Could coronavirus lockdown have big upside for China’s new economy stocks as users and smartphones become BFFs?

- Investors piling into stocks linked to online education, digital medical services, and remote working

- Massive quarantines, ban on big gatherings in China could be as transformative as Sars for e-commerce, many traders bet

It’s never happened before: more than 50 million people in the world’s most wired country locked down at home with their smartphones turned into lifelines. Some analysts think this may later be recognised as a watershed moment, marking the start of a new era for online services – and the stocks closely tied to them.

Hong Kong-listed companies linked to online games, digital medical services, remote working and distance education are among new economy stocks that soared last week, as investors sensed a transformative moment might be at hand – literally – as China’s unprecedented decision to keep tens of millions of people quarantined in their flats to combat a deadly new virus deepened mainlanders’ intimacy with their smartphones.

With countless Chinese schools closed, NetDragon Websoft, a Chinese online gaming company offering online learning products, rallied for six straight sessions, running up a gain of nearly 48 per cent.

Cloud services and office software stocks surged on demand from remote work arrangements.

Kingsoft, a software company with cloud and business management services, reached a 52-week high at HK$29.5 on Friday, closing the day ahead 9.8 per cent and fetching a 20 per cent gain for the week.

Cloud services vendor Kingdee International Software closed at a one-month high on Friday, posting a weekly gain of 17.7 per cent.

Ping An Good Doctor, China’s leading health care platform, gained 8.6 per cent over four straight sessions, closing at HK$73.5 on Friday.

In contrast, the Hang Seng Index posted a 4.2 per cent weekly gain as investors bet efforts to contain the virus will work.

It’s too early to know whether the lockdown will spur widespread adoption of next-generation online services, comparable to how Sars proved to be a turning point for adoption of e-commerce in 2003 as worried people stayed home and got hooked on online shopping. But some analysts predict that the unprecedented experiment that began on January 23 in Wuhan in Hubei province and extended to bans on large gatherings and closed schools and workplaces throughout much of China might lead not only to wider app use but also to profound shifts in deeply rooted cultural beliefs. Hospitals, wet markets and large community gatherings may come to been seen as potentially dangerous compared to online alternatives.

“A few years later, we will look back and it might be a turning point when a new ecosystem just took off. This whole incident, which is holding people at home, is basically a new era,” said Leon Qi, executive director at Daiwa Capital Markets.

“Millions of people being kept at home is a big trigger for people to download the apps and start using them and get familiarised with what kinds of services can be offered,” said Qi, whose top stock pick is Ping An Good Doctor. “These companies spend millions of dollars to get people to use them. They offer all these free trials. Now this is an ideal scenario to get started.”

Real world institutions such as hospitals have suddenly become associated with dangerous crowds of panicking, sick people, as videos and photos documenting the horror have indeed “gone viral.” Likewise, traditional Chinese shopping habits may now seem risky to many mainland consumers: a Wuhan wet market – where snakes, beavers and other exotic creatures were reportedly being hawked along seafood as dinner fare – is thought to be where the deadly new coronavirus first passed from animals to humans.

And, just as suddenly, a variety of apps that a lot of smartphone users had ignored before were tried out. Early numbers show surges for online games, remote work apps and online medical consultations.

For example, in six days to January 29, Tencent’s Trusted Doctors platform handled 1.21 million online consultations nationwide. That’s four times that of the same period last year.

Jumps were also reported in the use of remote office apps like Alibaba’s DingTalk, Tencent’s WeChat Work, ByteDance’s Slack-like Lark and Huawei’s WeLink. (Alibaba Group Holding owns the South China Morning Post.)

The lockdown also comes as China rolls out 5G, a superfast wireless network expected to revolutionise everything from health care to law to transport.

Meanwhile, a new report suggests a big next-generation smartphone buying spree in the second half of the year.

Four in 10 mainlanders – 39 per cent – said they will buy a new phone in the next 12 months “no matter what,” according to a survey of 6,000 consumers released by Jefferies at the end of December.

