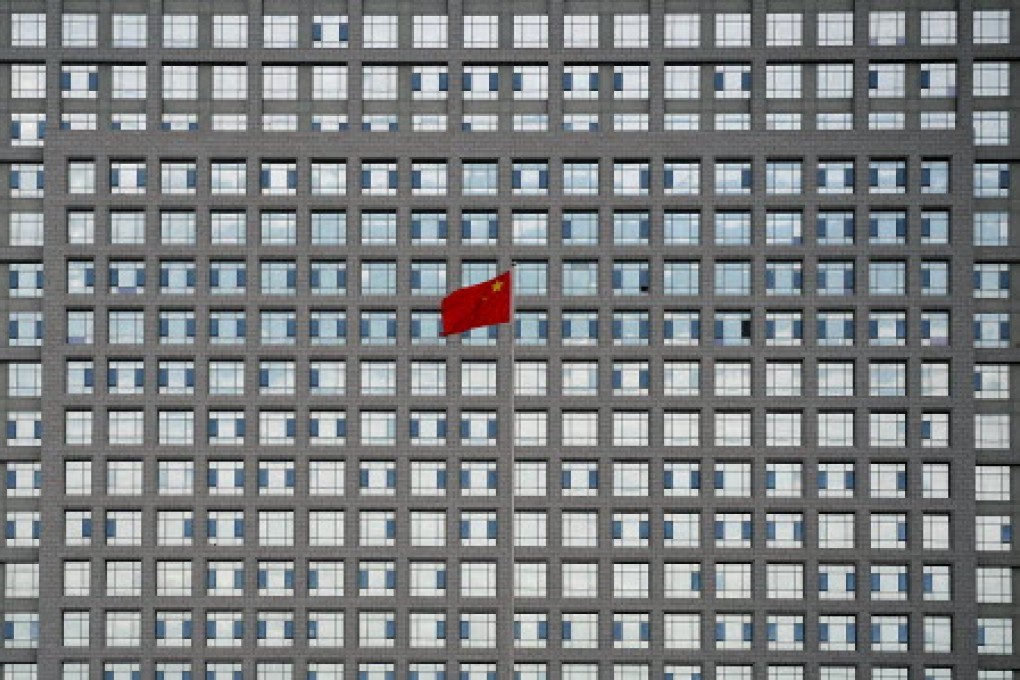

China's fear of inflation puts brakes on growth

Yu Yongding says fundamental changes have weakened Beijing's ability to stimulate the economy

China's economic-growth rate slowed in the second quarter of this year to 7.5 per cent year on year, down from 7.7 per cent in the January-March period, in line with Chinese economists' forecasts in recent months. At the start of 2013, however, economists - both at home and abroad - were much more upbeat about the prospects for growth. So, what changed?

China's growth has shown a cyclical pattern over the past two decades. Immediately after the collapse of Lehman Brothers in September 2008, China unveiled a 4 trillion yuan stimulus package. The economy rebounded quickly, with the annualised growth rate soaring to 12.1 per cent in the first quarter of 2010.

The new leaders do not wish to pursue growth at the expense of structural adjustment

To rein in a housing bubble and pre-empt a rise in inflation, the People's Bank of China tightened monetary policy in January 2010. Then, to arrest the resulting loss of economic momentum, the central bank loosened monetary policy in November 2011.

Most believed rapid growth would quickly be restored again. But the rebound did not come until the fourth quarter of 2012. Worse, instead of establishing renewed economic momentum, the growth rate fell in the second quarter of this year and all major forecasters are now revising their projections of full-year growth downward.

Of course, if the central government wished, China's growth rate in 2013 could still surpass 8 per cent. But the country's new leaders do not wish to pursue growth at the expense of structural adjustment, which has been delayed for too long. It seems that the government has established a floor for growth; as long as it is not hit, there will be no more fiscal or monetary stimulus.

But the new leadership's reluctance to intervene in order to spur growth is just part of the story of China's current slowdown. Something more fundamental has happened, weakening the government's ability to stimulate the economy. In particular, even as the annualised growth rate in the first quarter of 2013 fell far below the average growth rate over the past 30 years, the annual increase in the consumer price index rose to a 10-month high of 3.2 per cent in February, while house prices have been rising unabatedly.

Slower growth and higher inflation in the expansionary phase of the economic cycle (compared with previous cycles) reflect an essential macroeconomic change. For many years, China's Phillips curve - the historical inverse relationship between inflation and unemployment - was rather flat, which meant that when the government used expansionary monetary and fiscal policies to spur growth, it did not have to fret about price instability.