China’s US$1.35 trillion sovereign fund boosts stake in Big Four banks, fuelling speculation on stock market intervention

- Central Huijin Investment spent the equivalent of about US$65.4 million to pick up additional A shares in China’s four biggest lenders

- The symbolic move is fuelling speculation Beijing is intervening to shore up confidence in the market after a record sell-off by foreign funds

Central Huijin Investment, which owns strategic stakes in local financial institutions, picked up additional domestic shares in Industrial and Commercial Bank, Construction Bank, Bank of China and the Agricultural Bank of China, according to stock exchange filings late on Wednesday.

The purchases, which would have cost about 477.5 million yuan (US$65.4 million) based on their closing prices on Wednesday, may be symbolic. While they only boosted Central Huijin’s shareholding in each lender by 0.01 percentage point, the wealth fund would be raising its stakes further over the next six months, the banks said in their respective filings.

Vocal Chinese hedge fund urges Beijing to stabilise market, overcome stock bears

Central Huijin, a vehicle under China Investment Corp, undertakes domestic equity investments in state-owned financial institutions, without interfering in their daily operations. It exercises its rights and performs its obligations as a shareholder to the extent of its capital contribution, according to its website.

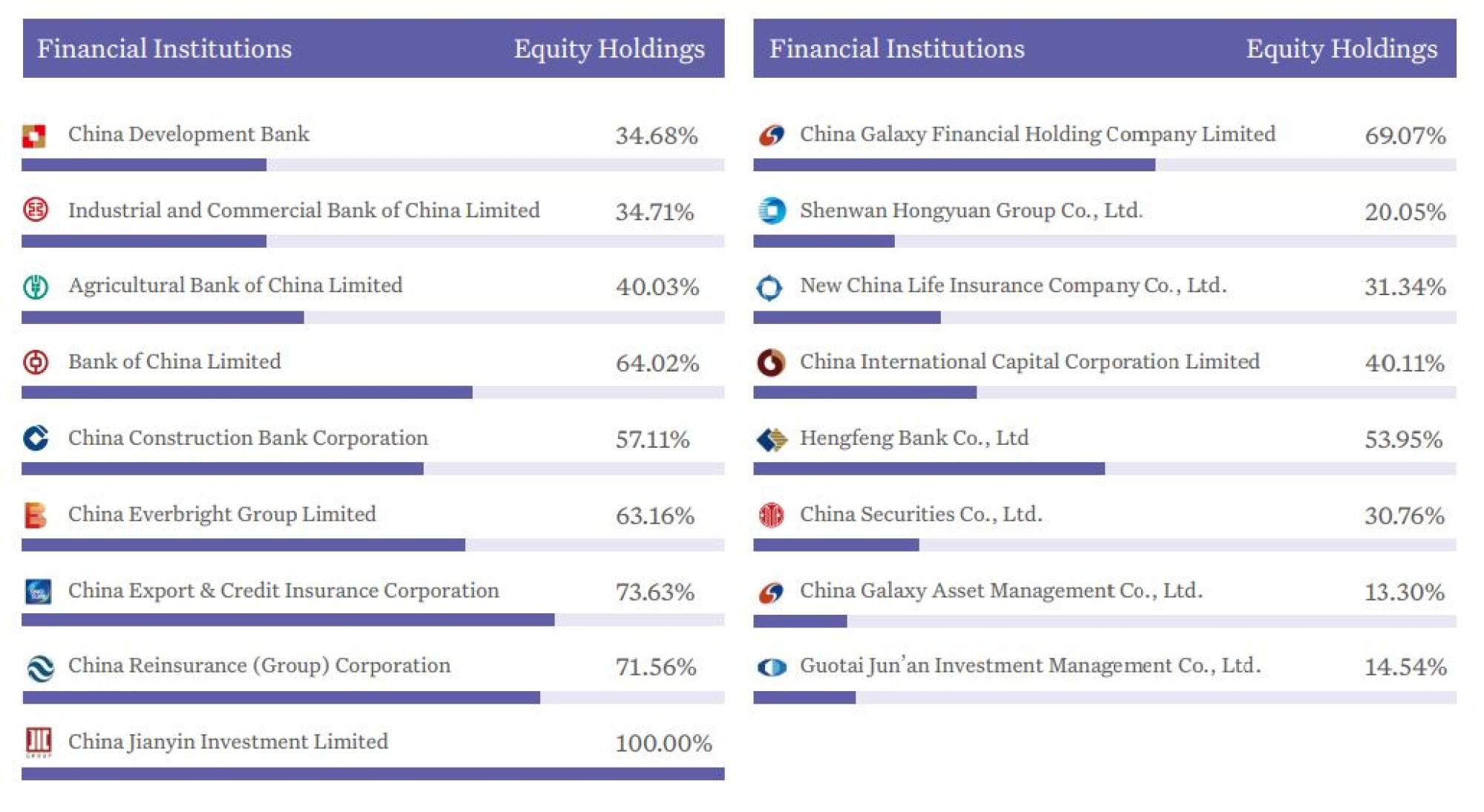

It directly held equity interests in 17 financial institutions, including banks, securities companies, insurance companies at the end of 2021, according to its latest annual report.

Shares of the Big Four lenders climbed by 4 per cent to 5.6 per centin Hong Kong, helping lift the Hang Seng Index to a five-week high. They gained 0.6 per cent to 3.2 per cent in Shanghai, while the CSI 300 Index jumped 1 per cent, the most in nearly three weeks.

China’s stock market has been in the doldrums, with the CSI 300 Index losing 4.4 per cent since the start of the year, amid disappointment with Beijing’s slow-drip approach to injecting stimulus to revive the economy as the post-Covid recovery momentum waned.

Hong Kong stocks rise to 5-week high on signs of Beijing’s market support

Global investors sold US$5.1 billion of A shares in September and US$12.3 billion in August in an unprecedented sell-off, according to data compiled by Goldman Sachs. They have sold another 6.7 billion yuan so far this month through Thursday, Stock Connect data showed.

The Chinese yuan traded at 7.2979 per dollar in the onshore market, having depreciated 5.5 per cent this year to the weakest level in 16 years, according to Bloomberg data.

“Huijin is widely regarded as China’s stabilisation fund,” Hong Hao, a partner and chief economist at hedge fund Grow Investment Group, said in a social media post. The buying is a strong signal of the top-down view and will help shore up market confidence, he added.