The Federal Reserve has halted policy normalisation. Now, other central banks should follow suit

- The Fed’s decision to stop interest rate rises and the shrinking of its balance sheet this year should be a cue for central banks in Europe, Japan and particularly China to take steps to bolster economic activity

World markets are taking a turn for the worse and crying out for central banks to adjust policies to stop the rot. Global manufacturing has taken a dive, stock market confidence is on the ropes and the US Treasury yield curve is firing early warning shots about a possible future recession. It is not panic stations yet, but the US Federal Reserve seems ready for action. The Fed cannot succeed in isolation and needs other central banks to join forces to stop a deeper crisis unfolding. The worry is whether there is enough left in monetary reserves to turn the tide.

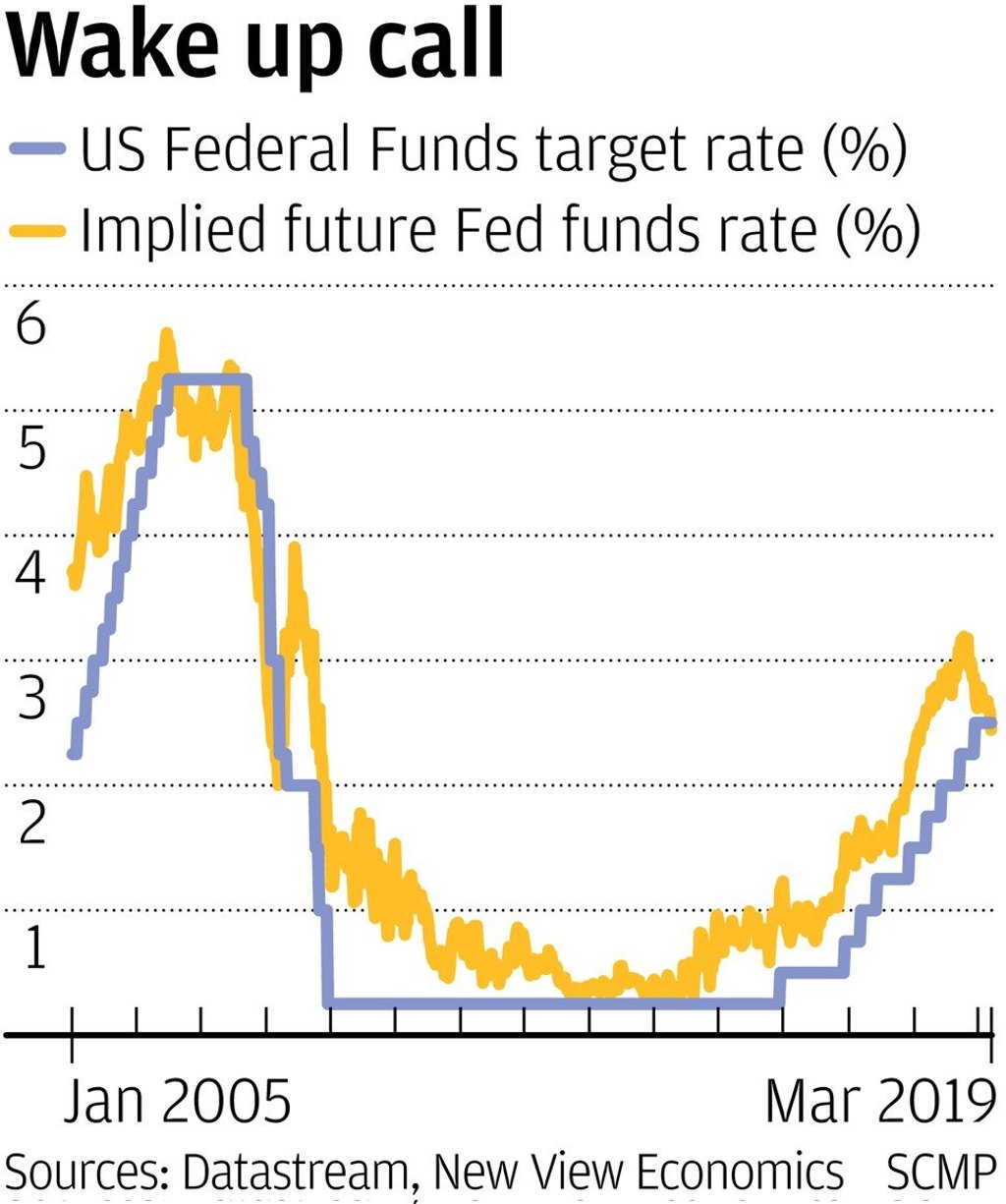

The Fed may be shying away from the suggestion of lower rates just yet, but that option should not be ruled out if the outlook deteriorates any further. The 2008 crash taught the Fed some hard home truths and it is now showing better readiness to proceed with a new monetary approach. The old dogma, worrying about overegging growth and inflation risks, has given way to a new thinking – global recovery is under par, deflation risks persist and super-stimulus should stay intact for longer than anticipated.

The Fed is acting out of caution rather than fear and it holds important lessons for other central banks, especially for China, Europe and Japan. The world changed inexorably after the 2008 crisis, paving the way for a new order of altered economic priorities and more effective policy remedies. There should still be plenty of scope for central banks to intercede before any future storm hits.