Advertisement

Macroscope | Why the Fed, and central banks in China, Europe and Japan should work together on rate cuts to stop the global economic rot

- It can stonewall, but ultimately the US central bank will have to respond to economic conditions by lowering interest rates

- Other major economies have a similar need for stimulus, so this should be a chance for global policy coordination

Reading Time:3 minutes

Why you can trust SCMP

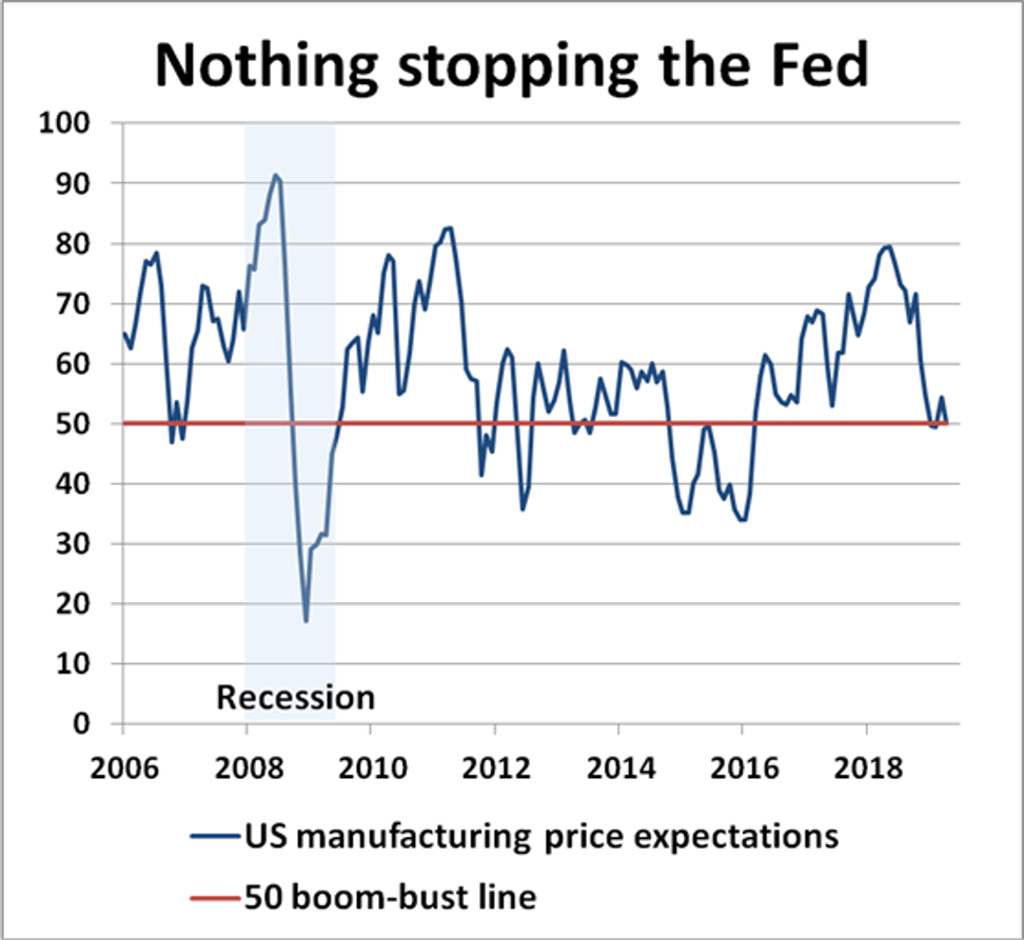

The clock is ticking louder for lower global interest rates. The US Federal Reserve may be stonewalling against another easing measure but it is not a question of if, but when interest rates are cut again. The Fed favours patience, but the longer central banks delay, the more peril the world faces.

Economic recovery is faltering, global risks abound and world equity markets are finally latching on. Rather than be overtaken by events, it’s time for central banks to get ahead and signal their readiness to ease again.

Staying proactive is imperative but the major central banks remain deeply conflicted right now. Their natural instinct is to return policy to normal after 10 years of monetary overkill but major obstacles stand in the way. Aftershocks are still being felt from the 2008 crash, while the deepening US-China trade war poses a mounting threat to global well-being.

Advertisement

Economic confidence has taken a hard knock, world trade is in retreat, global stability is being undermined and it’s certainly not the right time for policymakers to sit on their hands. The central banks of the US, China, Europe and Japan should combine forces to stop the rot. If governments are at odds, then central banks must step in and begin the countdown for lower rates.

Certainly, the Fed needs to jump off the fence and re-engage effective policy. US employment conditions may be going through the roof, but the economy shows signs of wear and tear, with the trade war and growing political risks on Capitol Hill taking their toll.

Advertisement

Advertisement

Select Voice

Select Speed

1.00x