Of the 97 per cent not yet on 5G, 70 per cent signalled interest in signing up for 5G service within three to six months.

That could lead to 460 million to 512 million handset unit sales for the 12-month period beginning in the second half of 2020, Jefferies said, with 70 per cent or more of the new phones 5G ready.

That could further fuel the move to app-based services expected to catch fire during the lockdown, analysts said.

The Sars epidemic boosted the fortunes of e-commerce, most notably Alibaba, as people feared infection, worked from home at the request of their bosses and tried out ordering products from online shopping malls.

“Although it sickened thousands and killed almost 800 people, the outbreak had a curiously beneficial impact on the Chinese internet sector,” Duncan Clark wrote in Alibaba: The House that Jack Ma Built. “Sars validated digital mobile telephony and the internet, and so came to represent the turning point when the internet emerged as a truly mass medium in China.”

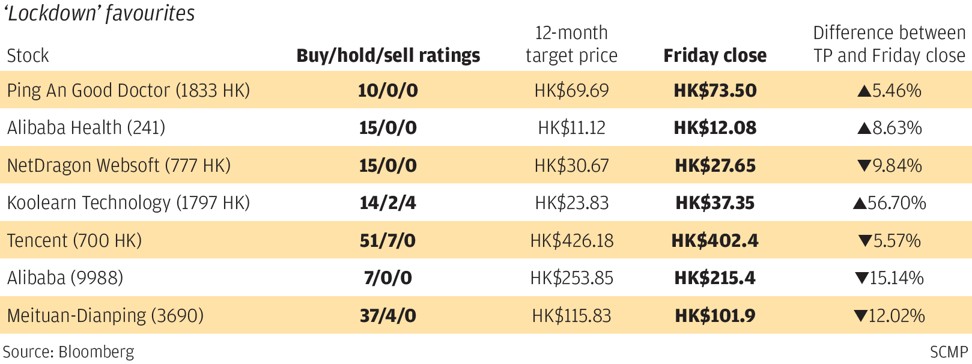

To be sure, it will take months to know whether a next generation embrace of apps and other online services truly takes hold from the lockdown phenomenon. And the recent price run-ups of some of the stocks favoured by investors last week has already propelled them beyond the 12-month target prices of analysts tracked by Bloomberg.

“For the long term, online medical and shopping will be getting even more popular,” said Kenny Wen, wealth management strategist at Everbright Sun Hung Kai. “But it is hard to say now that this is the watershed moment as usually a virus outbreak won’t last long. If the coronavirus situation improves, the habits will go back to normal. Demand for online medical advice or pharmaceuticals or new online games may decrease.”

Hong Kong-listed Alibaba, Ping An Good Doctor and Alibaba Health Information – Alibaba’s health care platform – stand to get the biggest boosts from the lockdown, Wen said.

But Alan Li, portfolio manager at Atta Capital, said he expects Tencent to be the biggest beneficiary, as cooped-up people turn to online games and other entertainment. Tencent, the social media and online game giant, is his top “lockdown” pick, followed by food delivery giant Meituan Dianping and Alibaba.

“Demand for online shopping and food ordering is increasing, but it’s still hard to fulfil those needs due to shortage of delivery capacity. So Alibaba and Meituan Dianping may see a rapid growth when logistics recover,” Li said.

While Ping An Good Doctor and Alibaba Health and Technology are likely to see registered users and daily usage go up, “their monetisation is still a concern,” said Li.

But other analysts suspect the markets are experiencing only a speculative blip. A new economy breakthrough won’t happen because of the massive lockdown, argues Brock Silvers, managing director at Adamas Asset Management.

“It’s hard to see any sort of silver lining for markets,” Silvers said.

“The new economy just can’t make up for retail, entertainment, and office closures. China’s economy was profoundly troubled before coronavirus, and this now looks like a major shock to the economy,” he said. “Market appetites should remain weak at least until the situation stabilises, which may take weeks or even months.”