Shenzhen relaxes rules for developers buying land, backing away from the cap that sent real estate auctions into a tailspin

- According to the Shenzhen Planning and Natural Resources Bureau, more than one developer will be allowed to bid for land at the same price

- The competition will be based on how many homes they can build under the “affordable” price category

Shenzhen has relaxed the conditions for taking part in land sales, one of the first among China’s local authorities to backtrack from the draconian measures that have sent the entire country’s real estate industry into a tailspin.

According to the new rules laid out by the Planning and Natural Resources Bureau of China’s technology metropolis, more than one developer will be allowed to bid for land at the same price, where the competition will be based on how many homes they can build under the “affordable” price category. The bureau put 11 plots on the market last week, the third land sale this year.

“It is good for developers’ cash flow as they can sell affordable homes while public rental homes are only for collecting rent,” said Yan Yuejin, director of E-house China Research and Development Institute. “The change is to lure more developers to purchase lands. Many of them struggled with their liquidity and chose to sit aside last time, and we saw many land withdrawn in the second round of land auctions.”

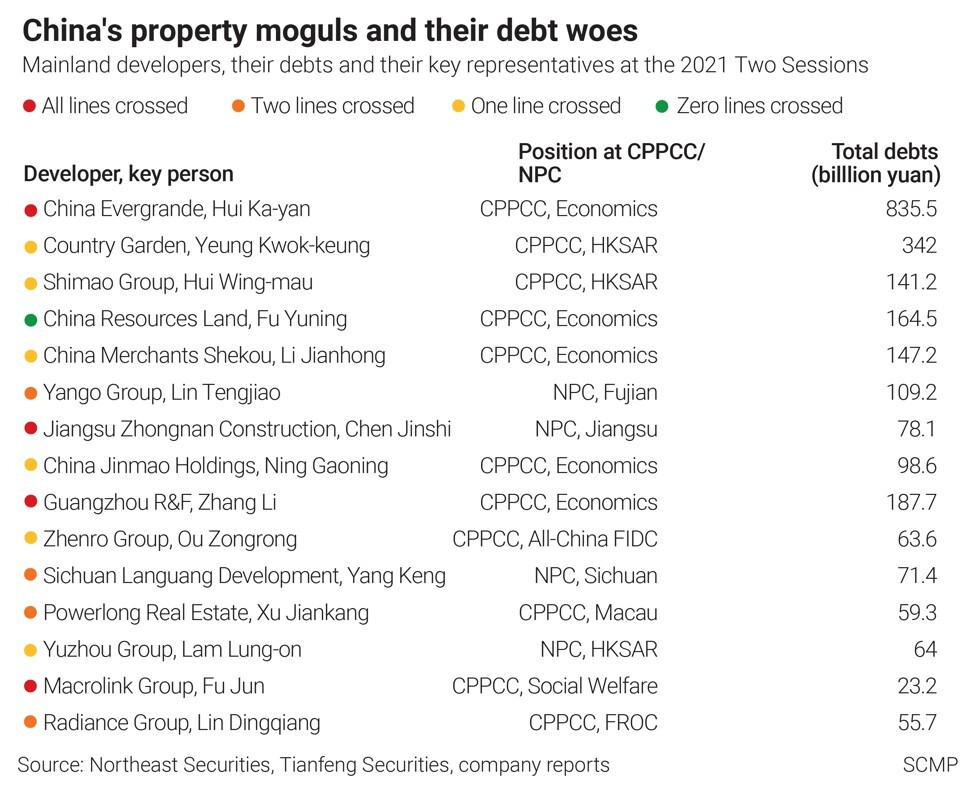

The crisis is poised to spiral out of control, driving Evergrande, Sichuan Languang Development, Fantasia Holdings and Modern Land (China) to either miss or default on bond payments.

“More cities will see such loosening up as developers were less willing to pour big bucks into buying land while they are under deleveraging campaign,” said Yang Kan, a property analyst with Ping An Securities.

The recent failures are in stark contrast to the first round of auction, when several cities were forced to stop or postpone them as buoyant demand kept prices elevated, defeating the auction system that was designed to tame land prices.

Shenzhen is not the only local government to be relaxing the land sale rules. The Jiangsu provincial capital of Nanjing, and its premier city Suzhou, have also lowered the threshold for developers to participate in the land sale last week. Suzhou’s planning bureau said that the deposit for bidding on each plot in the third round of land auctions will be lowered to 30 per cent of the reserve price, from 50 per cent in the previous round.

“Only such an optimised arrangement can ease the pressure on developers and boost their willingness to participate in land auctions to stabilise the land market,” said Yang.