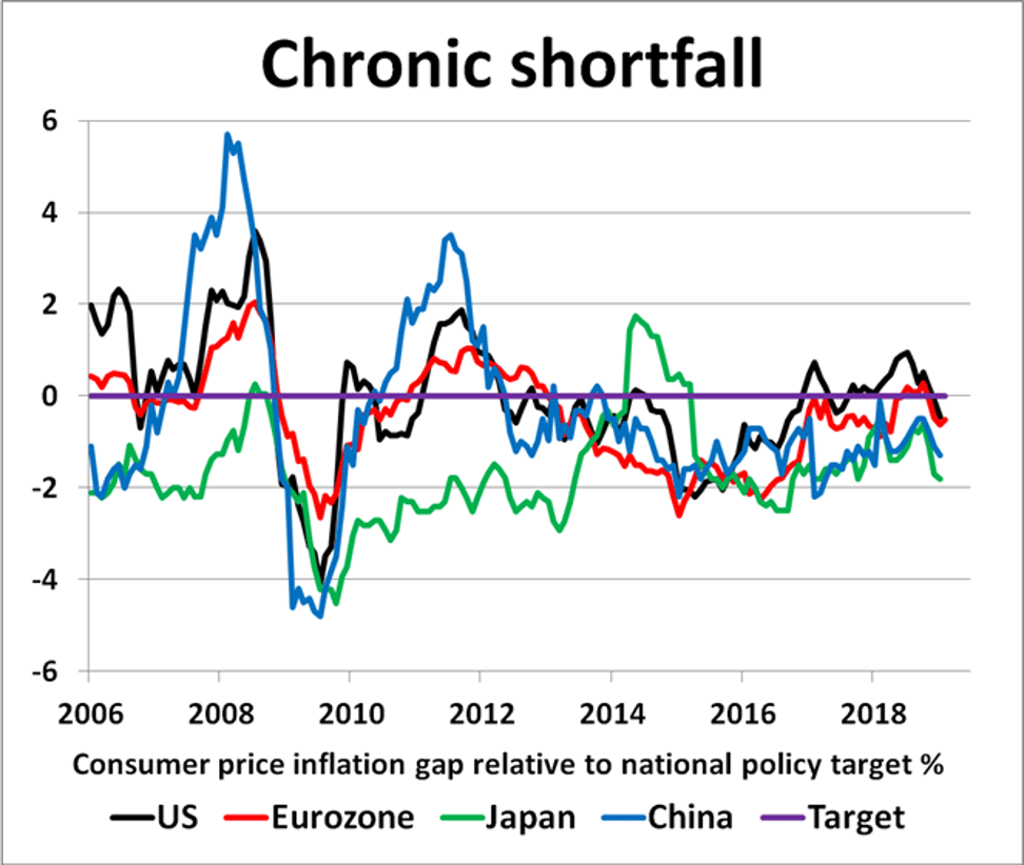

There is something missing from the global economy right now – there’s not enough inflation. It was once the dreaded scourge of central bankers around the world, but the worry now is that inflation is too low for comfort. It is symptomatic of a shortfall in global demand and central banks are stumped on how to resolve it. Despite their best efforts since the 2008 crash,

global recovery is decelerating, price pressures are anaemic and there are fears another recession is waiting in the wings.

You have to sympathise with policymakers, considering all the mayhem they have had to tackle in the past decade – from financial market meltdown to global recession, deflation and grinding austerity. They did well to jump-start a global economic revival after such a deep stall but, even 10 years on, the world is still operating below par, with global inflation pressures stuck in the doldrums.

Central banks are struggling to hit their price stability targets, generally set at 2 per cent for most major economies. Headline US consumer price inflation (CPI)

sank below the Federal Reserve’s 2 per cent target at the end of 2018 and, having fallen to 1.6 per cent in January, it is no surprise that Fed chair Jerome Powell

calls for “patience” on future tightening. Central banks face a similar conundrum, too.

The European Central Bank’s pledge to start hiking interest rates this year has hit a brick wall with

headline inflation as low as 1.5 per cent, meaning planned rate rises will probably get postponed until 2020. In Japan, CPI inflation has been

stuck below the Bank of Japan’s 2 per cent target since March 2015. With the current headline rate at only 0.2 per cent, the economy is on the verge of deflation again, with the risk of falling prices looming larger.

The People’s Bank of China is

also struggling to meet its inflation target of around 3 per cent, especially with January’s headline CPI rate falling to 1.7 per cent from 1.9 per cent last December. The cooling in domestic price pressures mirrors the slowdown in China’s economy, as the impact of the trade war with the US continues to dent consumer confidence and business activity.

It is not just headline and core CPI rates that are falling short; other inflation proxies remain on the soft side around the world. Price components are sinking in purchasing managers’ surveys, consumer inflation expectations are weak, while derivatives-based five-year, five-year forward inflation swap rates tell the same sorry tale. Global price pressures are on the back foot.