Macroscope | Boom to busting and back again: the ‘BRICs’ highlight how catchy acronyms don’t form the basis of a solid trading strategy

Renewed appetite for emerging-market assets should not be conflated with a revival of the BRICs trade

On Monday, Argentina, which has defaulted on its sovereign debt eight times, most recently in 2014, issued a landmark 100-year US dollar-denominated bond in a sign of the fierce appetite among international investors for higher-yielding emerging-market assets.

If even Argentina, which only lifted capital controls two years ago and is still assigned a “junk” credit rating despite having launched ambitious reforms under a new president, is able to issue a “century bond”, then it is not surprising that investors are once again ploughing money into the quartet of Brazil, Russia India and China, otherwise known as the BRICs.

The BRIC thesis itself was developed by Jim O’Neill, a former chief economist at Goldman Sachs, in 2001 to describe the growing economic clout of some of the largest emerging markets. South Africa was later added making it BRICS.

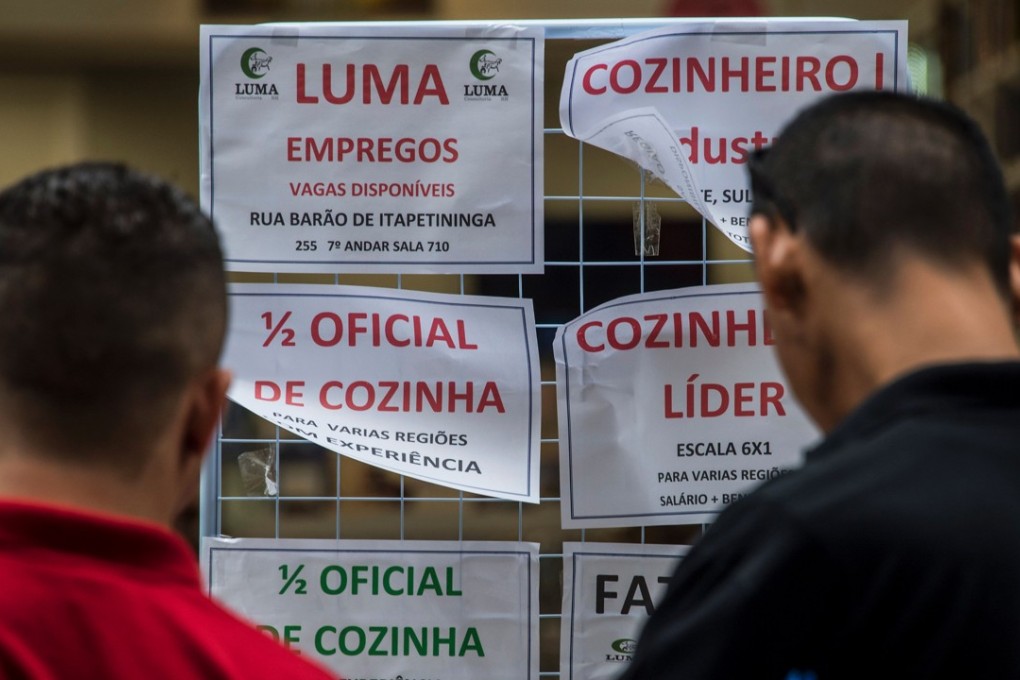

But as a trading strategy, the original four appear have lost their appeal over the past several years as recession-plagued Brazil and Russia were stripped of their investment-grade credit ratings, India suffered a sharp sell-off during the “taper tantrum” in 2013 and concerns about China’s economy and policy regime intensified in 2015.

According to Bloomberg, the largest BRIC exchange-traded fund, a popular investment product that tracks an index or market, plummeted 40 per cent between the end of 2012 and the beginning of 2016.