China stocks are bull traps as market regulators’ pain threshold remains untested: BCA Research

- More than a week of stock sell-offs will be needed for policymakers to halt regulatory reforms, strategists at BCA Research say in report

- China has traded short-term pain for long-term benefits under its multi-year growth planning; that pain threshold remains untested by stock slump

“More than a week of stock sell-offs will be needed for policymakers to halt reforms,” strategists led by Sima Jing said in a report to clients on Wednesday. “Furthermore, even if the pace of reforms eases and policymakers start to reflate the economy, it will likely take between six and 12 months for stock prices to find a bottom.”

China’s economic policy has shifted from setting an annual economic growth target to multi-year planning, affording policymakers a higher tolerance for near-term distress in exchange for long-term benefits, they added. Despite a deep dive in stock prices, China’s bond and currency markets have been stable relative to the gyrations during the 2015 and 2018 market routs.

Mainland stocks suffered a US$434 billion slide in July, sparked by a cybersecurity review soon after ride-hailing firm Didi Global completed its US$4.4 billion listing in New York. In Hong Kong, investors took at US$752 billion drubbing. Combined, the US$1.2 trillion sell-off was the most since January 2016, according to Bloomberg data.

Still, the side-effects on the broader economy remain insignificant. A slowdown in economic activity appears to be within the policymakers’ comfort zone, the strategists at the Montreal-based research firm added.

The current crackdown may stem from China’s aim to become a “great modern socialist nation” by 2049, leading to a shift in policy from wealth accumulation to fixing income inequality and social welfare for average households.

05:57

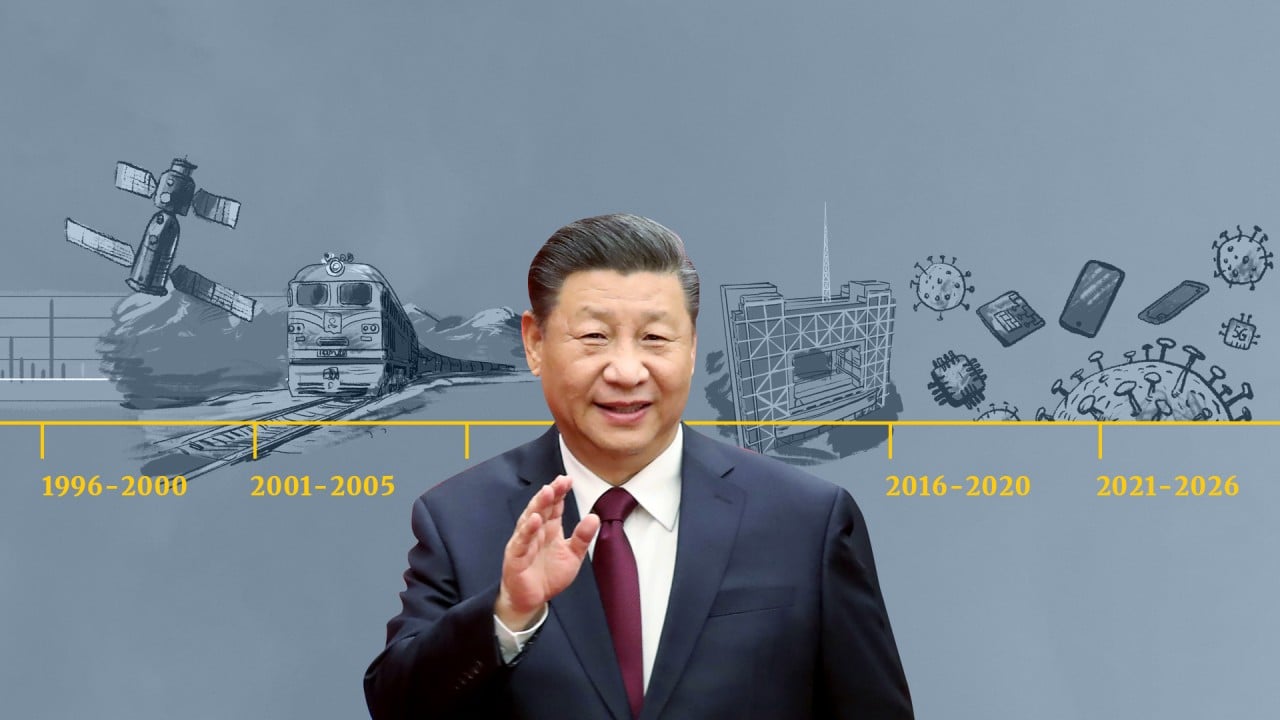

SCMP Explains: China’s five-year plans that map out the government priorities for development

The objective is not only to close regulatory loopholes and stem disorderly expansion of capital and market shares, but also assign a larger weight of social equality and responsibility to the private sector’s business practices.

The pace in achieving this overarching goal will only moderate when China’s economy and financial markets show significant signs of stress, according to the report. Even if the pace of reforms eases and policymakers start to reflate the economy, it will likely take between six and 12 months for stock prices to find a bottom.

Investors will be kept on edge by a confluence of a slowing economy and heightened regulatory oversight. The market will oscillate between technical rebounds when macro policy eases and sell-offs when industry regulations tighten.

“Investors should resist the urge to buy on the dip,” they concluded.