Advertisement

Advertisement

Chen Zhao

Chen Zhao is founding partner and chief strategist of Alpine Macro. From 2015 to 2016, he was co-director of macro research at Brandywine Global Investment Management. Prior to that, Chen spent 23 years at BCA Research. He holds an MA in economics from the Central University of Finance and Economics, was a visiting scholar at University of Illinois at Urbana-Champaign and pursued post-graduate studies with a PhD candidacy at McGill University.

Chen Zhao is founding partner and chief strategist of Alpine Macro. From 2015 to 2016, he was co-director of macro research at Brandywine Global Investment Management. Prior to that, Chen spent 23 years at BCA Research. He holds an MA in economics from the Central University of Finance and Economics, was a visiting scholar at University of Illinois at Urbana-Champaign and pursued post-graduate studies with a PhD candidacy at McGill University.

The right question to ask is whether China’s overall current account represents a destabilising imbalance that siphons growth from trading partners.

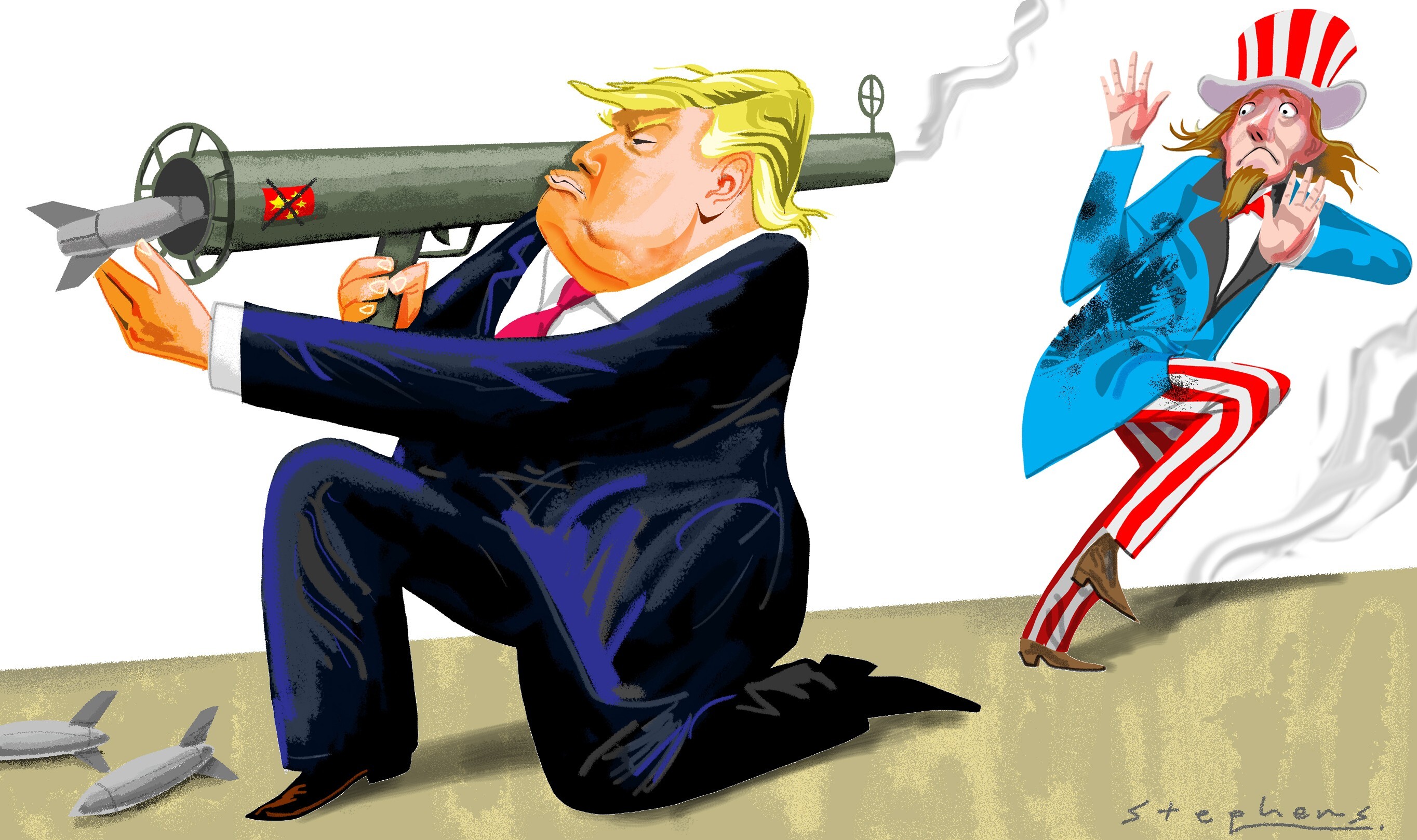

The West fears a reverse of economic reforms, sees a lack of political progress and accuses Beijing of becoming aggressive and provocative, particularly on Taiwan. Yet America’s China-bashing is closely linked to its domestic politics, and accusations of Chinese sabre-rattling must be seen in the context of US provocations.

