It’s all or nothing for China as trade collision with the US looms

Andy Xie says rising US interest rates and China’s property bubble at bursting point, coupled with renminbi depreciation fears, are set to whip up the perfect storm. But China could make the decision to change, and make 2017 a year of breakthrough

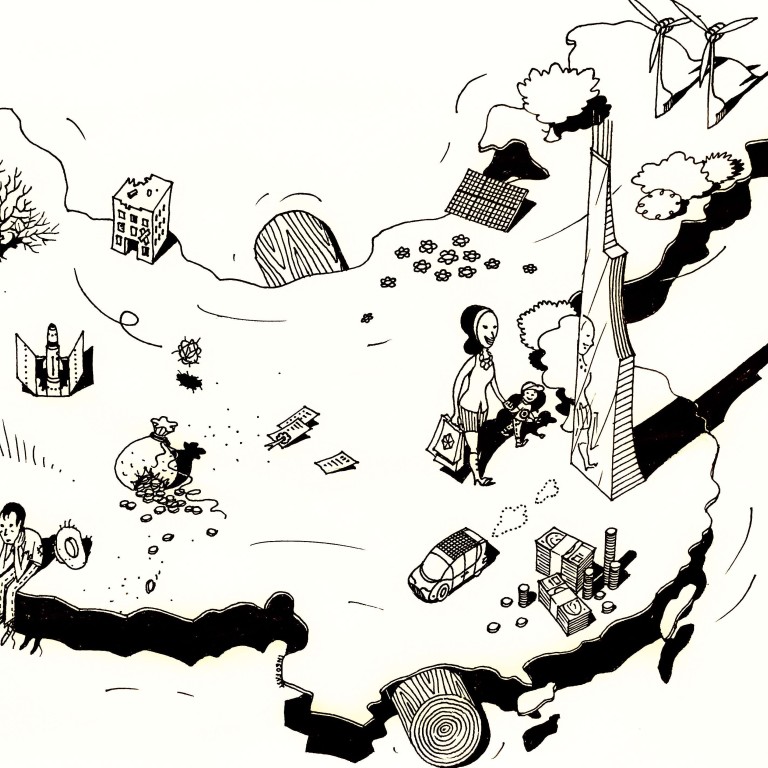

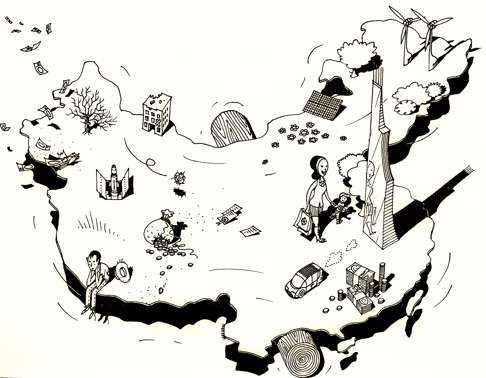

The best-case scenario would be that China holds up the currency, accepts the bursting of the property bubble, and embarks on fundamental restructuring to ultimately lead the global economy.

The worst-case scenario would see a maxi-devaluation of the renminbi, coupled with a China-US trade war that could spiral into military conflict.

Watch: How the Fed rate hike impacts Asian markets

This time may not be different. The higher US interest rate and infrastructure stimulus would suck liquidity out of emerging economies. This is happening at a most inconvenient moment for China. Its property bubble is already at bursting point, while expectations of currency depreciation are already draining liquidity.

China’s central bank has been replacing the liquidity outflow with more liquidity, worsening fears of currency depreciation. The added pressure from rising US interest rates may force China to accept the bursting of the property bubble.

In addition to the opposing cyclical forces between China and the US, the pair are clashing on the structural side as well. Donald Trump won the US presidential election riding on the anger against an unfair system. He railed against immigration, international trade and Wall Street, and was rewarded. From his cabinet appointments, it appears that he has no intention to rein in Wall Street fat cats; on illegal immigration, he has already dialled back on how many to deport. Hence, he would have to come down doubly hard on trade, especially with China, to please voters.

Watch: Trump slams China’s currency devaluation

Race will be an important factor in the forthcoming trade friction between China and the US

White blue-collar workers have enjoyed high living standards for more than a century because the Chinese system suppressed their productivity at home. When China joined the World Trade Organisation, it signalled the beginning of the end of the white premium in the global economic pecking order.

I’m not belittling the concerns about China’s trade practices. I would be the first to decry the Chinese system that keeps household disposable income low, sucks it away with bubbles, and holds capital costs artificially low. As the world’s largest exporter, China sets the benchmark for labour compensation. How the Chinese government treats its people is fair game for global discussions. Nonetheless, race will be an important factor in the forthcoming trade friction between China and the US.

The irony is that China could initiate reform and just leave this mess behind. Its per capita income is only US$7,400, merely a seventh of US workers. Chinese workers are as well-educated and productive as their US counterparts. Moreover, the Chinese work longer hours, and China’s female labour participation rate is at 90 per cent, much higher than that of Western countries. China has better infrastructure and newer factories. Granted, the US has unrivalled high technologies, but that accounts for a small part of its economy.

The [Chinese] government is obsessed with concentrating economic resources in its own hands, and asset markets are like casinos

China’s domestic woes and international challenges are largely due to its inefficient system. The government is obsessed with concentrating economic resources in its own hands, and asset markets are like casinos, sucking people in and making them lose money. The government uses its vast resources inefficiently. Hence, China’s currency has a tendency to depreciate.

China’s economic development has been just as fast as the 1952-92 rise of a bombed-out Japan after the second world war. The difference is in how their currencies behaved. The yen tripled against the dollar during the period, while the Chinese currency has been mostly declining. Economic inefficiency and its implications for the exchange rate explain why China’s rapid economic development has not translated into matching gains in per capita income.

The coming struggle between the US and China will likely end either with an economic collapse in China or its ascendancy to the dominant world economy. There is little middle ground. If China embarks on structural economic reforms by embracing the market and shrinking the government, its GDP will quickly surpass that of the US, probably within 10 years.

China’s bid to cut production overcapacity in heavy industries ‘losing steam’, survey suggests

As it becomes the largest consumer market, the best and brightest from the world over will come to China. It will become the world’s innovation centre by default. Meanwhile, the US will become just another country, just as Britain did one century ago.

With the right policies, China will reach escape velocity and become a developed nation

If China doesn’t initiate reform out of fears of the Communist Party losing control, the rising US economy will suck in global savings. To fight rising capital cost, China will try to squeeze its people more, weakening its consumer market further, and further drive away foreign capital. The obsession for control and the consequent need to squeeze the people form a vicious cycle. China’s modernisation has zig-zagged for one-and-a-half centuries . With the right policies, China will reach escape velocity and become a developed nation. But if the wrong policies are pursued, it could trigger a new tragedy in modern Chinese history.

Trump’s rise is destroying the muddling-through equilibrium since 2008. It involves easy monetary policy to foster bubbles and cover up structural problems and inefficiencies. A lot of pain will come. But, with the right response, it is a good thing. By forcing the right changes, China will finally rise to become a modern country.

Andy Xie is an independent economist