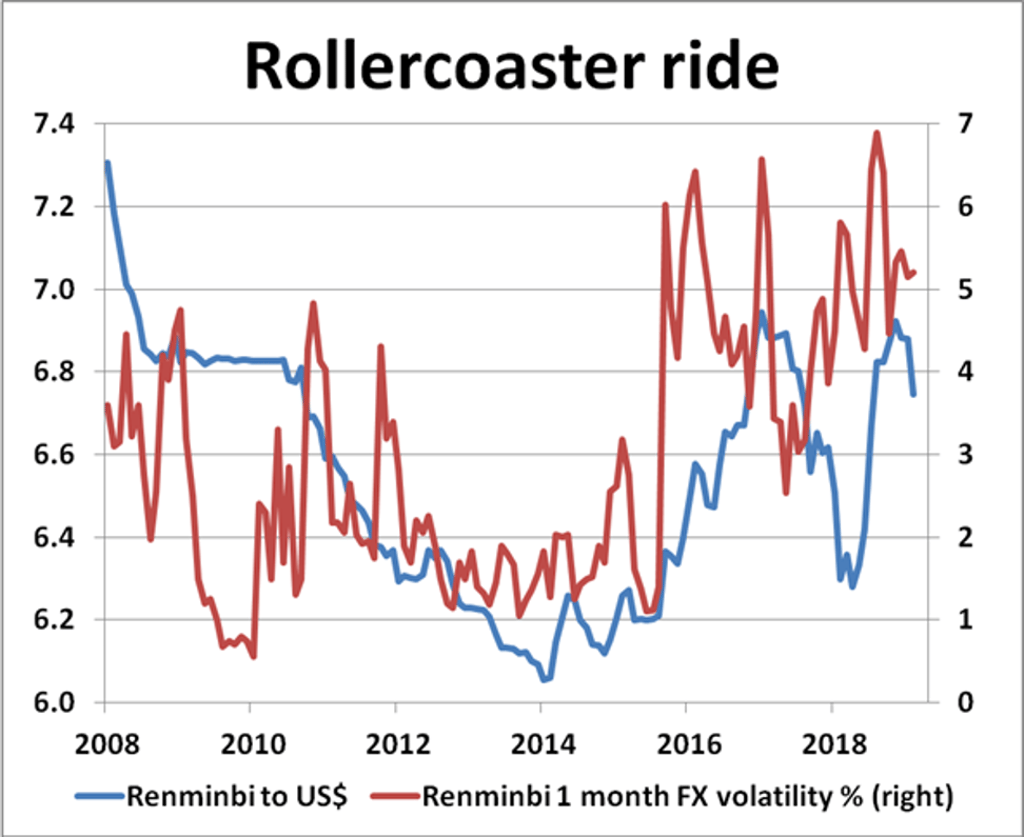

Macroscope | China’s currency is heading for a volatile year – and that may be a good thing

- David Brown says Beijing has a choice: blow its foreign exchange reserves on stabilising the renminbi or let it reach equilibrium on its own. The latter would be the better choice in the long term

The renminbi’s recent roller-coaster ride is not over yet. China’s currency is adrift in a sea of global uncertainty – and there’s not much Beijing can do to stop it. The renminbi is pitching about on huge swells of economic and political risk which have little chance of easing in the coming months. This means tough times ahead for investors trying to get a better handle on the currency’s outlook this year. Increased volatility and risk are likely to mark 2019 for the renminbi.

Currency markets may be challenging for the renminbi this year but should provide plenty of good scope for smart players to make the right call. Opinions on the currency’s outlook this year are broadly spread, judging by Reuters’ consensus forecasts ranging between 6.40 and 7.50 against the US dollar over the next 12 months, pivoting at around a 6.74 mean. The timing of upcoming global events will be crucial to determining which of the two extremes is closer to accurate.

These are major game changers, carrying significant event risk for currency players. Right now, markets are locked in a battle of wits between risk aversion and risk appetite, but fathoming whether the dollar is friend or foe is the key as these forces play out. In times of stress, the dollar is normally first as a safe haven and first to be set aside once risk appetites recover. As a risk asset, the renminbi should only play a secondary role.