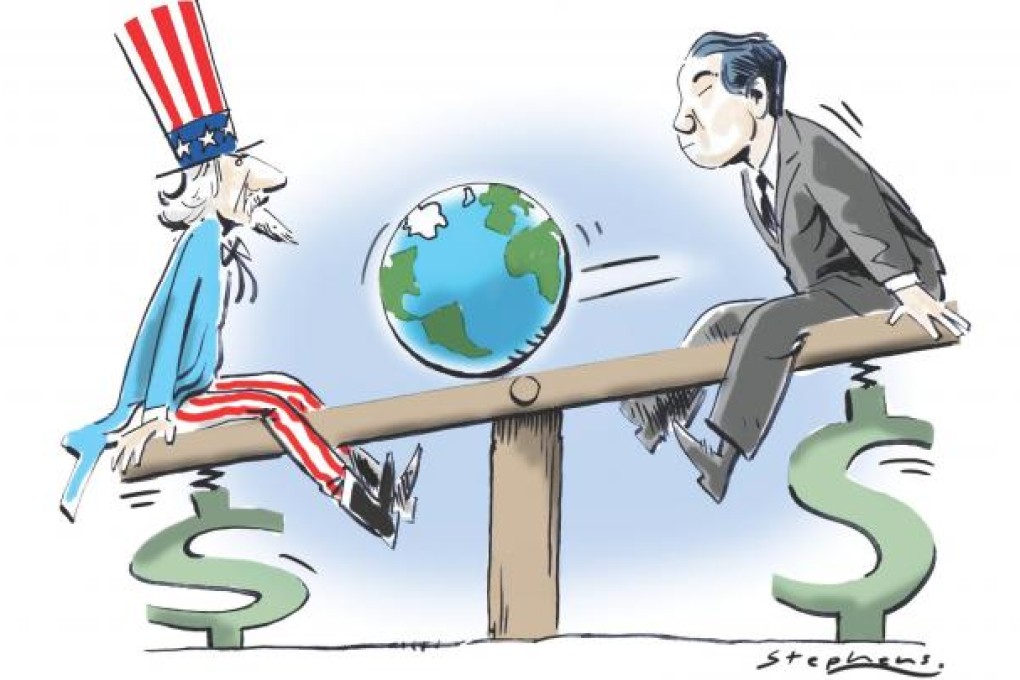

China, US focus on exports will cause more economic chaos

Andy Xie says the economies of China and the US, while vastly different, are our only hope out of the five-year-long crisis. Unfortunately, both seem to lack the will to make the right decisions

The global economy has been in constant crisis for five years. Muddling through with endless stimulus packages hasn't worked. The logical conclusion should be to try something new. Political changes in the US and China, the world's two largest economies, do not suggest that will happen, however. Continuation of the ineffective policies from the past awaits the world for years to come. While crises may become less violent over time, without real reforms they can go on and on, as Japan's two-decade-long decline shows.

The US election offered voters a poor choice. Barack Obama's policies stopped the economy from crashing, but they cannot reverse the slow and prolonged slide. On the other hand, Romney's tax-cutting pledge, if implemented, would have been a short cut to bankruptcy for the country. American voters picked the lesser of two evils. With the Republicans still in charge of the House, the US political system is likely to remain in gridlock, which will force the Federal Reserve to maintain or even expand quantitative easing.

Financial markets surge or swoon with every piece of data. Low interest rates make debt easier to carry and lift housing prices. Debt and housing bubbles got the economy into trouble in the first place. Reviving both won't put the economy on a sustained growth path.

The latest market obsession is whether the US will walk off the fiscal cliff - the automatic tax increase and spending cuts equivalent to 3.5 per cent of gross domestic product, early next year. Doing so may cause a recession, and that prospect is sparking fear in financial markets. But it would actually improve the economy over time by halving the federal budget deficit. Shouldn't the financial markets be happier about a better future? Unfortunately, everyone - not just politicians - seems obsessed with the short term.

China's leaders are promoted, not elected, and so do not have an independent mandate for change. Its economic problems are caused by a system that pushes more and more resources into the state sector, and government mandarins or state-owned enterprises allocate them to achieve an internal political balance. Inefficiency and corruption are its inevitable consequences. Overcapacity and empty buildings are the visible signs of the system's failings. Without fundamental changes, a banking crisis and high inflation are inevitable.

If the global economy is to have another sustained growth cycle, both the US and China must have a stable and balanced growth dynamic. Both have the potential for this. The US has population growth. China's per capita income is still low and could rise through improved productivity. Europe and Japan have neither and are unlikely to contribute to global growth. The other emerging economies aren't showing fast productivity growth from either capital accumulation or innovation and can't pull up the global economy in any meaningful way.

China and the US are the only hope. Unfortunately, both want to emphasise exports as the growth engine, which doesn't bode well.