TOPIC

Stocks

Stocks

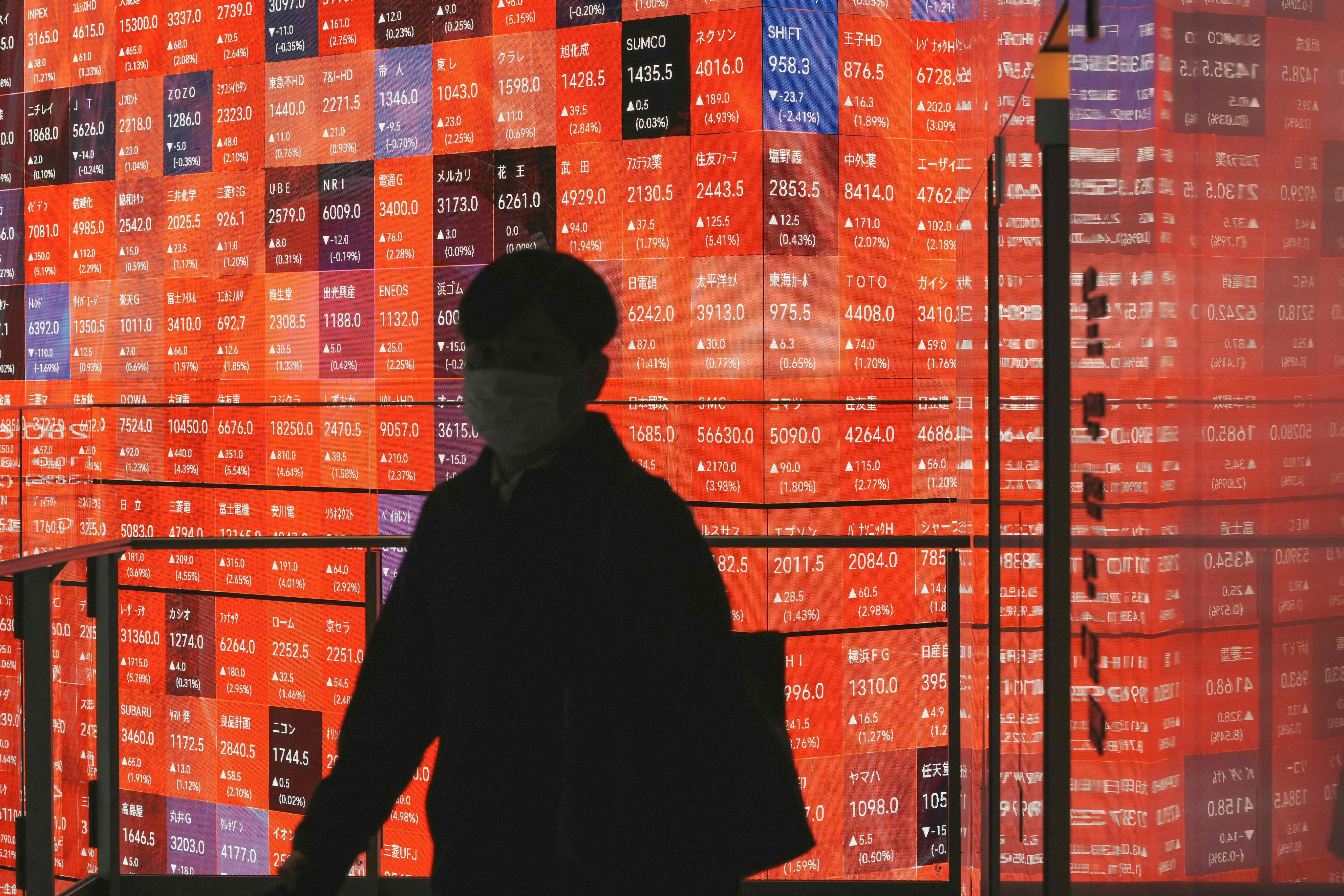

Stock market action from around the world, with a focus on Hong Kong, China and the rest of Asia.

Help preserve 120 years of quality journalism.

SUPPORT NOWAdvertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement