Why investors in the euro must beware the Ides of March as Italy goes to the polls

Political upheaval in the country and the possibility of an anti-EU government could spell trouble for investors

‘Beware the Ides of March’ is a time-honoured warning which investors should take very seriously ahead of next month’s Italian elections. Italy could be heading into deep political crisis after voters go to the polls on March 4. A hung parliament seems on the cards and European financial markets and the euro currency could end up dangerously exposed.

Italy’s la dolce vita is at stake. The supposed ‘good life’ which the Italian economy has enjoyed since the European Central Bank slashed rates down to zero in 2012 and flooded the market with cheap credit could come to an untimely end. Italian investors could be heading into a bloodbath leaving the euro facing another existential crisis.

Italy is no stranger to turmoil, having suffered 65 new governments since the end of the second world war. Political instability is a national pastime in Italy and next month’s elections will be no different. The elections are a wide open race and recent polls suggest no clear winner at this stage. The country could be heading into unstable political partnerships either on the left or right, and in Italy’s experience they never bode well or last too long.

Right now, the populist Five Star Movement has a slight lead in the polls but the odds are on a centre-right grouping assembled by the former prime minister, Silvio Berlusconi and including his own Forza Italia party. The polls are in a state of flux and next month’s elections, under new and untested electoral laws, will probably end with no outright winner.

Negotiations to form the next government will be tricky and could lead the country into months of political horse-trading. The stakes are high not least because the country is sitting on a tinderbox of growing social discontent and serious economic risks. At least one-third of young Italians under the age of 25 are out of work and nurturing feelings of deep rancour towards the government and establishment parties. Italian politics are becoming more volatile, polarised and increasingly anti-EU.

Some of the parties, like the radical right Northern League, are picking up on this and hinting at introducing a parallel currency that would ditch the euro for domestic transactions. Northern League leader Matteo Salvini has even gone so far as to call the euro a ‘German currency’ which has damaged Italy’s economy, arguing the case to abandon the euro altogether. As a key member of the centre-right coalition leading the polls, this could be dynamite for future euro stability.

The Italian economy remains a mess and can ill-afford another contagion crisis at this stage. Economic recovery remains on a weak footing, unemployment is far too high, business investment and productivity growth is lacklustre while trade competitiveness is ebbing away fast. Government finances remain a black hole with the national debt-to-GDP ratio running at 135 per cent, representing more than 20 per cent of all euro-zone sovereign debt.

So far, markets are being incredibly sanguine about the outlook. The benchmark 10-year Italian BTP-German bund government bond spread – seen as a barometer of investor confidence – has performed well over the last year, as euro zone ‘convergence expectations’ have been running at full throttle. The 10-year spread has narrowed to 120 basis points recently, but the trend is no guarantee of future confidence if the appetite for risk turns high tail.

It is the euro that has most to lose in the circumstances. Euro optimists tend to rely on the belief that Italy is too big to fail in the event of any major sovereign debt crisis. After all, the ECB intervened on Italy’s behalf with open market purchases of Italian government debt during the height of the European crisis in 2012. It has done it before, so surely it would do it again?

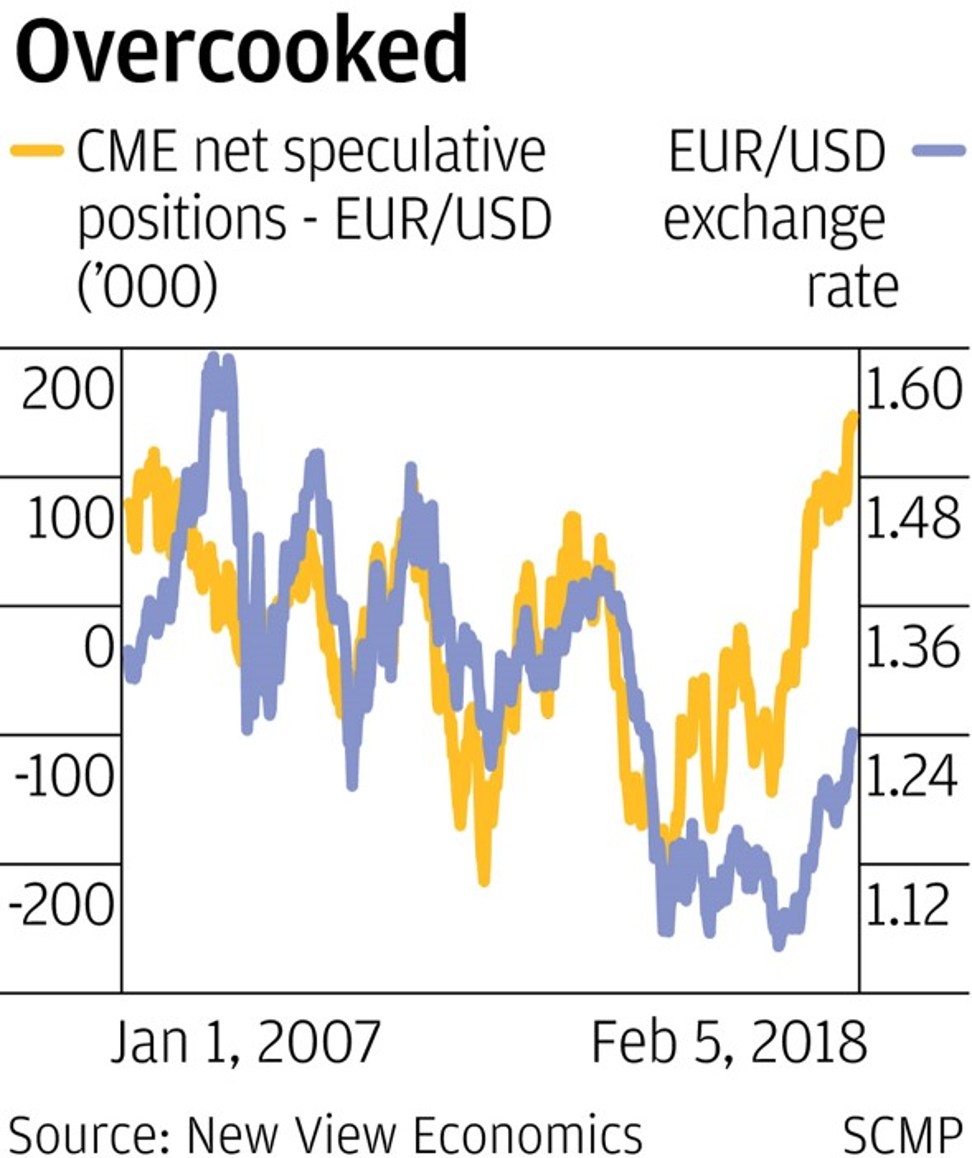

A new Italian government, showing less commitment to the euro, would open up the gates of hell to a new currency crisis. It seems hard to imagine considering the weight of speculative bets backing a stronger euro at the moment. But market confidence is a fickle thing and sentiment can quickly turn on a dime. The euro is looking so vulnerable simply because it’s such a one-way bet right now.

Next month’s Italian elections could prove incendiary for the euro, and global investors could get their fingers seriously burned.

David Brown is chief executive of New View Economics