Advertisement

Advertisement

TOPIC

/ company

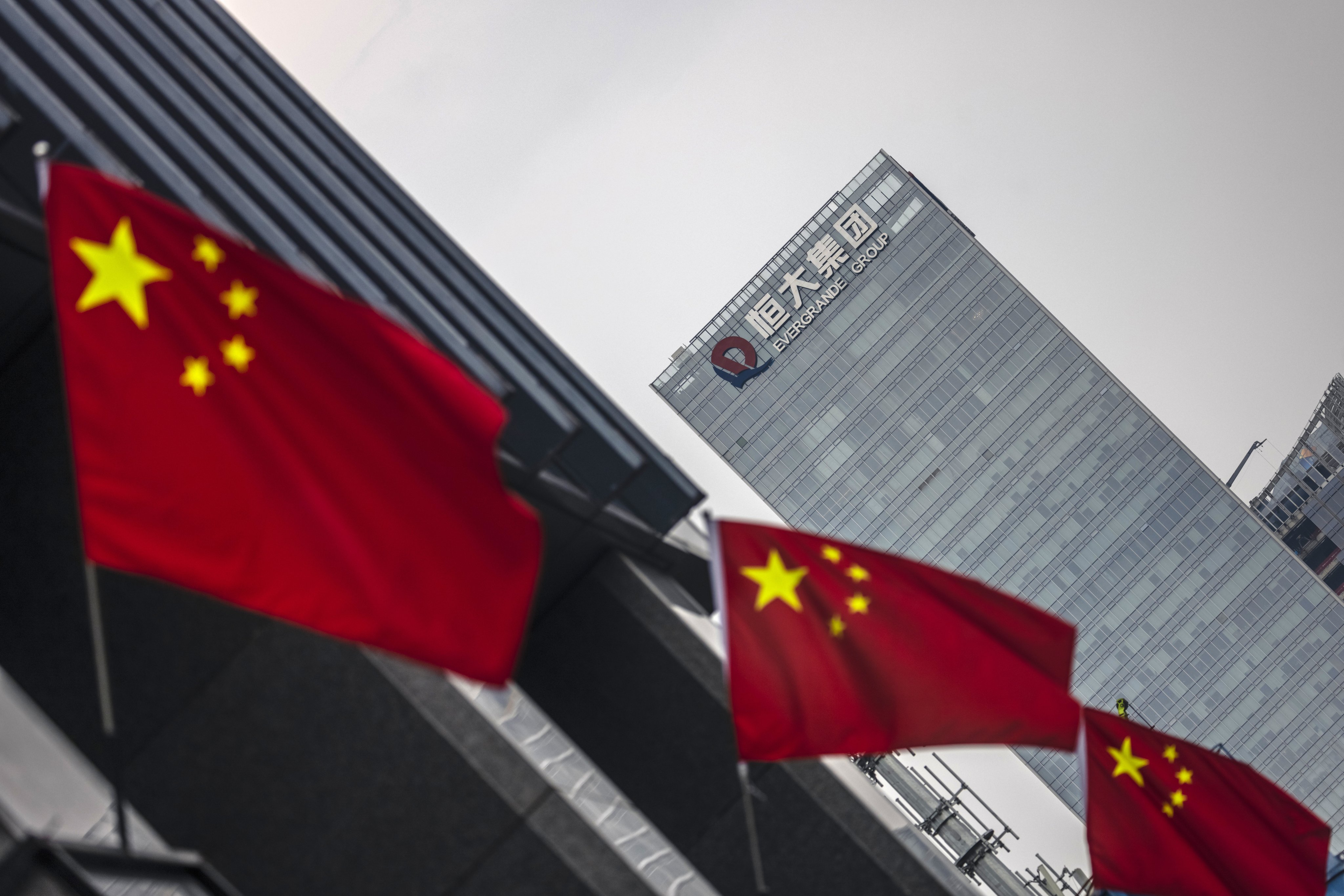

Evergrande crisis

Evergrande crisis

Latest news and analysis about the China Evergrande Group, the world’s most indebted property developer. Fears are rising about Evergrande’s ability to repay its cascading pile of debt against the backdrop of muted property sales in mainland China and efforts by Beijing to rein in the property sector in the past year.

Help preserve 120 years of quality journalism.

SUPPORT NOWAdvertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement