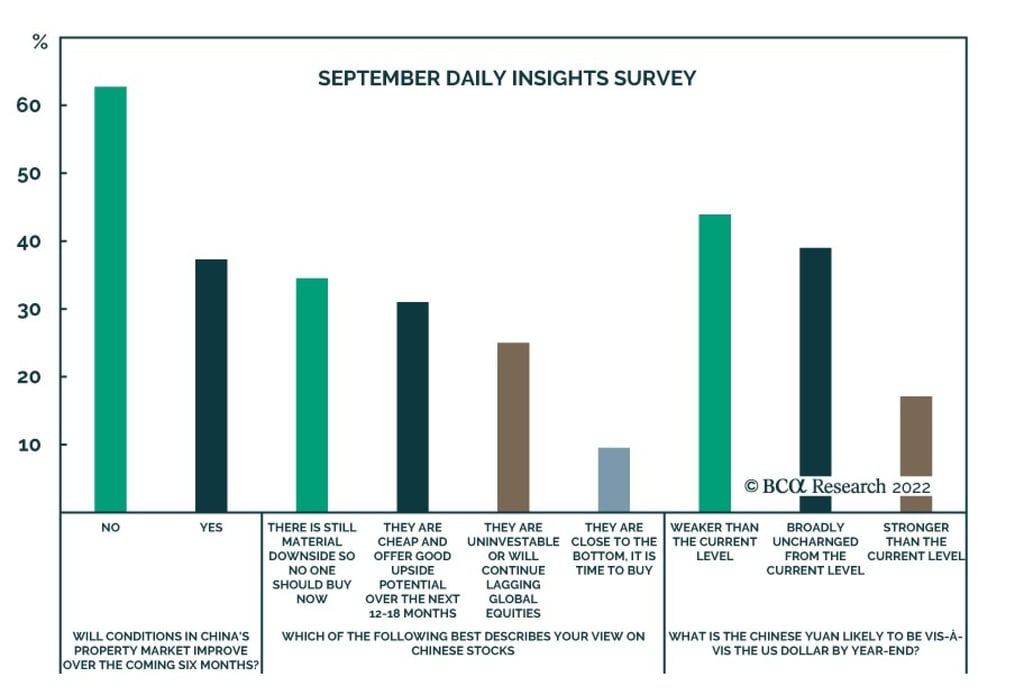

Most investors see Chinese stocks as unattractive, hold bearish views on property market and yuan weakness, BCA survey shows

- More people are bearish on China’s housing market and currency, pegging back expectations of a recovery in stock prices, according to a BCA survey

- Foreign funds were net sellers of Chinese stocks in September, based on Stock Connect’s Northbound data

Most global investors see Chinese equities as unattractive, deeming them partly uninvestable and likely to trail global peers over the next 12 to 18 months while bulls are a minority voice, according to a survey of clients conducted by BCA Research.

The survey showed sentiment among its clients remained fragile, with more than 60 per cent of respondents holding a bearish view on mainland China’s real estate market that has cracked under Beijing’s clampdown on excessive leverage, the Montreal-based research firm said in a report.

“The majority of respondents do not expect conditions in China’s property market to improve over the coming six months,” it said. China continues to ease policies in an attempt to shore up housing market activity but these measures “likely fall short of what is needed for an imminent turnaround”, it added.

Less than half of the respondents indicated that stocks are cheap and offer good upside potential over the next 12 to 18 months, while about 10 per cent said prices are near the bottom and worth buying.

Similarly, the majority of respondents were also concerned about the yuan, with 44 per cent expecting the local currency to weaken further by year-end versus 17 per cent predicting a recovery, BCA said. Like most Asian currencies, the yuan slumped past 7 per dollar last month as rate increases by the Federal Reserve fuelled a rally in the US dollar.

Chinese stock completed their worst quarter in seven years, with the CSI 300 Index of the biggest onshore Chinese shares crashing by 15 per cent from July to September. The country’s property crisis also deepened during the period, with the CSI 300 Real Estate Index sliding almost 7 per cent and more developers suffering from a liquidity crisis.