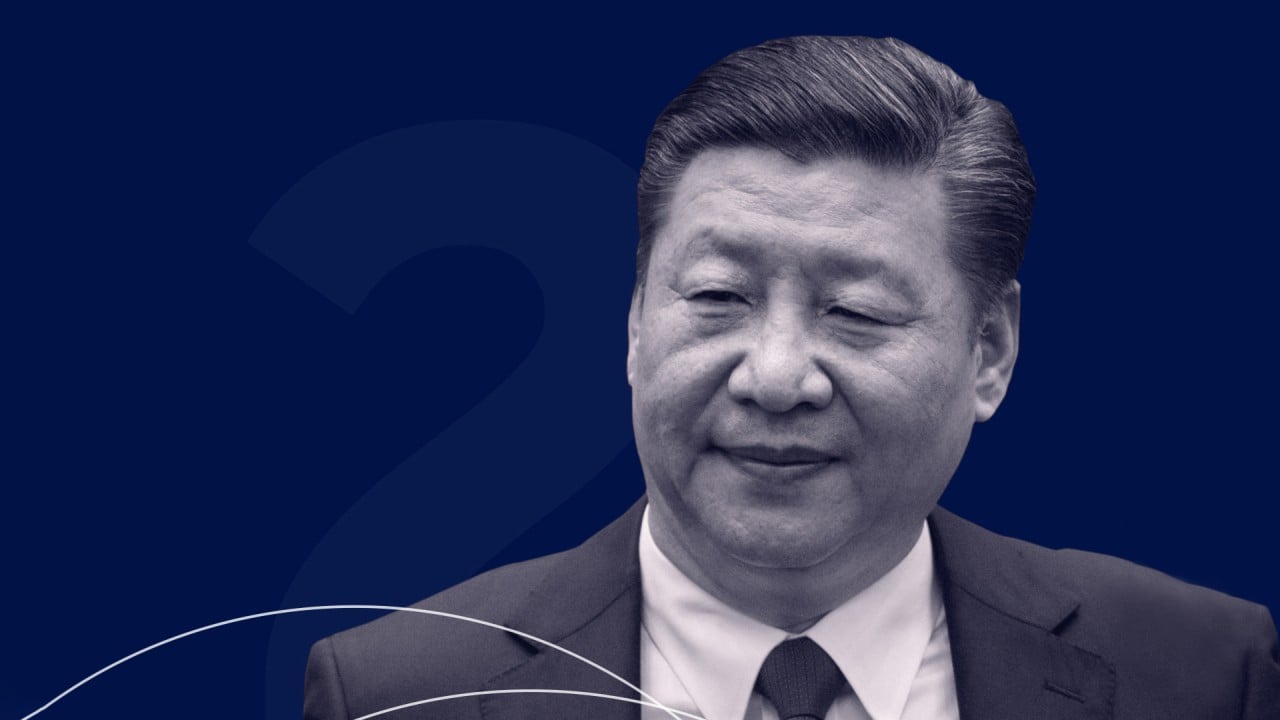

Hang Seng Index falls furthest in five years, with banks and builders leading losses, as Beijing moves to tighten grip on city

- The Hang Seng Index capped the biggest decline in almost five years as China’s legislature is set to vote on a security law that will increase Beijing’s control over Hong Kong

- All 50 members of the city’s benchmark fall, with developers and banks being the worst-performing industry groups

The benchmark sank 5.6 per cent, or 1,349.89 points, to 22,930.14 on Friday, its biggest decline since July 2015. All 50 constituents on the gauge fell, with property developers and banks leading the pack of decliners. The index was the worst performer in the Asia-Pacific region, where most equity gauges saw mild losses. The mainland’s Shanghai Composite Index fell 1.9 per cent to 2,813.77.

The Hong Kong currency weakened for a second day to trade at 7.7574 against the US dollar, extending a deprecation of 0.06 per cent for its biggest single-day loss since April 9.

Further downside pressure on Hong Kong stocks has been building up, as the South China Morning Post reported that China has proposed the deliberation of the security law bill during the National People’s Congress (NPC), the nation’s highest annual legislative conference, which kicked off in Beijing on Friday morning. A spokesman for the NPC confirmed the bill at a press conference on Thursday night.

“A horrible risk for markets is that much of the attention from today’s NPC will turn to Hong Kong,” said Stephen Innes, a strategist at AxiCorp. “But even more worrisome is the global backlash. A denouncement by the White House, which is most certainly to happen, could exacerbate already tenuous US-China relations and could trigger a global backlash that Trump seems to be pinning his hopes on. Indeed, it is starting to look like a US-China summer of discontent in the making.”

00:31

Hong Kong faces China imposed national security law

The proposed security law could lead to a fresh wave of protests in Hong Kong that would further drag down stocks, and the declines would not be arrested until the uprising was quelled, according to Francis Lun, chief executive officer at Geo Securities.

The Hang Seng Index slumped 8.6 per cent in the third quarter of 2019, the worst performance for the three-month period in four years, during the height of the anti-government protests. The uprising started from the opposition to a controversial extradition bill that was later withdrawn and turned into more violent street vandalism and fights between demonstrators and police, deterring tourists and forcing closures of shops.

US investors weigh business fallout from Beijing’s power play in Hong Kong

The new legislation has added to Hong Kong’s uncertain economic outlook, which has already been plunged into a recession after the double whammy of the coronavirus and months of unprecedented social unrest last year. The Hang Seng Index has retreated 19 per cent this year, one of the worst-performing equity gauges in Asia.

A gauge tracking property developers on the Hang Seng tumbled 7.7 per cent on Friday for the biggest decline among the four industry groups. Sino Land shed 10 per cent to HK$8.97 and Wharf Real Estate Investment slumped 9.4 per cent to HK$28.60.

03:35

The ‘two sessions’ explained: China’s most important political meetings of the year

AIA Group and Tencent Holdings were the biggest drag on the city’s benchmark, accounting for more than a quarter of its loss. The two stocks dropped 9.4 per cent and 4.9 per cent, respectively.

Banks sank in both Hong Kong and the mainland after The Wall Street Journal reported that two US senators were working on the bipartisan bill that would punish lenders that have links with the enactment of the security law in Hong Kong. Hang Seng Bank retreated 7.1 per cent to HK$124 and BOC Hong Kong Holdings shed 7.8 per cent to HK$22.45. Industrial and Commercial Bank of China slipped 1 per cent to 5.05 yuan in Shanghai and its Hong Kong-traded shares fell 2.4 per cent to HK$4.94.

Explainer | The key points of the national security law for Hong Kong

The NPC is expected to vote on the resolution at the end of the session on May 28 and the resolution will then be forwarded to the Standing Committee to work out the actual details of the legislation, the source said.

In 2003, the Hong Kong government was forced to shelve a national security bill after an estimated half a million people took to the streets to protest against the legislation, which they warned would hurt their rights and freedoms.

Help us understand what you are interested in so that we can improve SCMP and provide a better experience for you. We would like to invite you to take this five-minute survey on how you engage with SCMP and the news.