Hong Kong stock investors shrug off Trump move to revoke city’s special status, focus on Covid-19 spike, vaccine progress

- Tencent rises 3.4 per cent, snapping three-session losing streak

- Two of six newly listed stocks in Hong Kong rise by at least 59 per cent

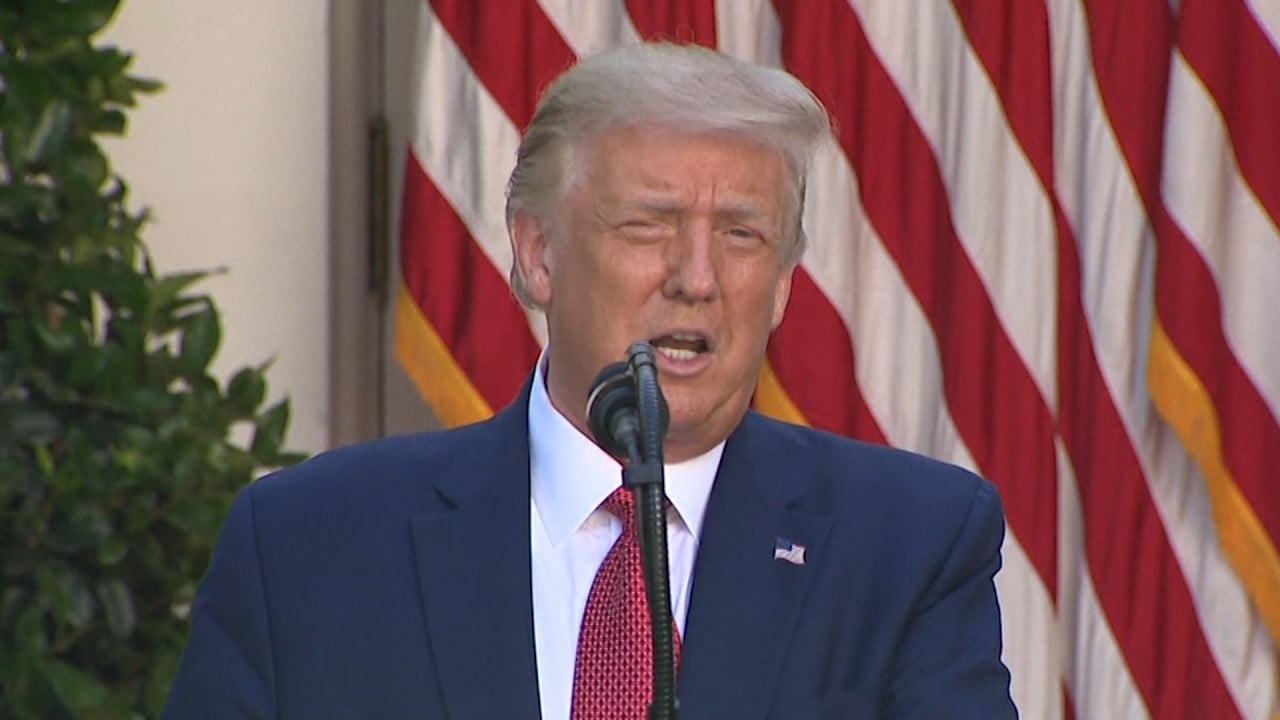

Hong Kong investors largely shrugged off US President Donald Trump’s move to revoke the special trade status of the city over Beijing’s controversial national security law, instead focusing on the spike in local Covid-19 cases and results of a promising new vaccine.

The Hang Seng Index swung 589 points during a session that featured dramatic moves in some recent high fliers like Chinese chip maker Semiconductor Manufacturing International Corp. The benchmark rose 0.01 per cent to 25,481.58.

Index heavyweight Tencent rose 3.4 per cent to HK$543, snapping a three-session losing streak. HSBC reiterated its “buy” rating on the WeChat operator and gaming giant and boosted the 12-month target price to HK$635.

The Hong Kong dollar traded near 7.7504, the stronger end of its dollar-peg band that has recently prompted the monetary authority to weaken its currency.

02:09

Trump signs Hong Kong Autonomy Act, ends city’s preferential trade status over national security law

Trump on late Tuesday signed an executive order ending the city’s preferential trade treatment and enacted a bill that would require sanctions against foreign individuals and banks for contributing to the erosion of Hong Kong’s autonomy. Beijing promptly warned of retaliation.

“The Trump law is being ignored and not many people were talking about it today,” said Kenny Wen, wealth management strategist at Everbright Sun Hung Kai. Traders were focused on the spike in local Covid-19 cases and the mainland markets, which have taken a beating after a frenzied run.

The Shanghai Composite fell 1.6 per cent to 3,361.30, while the Shenzhen Composite Index declined 2 per cent to 2,261.79. Communication services stocks, such as telecoms, led losses.

Two debutantes on the Nasdaq-like Star Market board soared. Shanghai Junshi Biosciences gained as much as 297 per cent, while robot maker Efort Intelligent Equipment surged about 446 per cent.

Biggest Chinese borrowing frenzy in five years fuels stocks rally

Liquor maker Kweichow Moutai, one of the most-traded stocks on Stock Connect, was little changed at 1,762.26 yuan. The stock has gained nearly 50 per cent this year, surpassing the consensus price target of analysts tracked by Bloomberg. Goldman Sachs reiterated its “buy” call and boosted its 12-month target price to 2,099 yuan from 1,549 yuan.

Like the benchmark Hang Seng Index, some stocks saw wild swings. Chip maker Semiconductor Manufacturing International Corp closed with an 8 per cent loss. The chip maker traded between as much as 7.2 per cent gain and 8.9 per cent loss during the session.

Of the six debutantes in the city, Archosaur Games, a mobile game developer, advanced 75 per cent, while film and TV producer Cathay Media and Education Group rose 59 per cent.

Elsewhere in the Asia-Pacific region, Japan’s Nikkei 225 rose 1.6 per cent, South Korea’s Kospi gained 0.8 per cent, and Australia’s S&P/ASX 200 climbed 1.9 per cent.