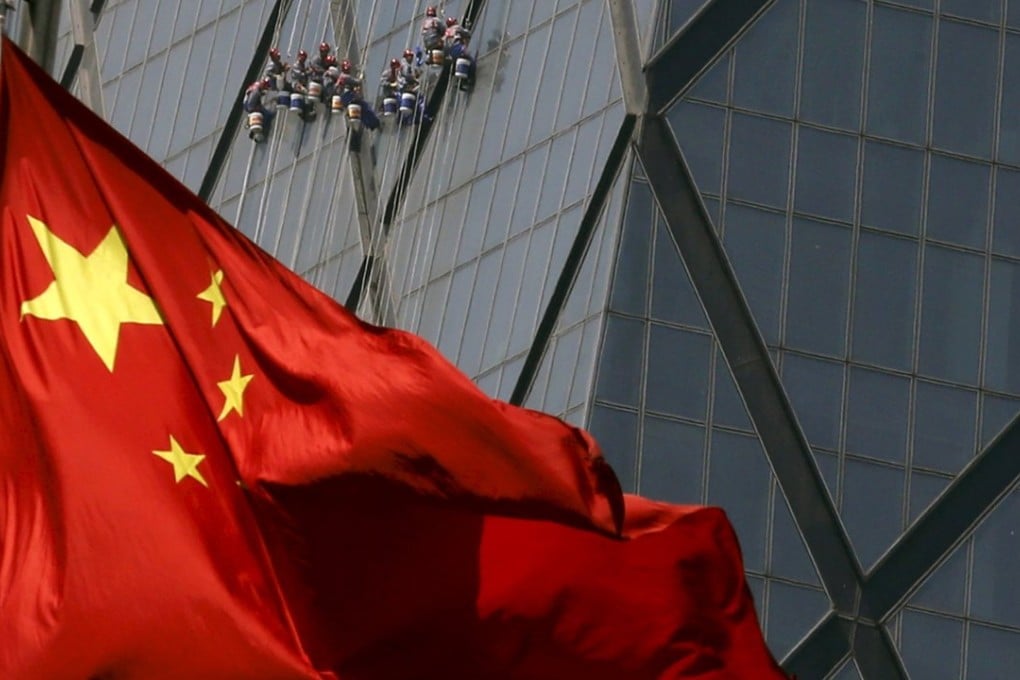

China’s services sector is growing, but far too few Chinese are spending

Stephen Roach says the success of its economic restructuring will depend on boosting low levels of private consumption, and that can happen only with improvements to its social safety net

Structural change and rebalancing are formidable undertakings for any economy. China has been focused on these objectives for five years – seeking to transform a powerful yet unbalanced growth model based largely on exports and investment into one driven increasingly by its consumers. Success is essential if China is to avoid the dreaded “middle-income trap”.

Anxiety over inadequate provisions for retirement is set to intensify as a rapidly ageing population enters the most vulnerable phase of its life cycle

The results have been mixed. China has been highly successful in its initial efforts to shift the industrial structure of its economy from manufacturing to services. But it has made far less progress in boosting private consumption. China now has no choice but to address this disconnect head on.

The performance of China’s services sector has been especially impressive in recent years, with its share of gross domestic product increasing from 44 per cent in 2010 to 51.6 per cent in the first three quarters of 2015, according to official statistics.

By contrast, consumer-led growth has been much slower to materialise. After bottoming out at 36 per cent of GDP in 2010, private consumption’s share of GDP inched up to 38 per cent in 2014.

With its prowess in central planning, China has always been adept at engineering shifts in its industrial structure. But it is apparently far less proficient in replicating the DNA of a modern consumer culture – specifically, in altering the behavioural norms of its people.

READ MORE: China’s services sector records fastest growth in three months, private survey reveals