests for comment.

Advertisement

Shanghai’s Star board was rolled out in 2019 as a testing ground that allowed streamlined registration-based IPOs, eased caps on valuations and price swings in the first few days of trading. More than 230 companies have debuted since then, including giants such as Semiconductor Manufacturing International and Bloomage Biotechnology.

Advertisement

Select Voice

Select Speed

1.00x