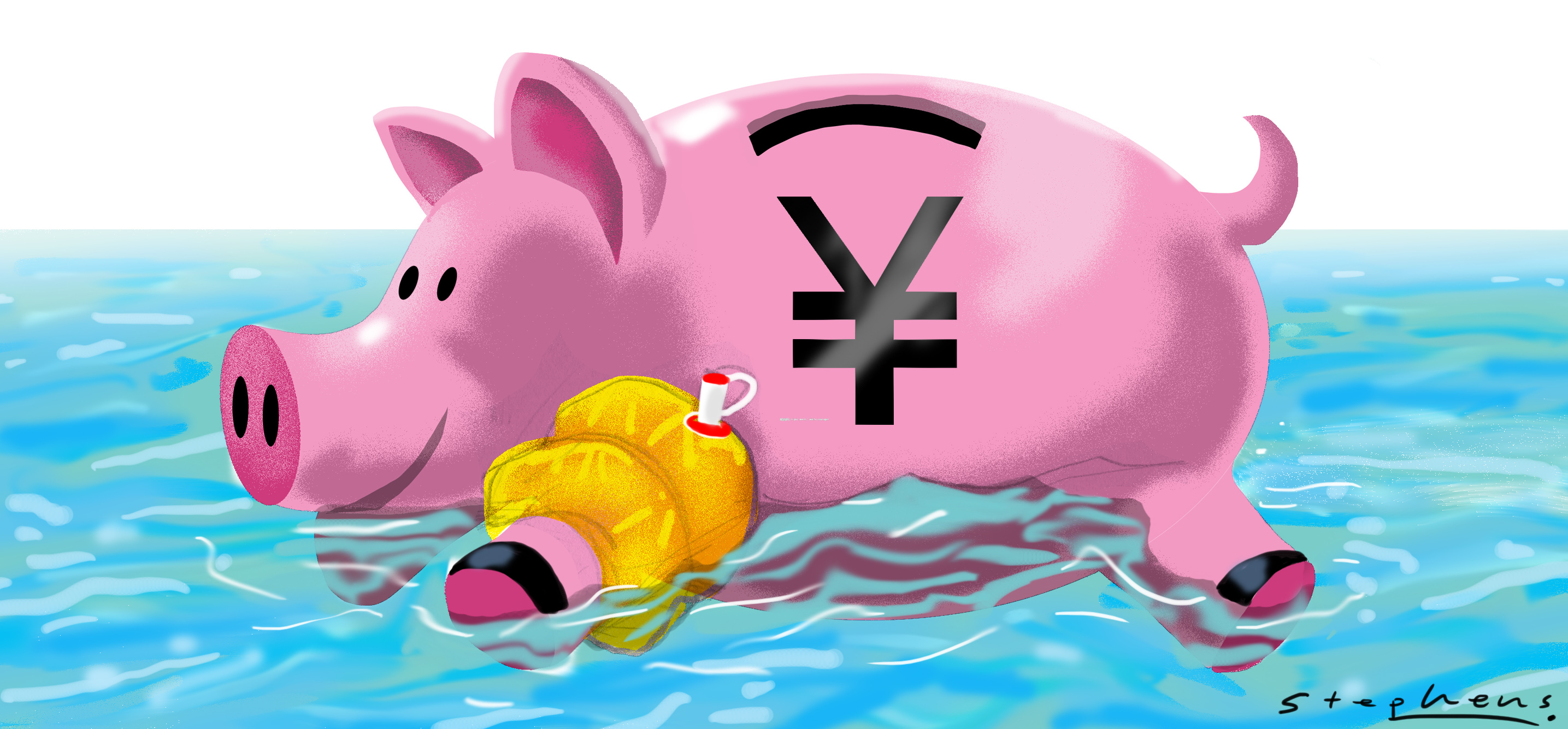

Sanctions on Moscow show that foreign reserves held by central banks are never truly ‘safe’, which is bound to make Beijing uncomfortable. Yet when it comes to shifting away from Western currencies, the alternatives – gold, the yuan and foreign infrastructure investment – struggle to match up.

Population growth is almost irrelevant to economic growth for a developing country. Besides, China has millions of rural workers, who can partially offset any potential labour shortage. It also has the option of raising the retirement age.

Advertisement