US money manager Marathon is buying Evergrande debt while others are turning away from the crisis

- New York-based Marathon Asset is picking up Evergrande debt at distressed levels, seeking to profit from the crisis

- Developer may kick the can by servicing some payments but debt will be eventually restructured, co-founder says

Evergrande will eventually need to be restructured, although the company may “kick the can” by making some debt payments in the short term, he said, adding that homebuyers, suppliers and Chinese bondholders are going to be paid before offshore investors.

There are “absolutely opportunities” stemming from Evergrande’s debt crisis, Richards said. “It is a problem for China, problem for its housing market. A problem for the whole segment that relies on this. There’s a lot of jobs related to this and a lot of commerce related to this.”

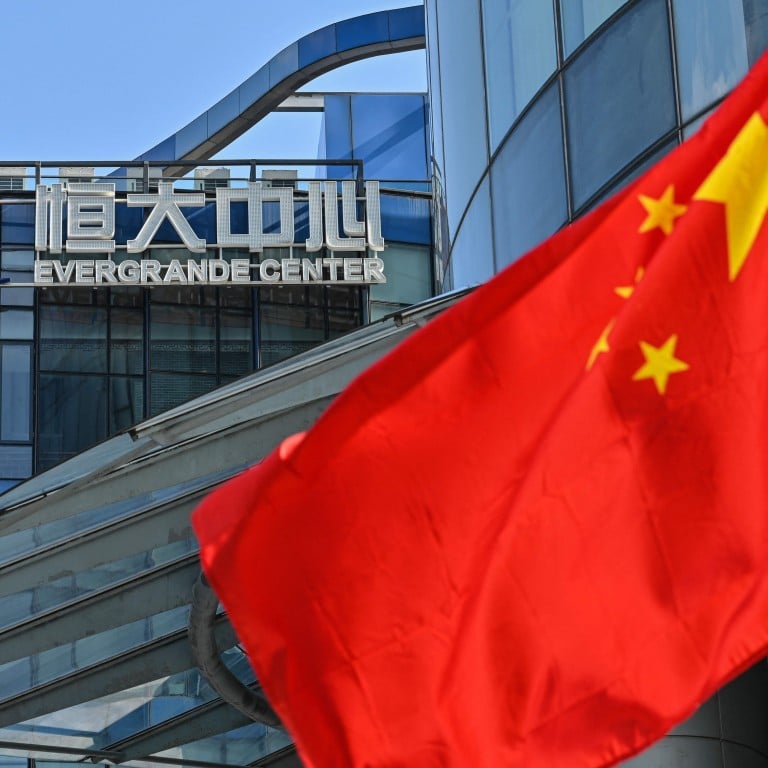

Evergrande, saddled with 1.97 trillion yuan (US$305 billion) of liabilities on June 30, hired outside financial advisers earlier this month to help tackle the debt burden. The developer has made no public statements on an US$83.5 million coupon that was due on September 23. Some bondholders have not been paid the interest on a 2024 bond on Wednesday.

Evergrande pares Shengjing Bank stake for US$1.55 billion to repay lender

The developer on Wednesday agreed to sell part of its stake in Shengjing Bank to a state-owned enterprise for US$1.55 billion to repay the lender. It faces four interest payment deadlines on offshore bonds through the end of the year.

Separately, China has urged financial institutions to help local governments stabilise the rapidly cooling housing market and protect the rights of some homebuyers, the latest signal that authorities are worried about the fallout from Evergrande’s debt crisis.

They should help maintain a healthy and stable development of the real estate market, and protect the legitimate rights of homebuyers, the People’s Bank of China said about a meeting on real estate finance work on Wednesday.