Advertisement

Advertisement

TOPIC

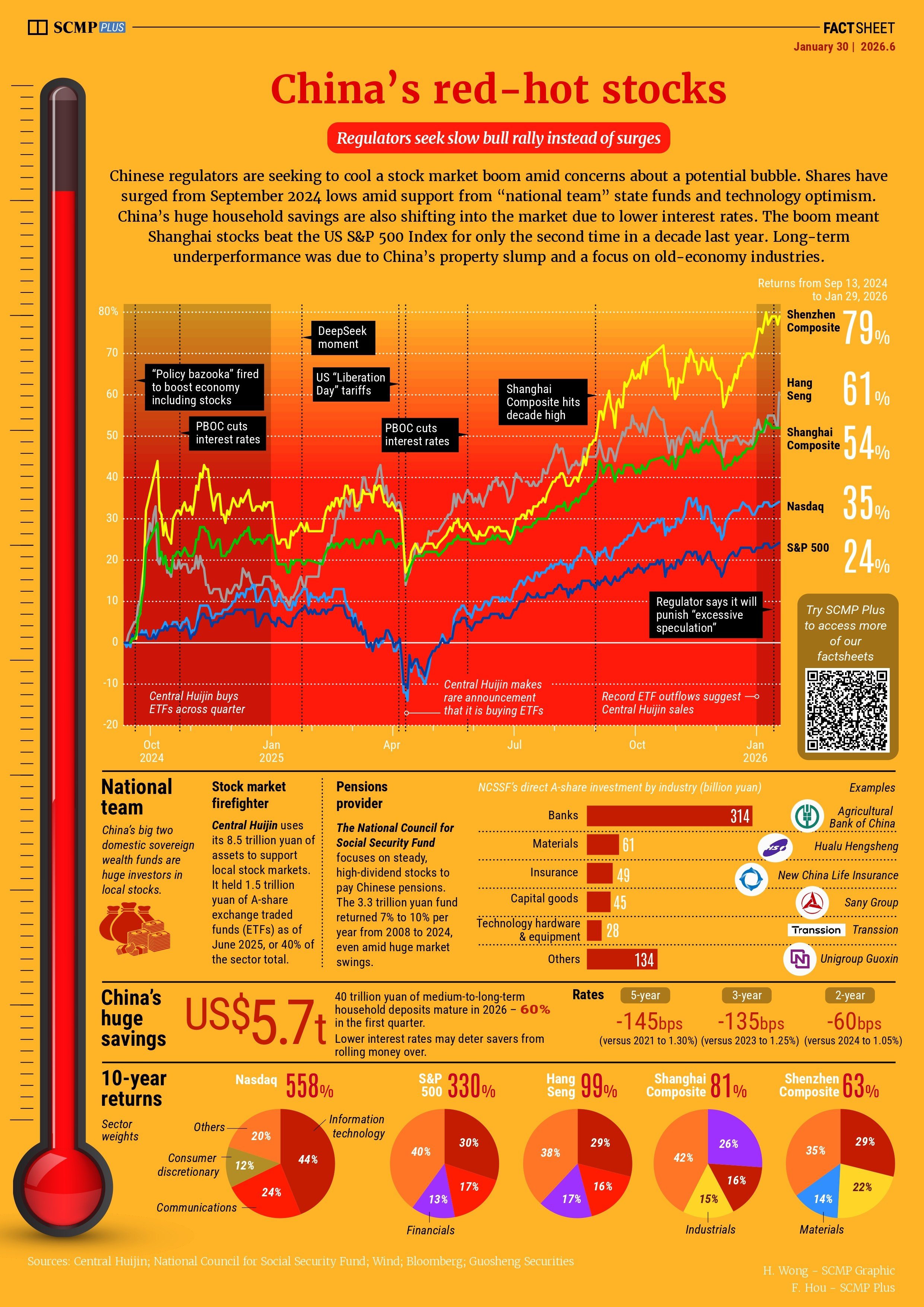

A-shares

Related Topics:

A-shares

A-share focus is for readers wanting to know more about mainland Chinese investment markets, and especially the A-share market in Shanghai, which has become accessible to international investors since the launch of the Shanghai-Hong Kong stock connect scheme in late 2014.

Help preserve 120 years of quality journalism.

SUPPORT NOWAdvertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement