China Evergrande’s survival battle gets ugly with warning of imminent slump in earnings

- Net profit in the first six months of this year seen falling by 29 to 39 per cent on the back of losses in property sales and carmaking venture

- It would be the third year in a row the developer has reported a slump in profit, and the lowest income in five years amid lingering liquidity crunch

The developer expects to report a net profit between 9 billion yuan (US$1.39 billion) and 10.5 billion yuan for the six months to June 30, according to a profit warning in an exchange filing late on Wednesday. That would represent a 29 to 39 per cent slide from the same period a year earlier.

“The decline in profit in the first half of 2021 was mainly due to the decrease in the selling price of properties and the increase in expenses in the first half of the year,” billionaire founder and chairman Hui Ka-yan said in the filing.

The warning added another layer of concerns to its operations, with shareholders having suffered a combined US$48.5 billion erosion in the market value of Hong Kong-listed companies linked to the tycoon. Shares of China Evergrande have tumbled 69 per cent this year, while its electric car and property management units fell by 82 and 35 per cent, respectively.

The stock closed 7.2 per cent lower at HK$4.23 in Hong Kong in a weak market that saw the Hang Seng Index retreat by 1.1 per cent.

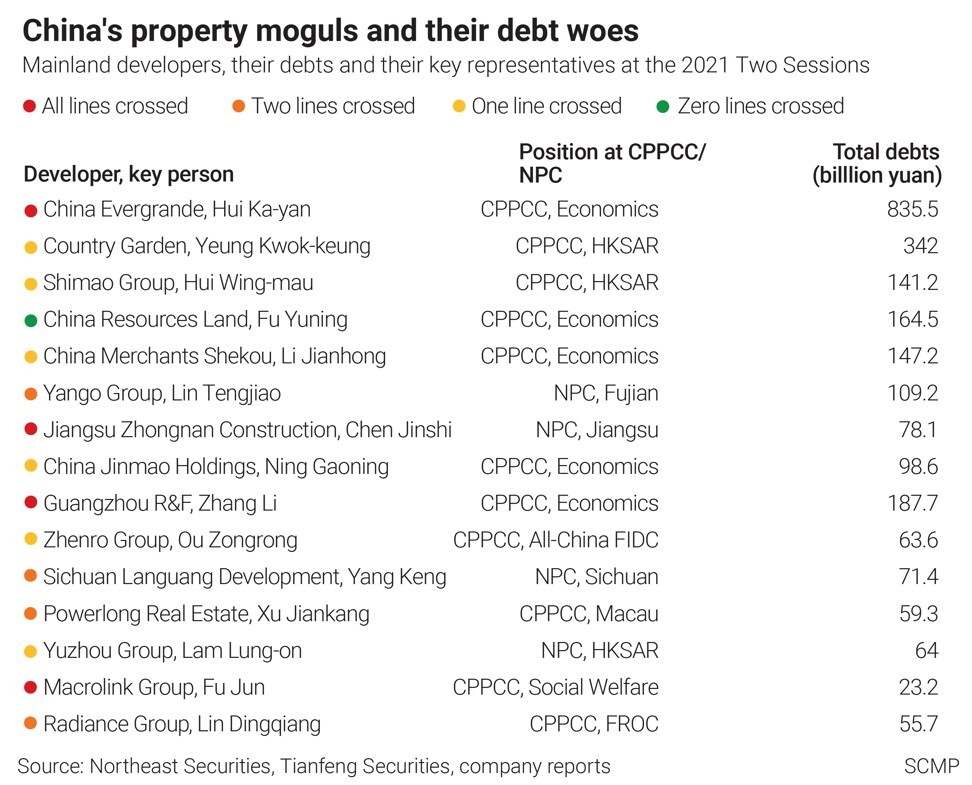

The liquidity crunch at Hui’s flagship company, whose more than US$300 billion of liabilities at the end of 2020 made it the most-indebted developer on Earth, has forced the billionaire to put some of its assets and ventures up for sale. At the same time, the government and the central bank have called on the firm to fix its balance sheet, a sign its distress is unnerving the highest authorities.

Evergrande takes early losses in plans to dominate Tesla, global electric car market

Meanwhile, the company’s dollar-denominated bonds are trading at 40 to 52 per cent of their face value, underscoring the erosion in confidence among local and foreign creditors about the company’s ability to service its maturing debt. The group has US$14 billion of dollar-bonds outstanding, according to Bloomberg data, and their deeply junk ratings are bordering levels deemed as default risks.

In the Wednesday filing, China Evergrande appears to compare its net profit with the level before minority interest of 14.8 billion yuan from a year ago. On that basis, it would be a third straight year of decline, and the lowest profit since the 7.1 billion yuan it made in the first half of 2016.

At the same time, it will book an 18.5 billion yuan gain from the sale of part of its shares in Hengten Networks Group, as well as the mark-to-market value of its remaining stake in the internet company.

China Evergrande sold another 11 per cent stake in Hengten for US$418 million earlier this month to Tencent Holdings and other undisclosed buyers.