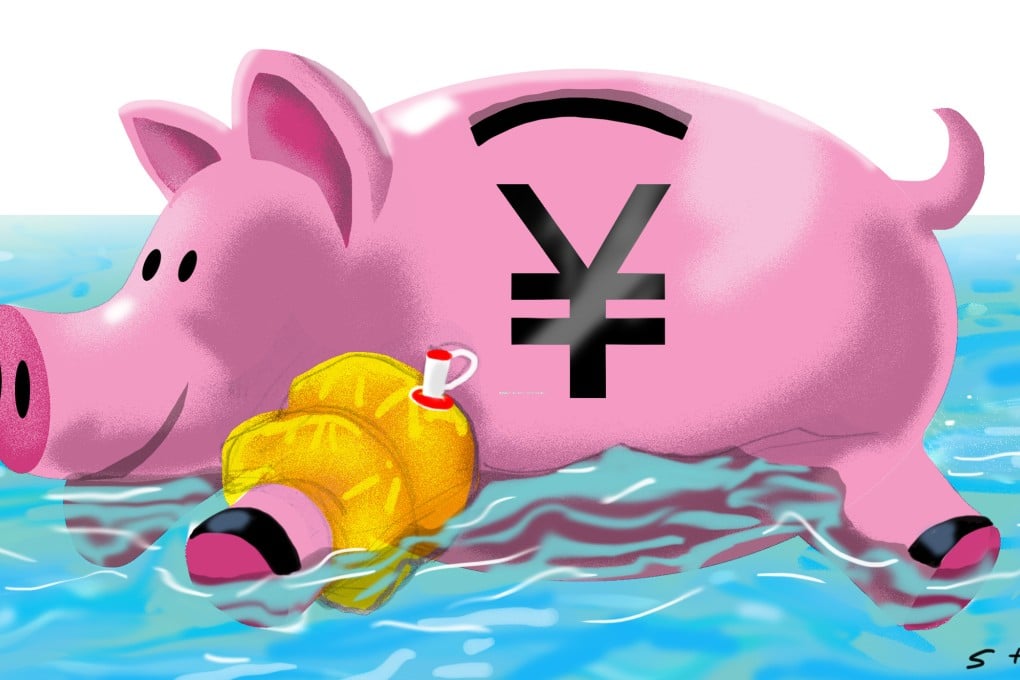

How China can best solve its currency crisis

Chen Zhao says the current strategy of defending the peg is unsustainable and Beijing must instead look to float the yuan and at the same time launch a large fiscal stimulus package

READ MORE: China currency head urges investors not to listen to ‘talking down’ of yuan

What should the central bank do? The PBOC is faced with the so-called “impossible trinity” – with capital account mobility, a central bank can either control interest rates or foreign exchange rates, but not both. Practically, therefore, the central bank has three options to deal with its currency market problem:

●The first is to reimpose or tighten capital controls, which would allow the central bank to drop interest rates and reserve requirements to stimulate the economy, while keeping the currency peg.

●The second option is to simply float the yuan, letting market forces find the new equilibrium for the currency market.

Each option has its own unique set of economic, social and political benefits and costs. Reimposing capital controls is easy and quick to implement, and may produce an instantaneous effect on reducing capital flight, but would entail many side effects in the longer run. For one, it is an anti-market move that would mark a major step back from China’s long-term goal of financial market liberalisation. It would also mark a major setback for the yuan to achieve full convertibility, which is essential for the currency to truly become a global reserve currency.

READ MORE: Yuan is China’s currency but US Federal Reserve’s problem

More importantly, restricting capital flows would guarantee dual pricing, with official foreign exchange rates living hand in hand with “black market” rates. This would lead to chaos and turmoil in the financial system down the road.