Asian economies should enjoy, while they can, a respite from the recent months of US dollar appreciation as senior policymakers continue to press the argument that the eventual rise in US interest rates could have negative spill-over effects in Asia.

On Monday, US Federal Reserve vice-chairman Stanley Fischer said “when we raise the interest rate … we will be moving from an ultra-expansionary monetary policy to an extremely expansionary monetary policy”. It is important to note Fischer prefaced his remark with the word when, not if.

Echoing a line adopted by other Fed officials recently, Fischer also said the strength of the dollar reflected the “relatively strong performance of the US economy”, while declining to give a forecast for the dollar’s future path, noting “exchange rates have a habit of overshooting”.

Financial markets may still be surprised by the timing of the US interest rate lift-off and by the pace of subsequent rate increases

Given the dollar has been on a rising trajectory for months, it might not be too much of a leap of faith to interpret Fischer’s overshooting risk as being for a yet stronger greenback.

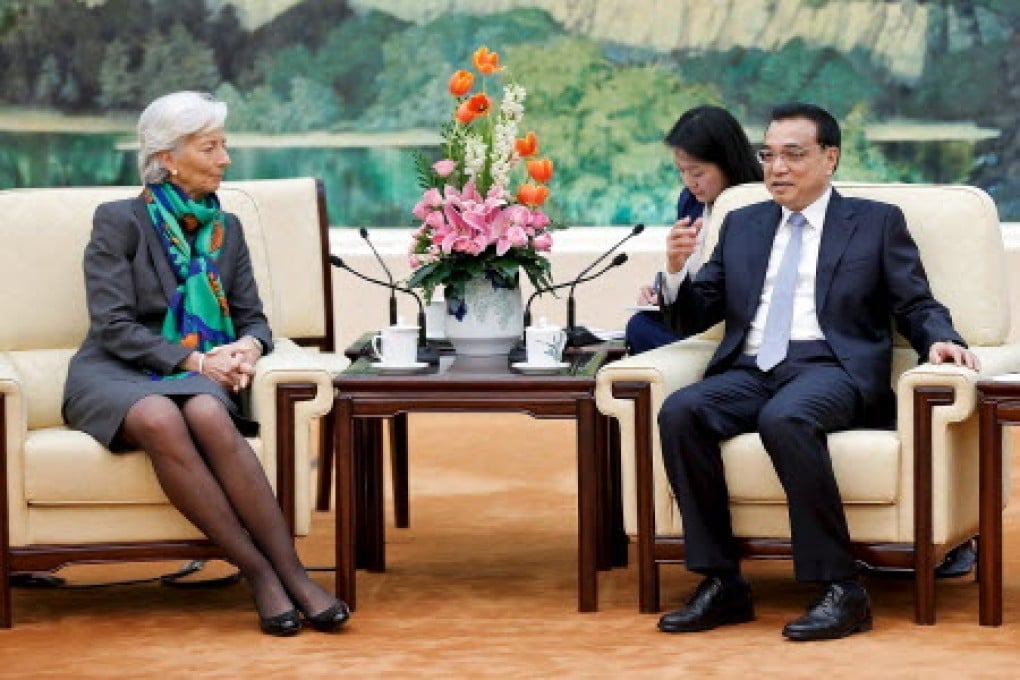

Christine Lagarde, head of the International Monetary Fund, certainly sees spill-over risks from developing Fed policy.

Speaking in Mumbai on March 17, the day before the Fed issued its latest policy statement, Lagarde said “the appreciation of the US dollar is … putting pressure on balance sheets of banks, firms, and households that borrow in dollars but have assets or earnings in other currencies … India’s corporate sector, which has borrowed heavily in foreign currency, is not immune to this vulnerability”.

Lagarde could easily have substituted the phrase emerging market economies (EMEs) for India.

In December, Claudio Borio, chief economist at the Bank for International Settlements (BIS) said “total international debt securities issued by nationals from these economies stood at US$2.6 trillion, of which three quarters was in dollars”.