The euro-zone is living on borrowed time bought by Mario Draghi’s ‘super stimulus’

‘Economic and political tensions are still lurking under the surface, threatening to return with a vengeance’

Crisis! What crisis? Not more than a few years ago, Europe seemed to be going to the wall. The end of the euro, economic disintegration and financial disaster were all being widely bandied about. Now confidence seems to be returning, investors are flocking back and the euro-zone economy is on the road to recovery. So what is going right?

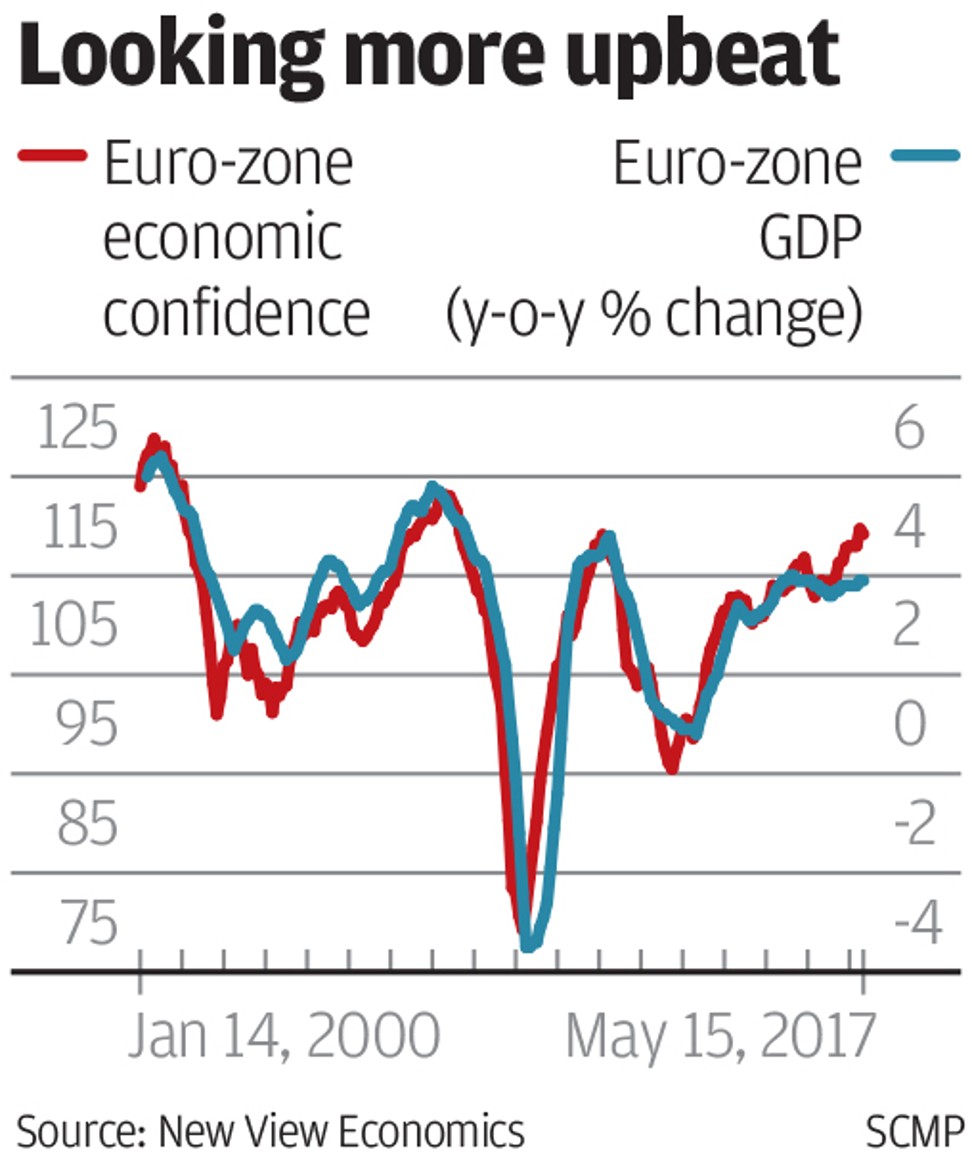

In the past few years, European policymakers have done a good job putting the economy back together again. Most credit is due to the European Central Bank, flooding the markets with a glut of free money and interest rates dropping to negative levels. Economic confidence has soared, growth is bouncing back and unemployment is retreating.

The best bellwether of the market’s newfound conviction about “Europe back on the mend” is the relative strength of the euro after the recent French presidential elections. It has bounced close to US$1.13 from its US$1.04 low at the start of the year. Fears of euro-zone break-up have proven unfounded and the bulls are gaining the upper hand.

It is not just the euro, but equity investors have been flooding back into European stocks, citing low market valuations compared with US and British stocks. It seems as if global investors are starting to have a major rethink about economic recovery while European unity is showing better chances of staying intact.

The big question is whether the European economy can stand on its own feet, once the ECB pulls the plug on super-stimulus

Without doubt, the economic fundamentals are looking a lot better. The latest gross domestic product growth data provides good ground for optimism, with output in the euro region rising 0.6 per cent over the first quarter. Growth was in positive territory for all 28 European Union members, including hard-pressed Greece, which saw output rising 0.4 per cent over the quarter.

Expansive ECB monetary policies have played a major role in turning around economic optimism. Activity correlations with the EU’s economic sentiment indicator at current levels suggests euro-zone GDP growth could quite feasibly reach 3 per cent on present trends if all goes well.

The risk outlook has improved, too. Uncertainties posed by Europe’s debt crisis have eased and the threat to EU trade from a Brexit “hard landing” has receded after last week’s stalemate British general election.

Meanwhile, relative quantitative easing factors are providing a steady boost to European equity market momentum as the impact of the first round of bond-buying programmes in the US and Britain lose impetus while the ECB is still keeping its quantitative easing stimulus at full throttle.

And therein lies the problem. The better the performance by Europe’s economy and financial markets, the greater the chances that the ECB’s boosters will be switched off sooner than expected. The central bank is already sounding early warning alerts that the monetary goodwill is not going to last forever.

ECB president Mario Draghi last week called an end to any more interest rate cuts, stressing the risks to growth were “broadly balanced” while the threat of falling prices had “definitely disappeared”. In other words, the ECB’s easing bias is over and the odds of winding down quantitative easing in 2018 are rising sharply.

If it means a return to the hardline German Bundesbank’s “tougher love” of higher interest rates and tighter liquidity provision, then the markets could have a major quantitative easing “taper test” on their hands quite soon. Global markets suffered a spectacular “taper tantrum” in 2013 when the US Federal Reserve threatened to wind down its quantitative easing programme, so world investors know what is lurking round the corner.

Most things in life are finite and no more so than the ECB’s quantitative easing programme, especially with the Bundesbank breathing down its neck. Economic confidence is a fickle thing and the big question is whether the European economy can stand on its own feet, once the ECB pulls the plug on super-stimulus.

The trouble is that there is a multitude of millennial consumers, businesses and investors that have experienced nothing other than zero or extremely low interest rates in Europe. When the day of reckoning finally arrives, it will come with a massive shock to expectations.

Clearly, it is not going to happen overnight but Europe is still living on borrowed time. The march of economic nationalism and political populism might have been temporarily halted after recent European elections, but they have not been erased forever. Economic and political tensions are still lurking under the surface, threatening to return with a vengeance.

Europe remains on the cusp. Investors should enjoy the sweet spot while it lasts.

David Brown is chief executive of New View Economics